It was once thought that the cloud would reduce the technology deficit SMBs face relative to larger firms – but it is difficult to say that this has proved to be the case. Indeed, the cloud has lowered the barriers to adopting new systems, giving SMBs access to applications and infrastructure resources that would have been well beyond their means five years ago. However, Techaisle’s SMB and Midmarket Cloud adoption trends research data show that cloud, and hybrid IT, has posed other challenges: difficulties in integrating systems with each other and with business processes, and in integrating data across applications (ensuring that data created by one application is input automatically into others); difficulty in securing systems that are based in multiple locations and managed by various organizations, each with their own set of operational rules; difficulty in applying appropriate levels of security and governance to an ever-expanding pool of data that moves at accelerating pace through an ever-more-complex constellation of systems, users and locations. Large organizations have IT teams dedicated to addressing specific issues within this shifting and complex set of requirements. SMBs rely on limited internal resources (often, small groups of generalists), supplemented by fractional headcount support from third-party channel members, to keep pace with the change that results from the constant advance of cloud and hybrid.

Despite these challenges, though, evidence suggests enormous scope for cloud growth in the global SMB segment. Data indicates an apparent leader/laggard dichotomy between midmarket and small businesses concerning IT-enabled innovation. Over 20% of midmarket firms have internal teams dedicated to “finding ‘what’s next?’ technology-driven innovations,” and 40% “have IT budgets specifically for technology-driven innovation;” 11% report that they have embedded IT professionals charged with finding innovations into business units. Small businesses are, on average, about half as likely to have taken these steps; instead, nearly half of firms with 1-99 employees state that their organizations do not expect IT to drive innovation actively.” Making the assumptions that a) midmarket firms will benefit from the express linkage of IT and innovation, and b) that the gap between large enterprises and midmarket firms is likely as significant as the delta between midmarket and small business. Additionally, large enterprises will, over time, capture IT-enabled business innovation benefits even more rapidly than midmarket competitors. Data illustrates the foundations of a cascade, where IT-enabled innovation drives business success and further cloud investments in larger firms, defining success patterns that small organizations then adopt.

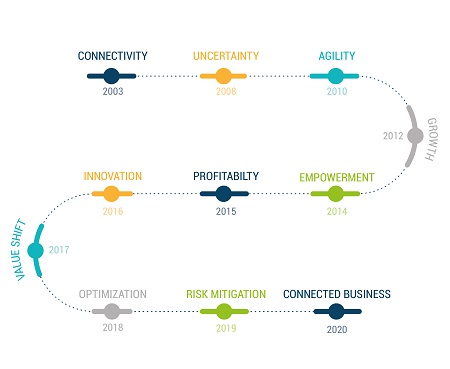

The findings also expose the uncertainty that SMBs face as they structure their IT/business strategies. The most significant proportion of SMBs – 42% of small businesses and 32% of midmarket firms – state that they are unsure of what the next 10-15 years will look like for their industry. Other SMBs worry about their ability to cope with the pace of change: an average of about 25% of SMBs report that they “are struggling to keep up with the pace of change,” and nearly 20% state that they “do not know if they will be able to complete over the next decade.” Against this backdrop, a cadre of forward-looking organizations – 15% of small businesses, roughly a quarter of midmarket firms – “are battling barriers to become a digital business by 2030.” The successes that these firms realize over the next several years will increase their appetite for further cloud investments and encourage their peers to commit additional resources to cloud-based business initiatives. Techaisle expects that if and as these digital leaders realize tangible benefits from cloud and hybrid, the cloud will become an essential element of SMB business operations. As a result, SMBs will become a significant force in the cloud market. Moreover, suppliers to the SMB market and the SMBs themselves can align to bring about this positive change. Techaisle believes that mutual benefit will drive commitment and innovation on both the supply and demand side of the cloud equation.