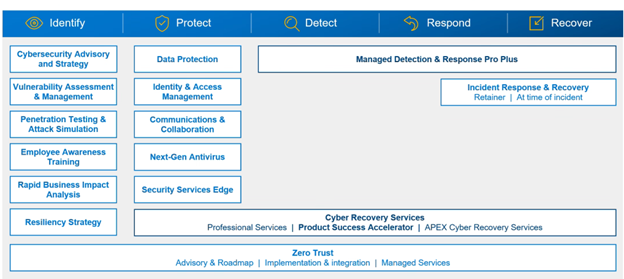

Zero Trust (ZT) is a concept that, while not universally recognized, holds significant relevance in many organizations, particularly within the mid-market sector. Techaisle’s SMB and Midmarket Security Adoption Trends research shows that Its awareness is relatively low in the small business segment, with a mere 8% familiarity. However, this awareness escalates within larger organizations, reaching 46% in core midmarket businesses (100-999 employees) and 69% in upper midmarket businesses (1000-4999 employees). This trend intensifies when examining the perceived importance of ZT among those aware of it. Only 29% of small businesses regard ZT as more than “moderately important,” whereas a staggering 90% of core midmarket and 93% of upper midmarket firms deem Zero Trust as “important” or “very important.”

About 30% of upper midmarket organizations are engaged in Zero Trust (ZT) access projects. In contrast, 45% of small businesses, compared to a mere 1%-2% of midmarket firms, have no immediate plans to implement ZT access. The data reveals that a significant number of businesses have initiated the deployment of ZT access solutions: 86% of upper midmarket firms, 69% of core midmarket organizations, and 42% of small businesses.

Balancing Immediate Needs with Proactive Planning: Zero Trust Drivers for Different SMB Segments

Cutting-edge midmarket companies are embracing a variety of adoption drivers in response to Zero Trust’s (ZT) capabilities. These capabilities resonate with executives addressing immediate needs, adapting to alterations in their IT landscapes, and proactively forecasting future demands. As with most business decisions, leadership teams carve out paths to success that align best with corporate requirements. ZT stands out for its unique ability to cater to a spectrum, or even a blend, of diverse motivations.