Techaisle Blog

SMBs and midmarket firms cautiously moving away from Hybrid Work

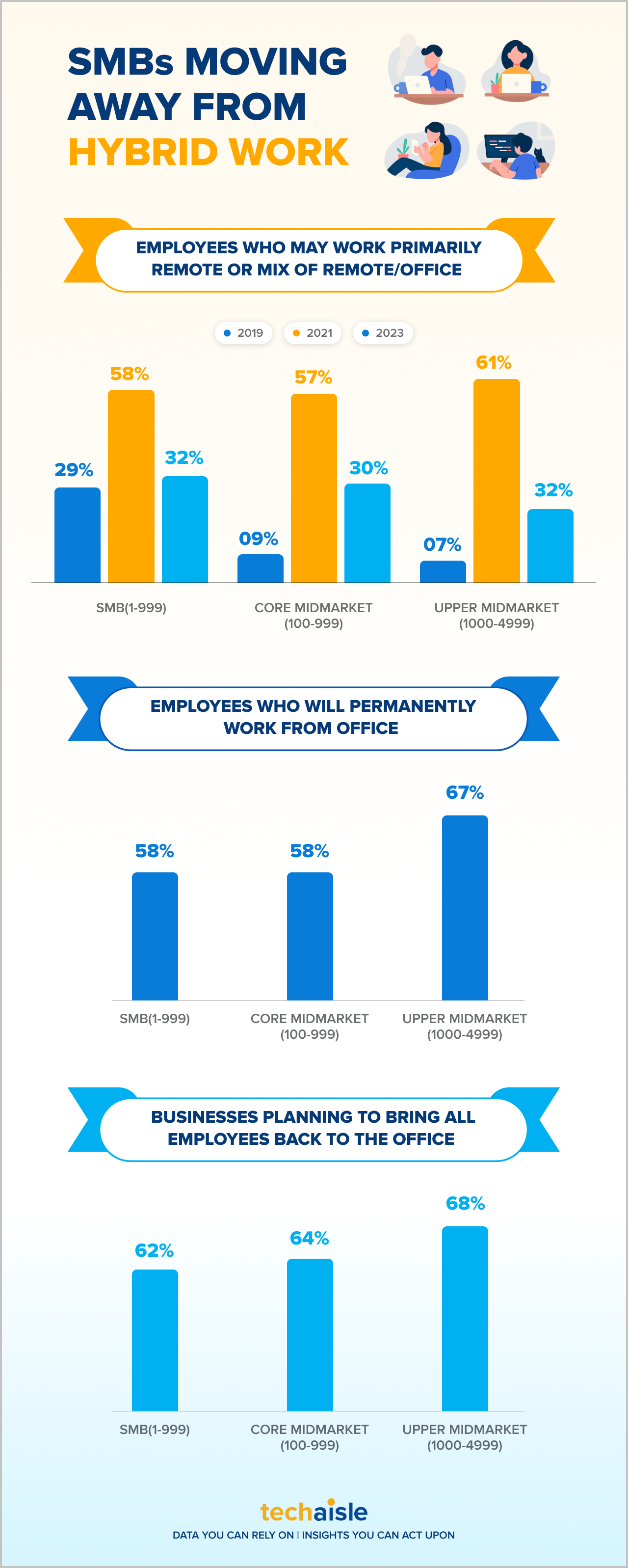

Poised for liftoff for some time, the remote work revolution was set to shift into overdrive. However, hybrid work is challenging the SMBs. By the end of 2023, 32% of employees within the SMB and midmarket firms expect to have hybrid work arrangements, down from 58% in 2021 and similar to 29% (pre-pandemic levels) in 2019. Over 40% of SMBs and Upper midmarket firms are experiencing significant challenges impacting remote employees’ productivity. In addition, 39% of SMBs and 41% of upper midmarket firms have critical security concerns relative to remote and hybrid work. Furthermore, 43% of businesses cannot adequately support remote employees, and 39% cannot provide consistent technology experience for remote and on-site employees. Finally, 41% of SMBs and upper midmarket firms have not overcome organizational challenges in managing remote employees. Techaisle data shows that senior management is spending 3X more time maintaining company culture through the hybrid organization, 2.5X more time in employee empathy, and 2X more time in supervision and management.

As a result, 62% of SMBs and 68% of upper midmarket firms plan to return all employees to the office in 2023. However, bringing the employees back to the office is also of concern to the executive management. As a result, 37% of SMBs are prioritizing office space planning, and 32% are identifying wayfinding technologies. In addition, 41% of upper midmarket firms are investigating ID management, and 40% are investing in smart meeting rooms.

Hybrid work trends have emerged rapidly over the past year. Not long ago, the hybrid mode of work was viewed as a luxury – a privilege only for people who could manage their job from home on occasion. However, the pandemic compelled organizations to scramble for new ways to ensure business continuity, and hybrid work transformed into a must-have from being a nice-to-have option. Organizations that fail to embrace this change and try to return to a 100-percent-office-based work strategy are at risk of falling short in productivity, talent retention, and much more. In addition, amid the worldwide trend of ‘great resignations’ with employees rejecting work from the office and stating that they would rather quit, organizations have been trying to find a balance between working from home and the office.

In a scenario where hybrid work is no longer a choice but a necessity, many organizations are already aware that they need to provide consistent technical support to employees across different locations to enable a hybrid work environment that is seamless, secure, and smart. Hybrid work requires more than just collaborative software; it requires advanced devices, robust security, dependable connection, and smooth networking—all of which must function in tandem. Furthermore, it requires a unified solution to avoid fragmented communication, additional IT administrative labor, and increased security concerns.

However, SMB management is showing some clarity in its strategy. For SMBs and midmarket firms, a return to office is imminent.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.