The Great Shift: From Digitization to Autonomy

For the last decade, the primary mandate for the Small and Midmarket Business (SMB) sector was digitization—migrating analog workflows to the cloud. As we approach 2026, that era is effectively over. The digitization infrastructure is laid; the new mandate is Autonomy.

This year marks the 18th annual release of Techaisle’s global SMB survey. Drawing from an expanding dataset of N=5,500 SMBs and Midmarket firms across more countries than ever before, we have identified a structural pivot in how these businesses consume technology. This data, derived from our unique, proprietary B2B panel of 2.5 million validated business and IT decision-makers—not general consumers—reflects the voice of the active buyer.

While we maintain granular data for Small Business (1-99 employees), Core Midmarket (100-999 employees), and Upper Midmarket (1000-4999 employees)—each with distinct priorities—the aggregate SMB data reveals a unified market truth: companies are no longer buying tools to support users; they are buying agents to augment them.

Download 2026 SMB Top 10 Business Issues, IT Challenges and Technology Priorities

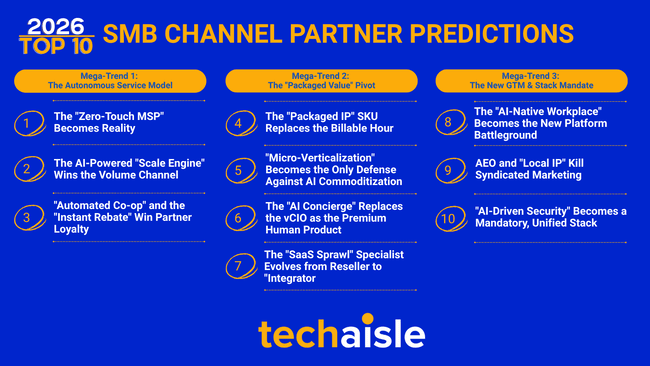

Here is the analytical breakdown of the 2026 SMB strategic agenda.