Techaisle Blog

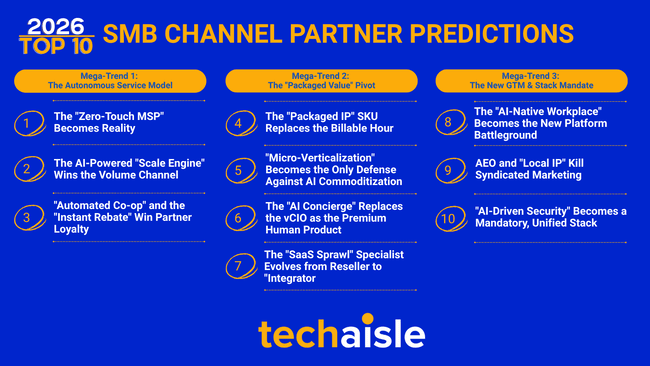

Techaisle’s Top 10 Predictions for the SMB & Midmarket Channel (2026-2028): The Efficiency Mandate

The high-volume SMB and midmarket channel will experience the AI-driven transformation just as profoundly as the enterprise space, but in fundamentally different ways. While enterprise-focused partners will be defined by their ability to create bespoke, complex IP and governance services, the winners in the SMB/midmarket segment will be defined by a different set of virtues: ruthless efficiency, service model automation, and the art of "packaged" (not custom) intellectual property.

The following 10 predictions detail the shift away from a "billable hours" model to one built on scalable, repeatable, and automated value. These trends are organized into three core "Mega-Trends" that define this new, efficiency-driven landscape.

Mega-Trend 1: The Autonomous Service Model

This mega-trend details the shift from human-led, manual service delivery to a new model built on automation, AI-driven platforms, and operational efficiency at scale.

1. The "Zero-Touch MSP" Becomes Reality.

The "Autonomous Partner" concept manifests differently in this context. It is not a custom-built agent fleet, but the mastery of a vendor's AI-native RMM/PSA platform. The winning MSPs will achieve a "Zero-Touch" service model where AI handles 90% of all tickets, patches, and provisioning, allowing them to scale to thousands of endpoints per human technician.

- Implications for Vendors: Your platform's AI automation is now your single most important feature. The vendor that provides the best AI-driven, self-healing, and auto-remediating platform will consolidate the MSP market.

- Implications for Partners: Your core competency is no longer service delivery; it is automation management. Your most valuable employee is the one who can train your platform's AI to handle more tasks.

2. The AI-Powered "Scale Engine" Wins the Volume Channel.

A vendor's new moat is not just its product; it's its ability to scale partner support with AI. While enterprise partners get a "Digital PAM," the SMB channel will get a "Zero-Friction Portal." This AI-driven engine will provide instant 24/7 technical support, personalized "just-in-time" micro-learnings, and generative AI co-marketing that automates campaign creation for thousands of partners at once.

- Implications for Vendors: Your partner program is no longer "one-to-many"; it's "AI-to-one-at-scale." You must invest in an AI-enabled platform that automates support, making you the "easiest" vendor to do business with.

- Implications for Partners: You will consolidate your business with the vendors whose AI-powered portals save you the most time. A vendor's portal will become a key profitability tool rather than an administrative burden.

3. "Automated Co-op" and the "Instant Rebate" Win Partner Loyalty.

SMB partners live and die by cash flow. They cannot wait 90 days for an MDF or co-op claim to be processed. The vendors who will win this channel will use "Incentive-as-an-API" to offer instant rebates and automated co-op (e.g., an AI-verified invoice scan = instant credit).

- Implications for Vendors: Your quarterly "program" is creating critical friction for your partners. The vendor who moves to a real-time, automated, and API-driven incentive model will capture the channel's mindshare.

- Implications for Partners: You must prioritize vendors whose programs are automated and instant. The "friction" of a partner program is now a real "cost of doing business" that you can no longer afford.

