The channel is no longer just at a pivot point; it has moved past the intersection entirely. For the last decade, we have analyzed the "MSP pivot" and the "cloud transition." Those chapters are closed. As we look toward 2026, the channel is entering the Agentic Era—a period defined not by the technology partners sell, but by the autonomous outcomes they package.

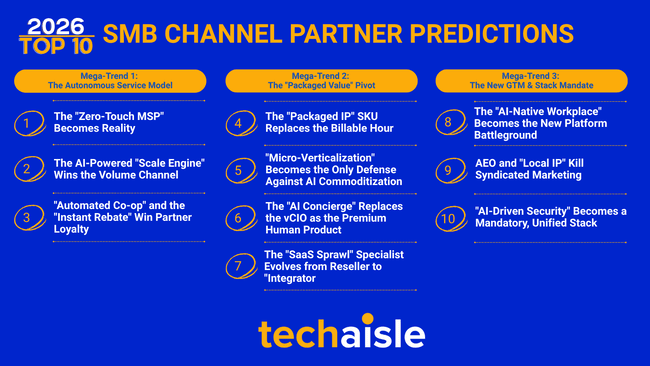

Typically, Techaisle distills the annual landscape into a "Top 10" list. But 2026 is an exception. In our latest study of 4,500 channel partners globally, the data revealed a level of interconnectivity and operational friction so dense that a list of ten simply couldn't capture the strategic reality. We expanded our analysis to the Top 15 Business Challenges and Priorities because the pressures facing partners today aren't isolated silos—they are a complex web of margin compression, AI ambiguity, and ecosystem sprawl.

The data reveals a stark reality: the traditional "labor-plus-license" model is facing an existential squeeze as the channel navigates a shift from service delivery to agentic orchestration. Here is my analysis of the 15 critical forces shaping the channel in 2026.