The Shift from Experimentation to Agentic Workflows

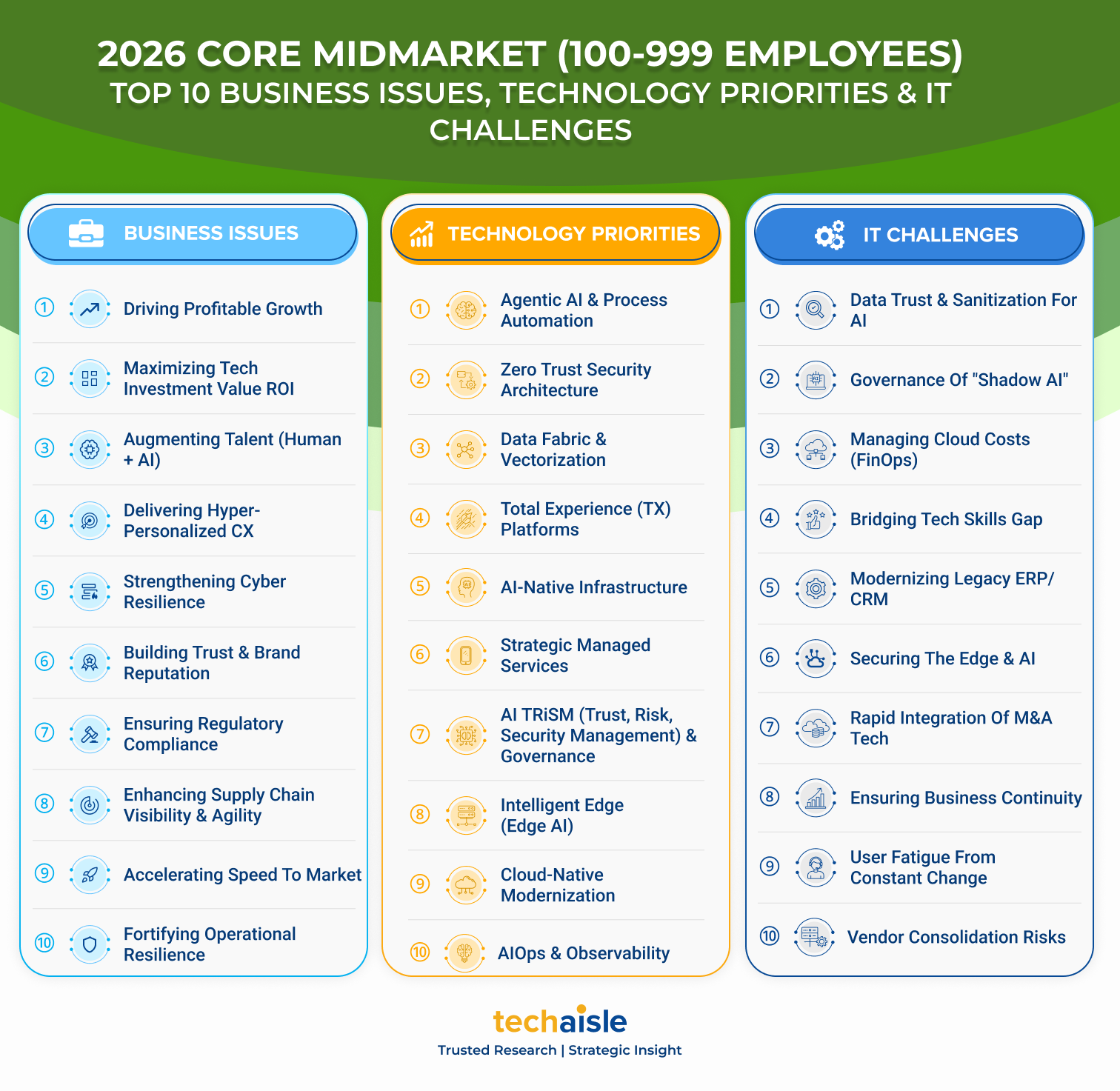

Based on Techaisle’s latest survey of over 5000 businesses, the 2026 core midmarket agenda reveals a profound transition from the era of experimental digital transformation to a period of rigorous, outcome-driven architectural overhaul. The data indicates that midmarket firms have moved beyond the initial hype of generative AI and are now confronting the complex reality of operationalizing it. The top business issue, driving profitable growth, is no longer being pursued through sheer volume or expansion, but through the precise application of Agentic AI and process automation. This alignment suggests that leadership has recognized that sustainable growth in a high-cost environment requires autonomous systems capable of executing complex workflows, rather than simple chatbots that merely retrieve information.