Mega-Trend 2: The "Packaged Value" Pivot

This mega-trend focuses on the partner's core business model transformation—moving away from selling "time" (billable hours) and "products" (resale) to selling pre-packaged, high-margin, repeatable IP and advisory services.

4. The "Packaged IP" SKU Replaces the Billable Hour.

SMB/Midmarket partners will stop selling "time" and "projects." Profitability will come from selling fixed-fee, "Packaged IP" SKUs. This is not a custom SOW; it is a product: "The 10-Step AI Security Onboarding," "Our Pre-trained Sales Bot for HubSpot," or "The AI-Ready CPA Bundle."

- Implications for Vendors: Your marketplaces must be re-architected to sell partner-packaged IP (a bundle of your licenses + their IP) as a single SKU, not just your own products or their consulting hours.

- Implications for Partners: Stop selling "hours." Productize your expertise. If you have done it once, package it. If you have done it three times, automate its delivery.

5. "Micro-Verticalization" Becomes the Only Defense Against AI Commoditization.

AI will completely commoditize the generalist "IT guy" MSP. The only way to protect margins is to become hyper-specialized. We are moving beyond "healthcare" to "AI for 10-person dental practices" or "AI-powered compliance for 3-attorney law firms." These partners will win by packaging industry-specific data, workflows, and compliance into their "Packaged IP."

- Implications for Vendors: Your generic "partner for all" program is becoming ineffective. You must build "micro-vertical" partner tracks with specific data, enablement, and solution development funds.

- Implications for Partners: Choose your micro-vertical now. The "IT for Everyone" partner will be in a race-to-the-bottom pricing environment against AI-powered platforms.

6. The "AI Concierge" Replaces the vCIO as the Premium Human Product.

As AI automates 90% of the technical work, the partner's human relationship becomes the core premium product. The vCIO model evolves into the "AI Concierge"—a human strategist who performs two critical, billable functions. 1/ AI Workforce Manager: They manage the customer's "agent economy," handling orchestration, governance, and inter-agent conflicts. 2/ AI FinOps Advisor: They manage the customer's "AI-nomics," optimizing compute spend and preventing shocking "AI bills."

- Implications for Vendors: You must shift partner enablement from technical certs (which AI can pass) to business advisory skills. Enable your partners to have strategic, C-level conversations with an SMB owner. You must provide the "AI-nomics" dashboards for your "Concierge" partners to use

- Implications for Partners: Your "helpdesk" is a cost center. Your "AI Concierge" is your profit center. This is the new, high-margin "human-in-the-loop" service that justifies your monthly recurring revenue (MRR).

7. The "SaaS Sprawl" Specialist Evolves from Reseller to Integrator.

SMBs are drowning in a sea of 50+ SaaS apps (and growing). The partner's value is no longer reselling a core productivity suite; instead, it is integrating that suite with accounting software, CRM platforms, collaboration tools, and other applications using AI-powered automation platforms (like a next-generation integration tool on steroids).

- Implications for Vendors: Your platform's value is 100% dependent on its open APIs and pre-built connectors. If your app is a "walled garden," partners will abandon it.

- Implications for Partners: Your next big hire is an "Automation Specialist" or "Integration Specialist." The revenue is in connecting the apps, not just selling the licenses.

Mega-Trend 3: The New GTM & Stack Mandate

This mega-trend covers the mandatory new tools and tactics partners must adopt to "go-to-market." This includes the new AI-driven marketing (AEO) and the critical new technology stacks (AI-Native Workplace, AI-Security) they must sell.

8. The "AI-Native Workplace" Becomes the New Platform Battleground.

The key contest is no longer just between the two dominant vendors of productivity suites. It is "Who owns the entire AI-driven productivity stack?" (e.g., a platform's integrated AI assistant + collaboration tools vs. a competitor's equivalent stack). Partners will be required to select a "productivity & collaboration" stack and commit fully to it, as driving the adoption of AI features will be their core value.

