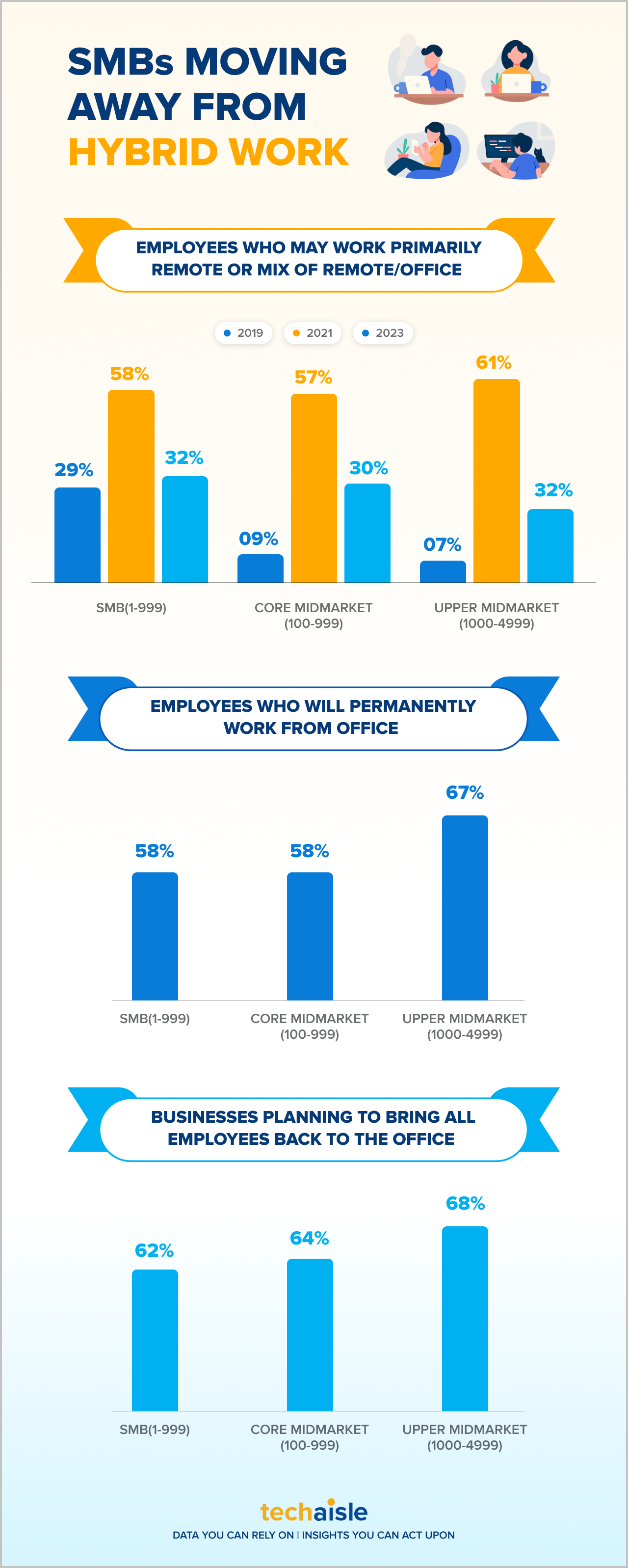

Poised for liftoff for some time, the remote work revolution was set to shift into overdrive. However, hybrid work is challenging the SMBs. By the end of 2023, 32% of employees within the SMB and midmarket firms expect to have hybrid work arrangements, down from 58% in 2021 and similar to 29% (pre-pandemic levels) in 2019. Over 40% of SMBs and Upper midmarket firms are experiencing significant challenges impacting remote employees’ productivity. In addition, 39% of SMBs and 41% of upper midmarket firms have critical security concerns relative to remote and hybrid work. Furthermore, 43% of businesses cannot adequately support remote employees, and 39% cannot provide consistent technology experience for remote and on-site employees. Finally, 41% of SMBs and upper midmarket firms have not overcome organizational challenges in managing remote employees. Techaisle data shows that senior management is spending 3X more time maintaining company culture through the hybrid organization, 2.5X more time in employee empathy, and 2X more time in supervision and management.

As a result, 62% of SMBs and 68% of upper midmarket firms plan to return all employees to the office in 2023. However, bringing the employees back to the office is also of concern to the executive management. As a result, 37% of SMBs are prioritizing office space planning, and 32% are identifying wayfinding technologies. In addition, 41% of upper midmarket firms are investigating ID management, and 40% are investing in smart meeting rooms.