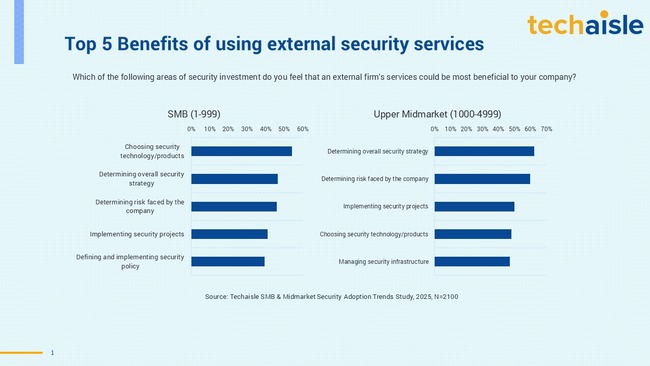

The cybersecurity landscape is in a state of constant flux, with threats becoming increasingly sophisticated and the consequences of a breach becoming more dire. For small and medium-sized businesses (SMBs) and midmarket firms, navigating this complex environment is a significant challenge. Lacking the extensive in-house resources of large enterprises, these organizations are increasingly turning to external security services firms for guidance and support. However, as new Techaisle research reveals, the type of support they seek differs dramatically depending on the size and complexity of their business.

A recent Techaisle survey of 2100 SMBs and Midmarket firms sheds light on this growing trend, highlighting a clear divergence in the cybersecurity priorities and needs of these two crucial market segments. While both recognize the critical importance of a robust security posture, their approach to achieving it and where they seek external help tells two very different stories. For technology vendors and channel partners, understanding this bifurcation is not just an academic exercise; it's the key to effectively serving these markets and unlocking significant growth opportunities.