One of Techaisle's SMB surveys' annual highlights is exploring top business challenges and IT priorities for small and midmarket organizations. They are here - Techaisle's annual SMB and Midmarket Top 10 IT Priorities, IT Challenges, and Business Issues infographics, 11th year of Techaisle tracking at a WW level, and is sought after by IT vendors, channels, and media. In all sectors, 2020 was a challenging year – and as a result, 2021 is challenging from a market planning perspective. The disconnect between 2020 and 2019 was so severe that it rendered forecasts effectively useless: IT suppliers reacted to shifting market trends in real-time. As we enter 2021, IT product and service suppliers look to create a context for understanding the range of outcomes that the new year may bring. Techaisle's "2021 in Focus" research series illuminates issues and requirements in the vast SMB market to support that effort.

Techaisle surveyed a total of 5720 SMBs, quota sampled to ensure adequate coverage of four small business (1-9, 10-19, 20-49, and 50-99 employees), three midmarket (100-249, 250-499, and 500-999 employees) and two upper midmarket (1000-2499, 2500-4999) segments. The data represents a robust and reliable sampling of the SMB market for IT products and services.

There is an ongoing trend – in both the buy-side and supplier communities – towards positioning IT initiatives and expenditures in a business context. By providing insight into the most pressing business issues, IT priorities, and IT challenges faced by small, midmarket, and upper midmarket businesses, Techaisle's research helps readers position their go-to-market strategies and offerings with core market drivers.

For 2021, Techaisle investigated 30 technology areas, each with several sub-technology categories, 30 IT challenges, and 30 business issues.

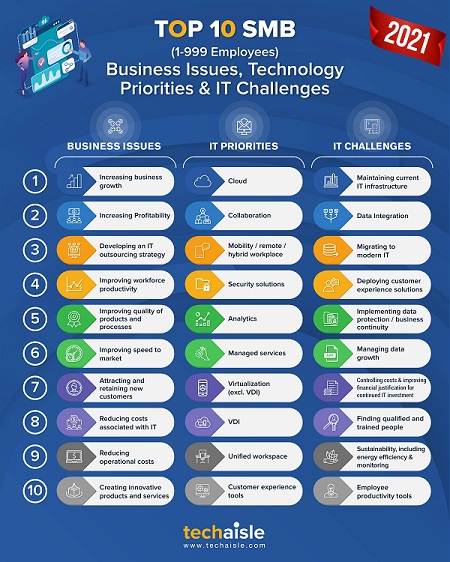

View and download Top 10 SMB Business Issues, IT Priorities, and IT Challenges

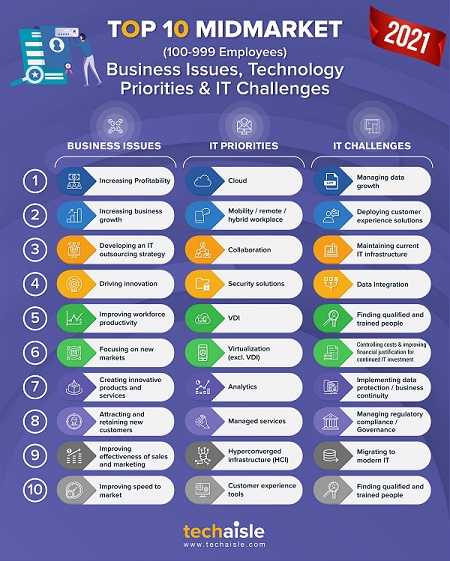

View and download Top 10 Midmarket Business Issues, IT Priorities, and IT Challenges

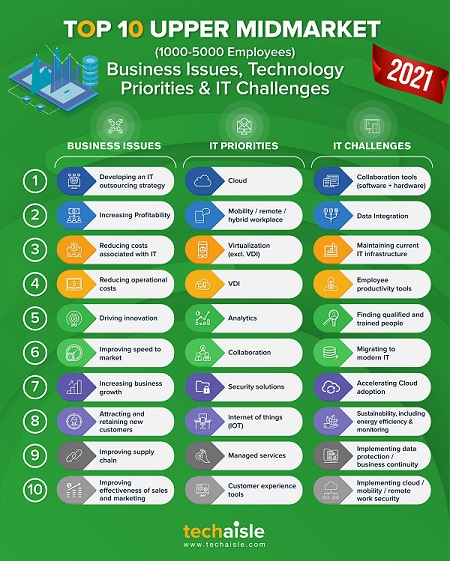

View and download Top 10 Upper Midmarket Business Issues, IT Priorities, and IT Challenges

In 2021, data shows that hybrid/remote work enablement is either the 2nd or 3rd top IT priority depending upon the segment. Collaboration, which Techaisle researched as a discrete category, is the 2nd top priority within SMBs, 3rd in the midmarket, and 6th in the upper-midmarket segments. Collaboration is already an established framework in most midsized businesses, hence a lesser priority in the enterprise-level mid-sized firms. There is a wide-ranging trend towards seeing collaboration as part of the fabric of business activity, rather than merely a means of enabling connections between discrete tasks. It is a core component for midmarket firms' digital transformation. For these firms, VDI and analytics are a greater priority.

The 2021 business challenge findings depict a wide range of objectives: expansion of the customer base, improved top-line, and bottom-line results, cost control (within IT and across the organization), competitiveness, improvement of existing operations and processes, product and process quality, workforce and regulatory issues, and (perhaps as a nod to the pandemic) a need for enhanced ability to manage the unknown.

It is a diverse list. But what is remarkable is that analytics solutions can help address all of these issues – and that, indeed, SMBs are using analytics to manage each today, which gives marketers who sell analytics solutions an enormous advantage. They can position their products as addressing strategic business priorities.

By far, within the SMB segment, the highest adoption growth rates will likely be in 5G, SD-WAN, containers/Kubernetes, UCaaS, VR/AR, AI, HCI, Customer experience tools, and Open-source solutions.

View and download Top 10 SMB Business Issues, IT Priorities, and IT Challenges

View and download Top 10 Midmarket Business Issues, IT Priorities, and IT Challenges

View and download Top 10 Upper Midmarket Business Issues, IT Priorities, and IT Challenges