- Implications for Vendors: Your "partner of the year" is no longer the one who sells the most licenses; it's the one who has the highest AI feature adoption and usage (MAU) in their customer base.

- Implications for Partners: You are now an "Adoption & Change Management" consultancy. Your MRR depends on proving your customer is using the AI you sold them.

9. AEO and "Local IP" Kill Syndicated Marketing.

Generic, vendor-supplied marketing blogs are officially dead and will be invisible to AI "Answer Engines." The SMB partner who wins will create a local, specific IP that AEO can surface (e.g., "A 5-step guide for Boston-based non-profits to secure their donor data with AI").

- Implications for Vendors: Shift from sending your partners blogs to sending them "data fragments" and "case study templates" that they can easily customize with local details to create unique, citable content.

- Implications for Partners: Your marketing must be 100% "local" and "specific." If it could be posted on any other MSP's website, it would be ineffective.

10. "AI-Driven Security" Becomes a Mandatory, Unified Stack.

AI-powered phishing, generative deepfake social engineering, and autonomous attacks will make "legacy" security stacks (basic AV and a firewall) completely obsolete. This forces a non-negotiable upsell to a unified "AI-for-Defense" stack. This stack must provide two core capabilities: AI-Driven Threat Detection and the tools for "AI Policy-as-a-Service" to discover and lock down "Shadow AI" data leaks.

- Implications for Vendors: Your security platform must be AI-driven. You must equip your partners with a new "AI-driven threat" narrative and a platform that combines threat defense with the tools to deliver "Policy-as-a-Service," and "show, not tell" the risk to their SMB customers.

- Implications for Partners: This is your most significant sales opportunity. You must go to every customer and replace their obsolete, component-based security with a new, unified managed service. This service will have two key components: "Managed AI Threat Defense" and "AI Policy-as-a-Service.

While these ten predictions paint a clear picture of an efficiency-driven, automated channel, they are not without their hurdles. The primary obstacles for this segment are operational rather than technological. They demand a fundamental re-engineering of the partner business model and, just as critically, a complete overhaul of the vendor-partner relationship.

Unlike the enterprise channel, whose future is defined by a conceptual "moonshot," the SMB/midmarket channel's future is a story of execution. This set of predictions is grounded in business model innovation, not futuristic technology. It's less about "what if" and more about "how to" apply AI to a business model that is already built on efficiency and scale.

However, just like the enterprise list, one prediction stands out—not because it is technologically complex, but because it challenges decades of entrenched vendor behavior.

Pressure Test

While these ten predictions paint a clear picture of an efficiency-driven, automated channel, they are not without their hurdles. The primary obstacles for this segment are operational rather than technological. They demand a fundamental re-engineering of the partner business model and, just as critically, a complete overhaul of the vendor-partner relationship.

Unlike the enterprise channel, whose future is defined by a conceptual "moonshot," the SMB/midmarket channel's future is a story of execution. This set of predictions is grounded in business model innovation, not futuristic technology. It's less about "what if" and more about "how to" apply AI to a business model that is already built on efficiency and scale.

- The Most "Bureaucratically-Challenged" Prediction: "Automated Co-op" and the "Instant Rebate" (#3). This is technologically simple. The demand is at an all-time high. The biggest hurdle is the massive organizational inertia within vendors, who are resistant to giving up a 30-year-old "program" and "approval" process.

- The Prediction That Seems Far-Fetched (But Isn't): The "Zero-Touch MSP" (#1). The "90% automation" of L1/L2 tickets sounds high to partners who are overwhelmed by daily tickets. But this is the explicit, stated goal of every major RMM and PSA platform vendor. This isn't a partner-led innovation; it's a vendor-led disruption that partners must either adapt to scale or be crushed by.

In summary, this list of predictions is less of a "sci-fi story" and more of an executional roadmap. The barriers here are not in the lab; they are in the boardroom and the partner's own P&L.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.