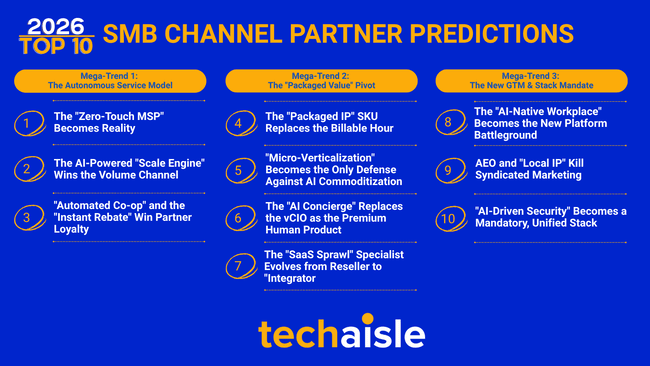

The high-volume SMB and midmarket channel will experience the AI-driven transformation just as profoundly as the enterprise space, but in fundamentally different ways. While enterprise-focused partners will be defined by their ability to create bespoke, complex IP and governance services, the winners in the SMB/midmarket segment will be defined by a different set of virtues: ruthless efficiency, service model automation, and the art of "packaged" (not custom) intellectual property.

The following 10 predictions detail the shift away from a "billable hours" model to one built on scalable, repeatable, and automated value. These trends are organized into three core "Mega-Trends" that define this new, efficiency-driven landscape.

Mega-Trend 1: The Autonomous Service Model

This mega-trend details the shift from human-led, manual service delivery to a new model built on automation, AI-driven platforms, and operational efficiency at scale.

1. The "Zero-Touch MSP" Becomes Reality.

The "Autonomous Partner" concept manifests differently in this context. It is not a custom-built agent fleet, but the mastery of a vendor's AI-native RMM/PSA platform. The winning MSPs will achieve a "Zero-Touch" service model where AI handles 90% of all tickets, patches, and provisioning, allowing them to scale to thousands of endpoints per human technician.

- Implications for Vendors: Your platform's AI automation is now your single most important feature. The vendor that provides the best AI-driven, self-healing, and auto-remediating platform will consolidate the MSP market.

- Implications for Partners: Your core competency is no longer service delivery; it is automation management. Your most valuable employee is the one who can train your platform's AI to handle more tasks.