- ‘The’ IT market is comprised of many segments: large enterprises act at a different pace than SMBs.

- The ‘run rate’ revenue in the IT industry is attributable to products that are mature, accessible to buyers in all segments.

- In many cases, the IT industry focuses on new product categories (e.g., IoT) appealing to sophisticated buyers as growth drivers.

- For the most part, adoption begins in large accounts, and ‘filters down’ into SMBs over time.

- Techaisle research demonstrates that the SMB market is not a monolith – and provides the insight needed to understand advanced IT adopters within the SMB community. And trend analysis serves as an important illustration of the impact that IT’s relentless progress has on different buying segments within SMBs

IT products are often described as having ‘a market’ – but ‘the’ IT market is comprised of many segments, each of which has its own approach to IT adoption. Some industry sectors (e.g., aerospace) tend to move faster than others (e.g., retail); large enterprises tend to adopt technology earlier than SMBs; and different countries and regions invest in new technologies at different rates.

Unless/until they are supplanted by new solutions, mature IT products (e.g., printers, desktop computers) are acquired at about the same rate by all buyers: large enterprises, SMBs, and various industries all have well-defined needs and acquisition patterns for these technologies. These technologies generate the majority of ‘run rate’ revenue in the IT industry.

When IT industry growth opportunities are discussed, the focus often turns to earlier-stage technologies – witness current enthusiasm over IoT, analytics/Big Data and cloud. Sellers of these technologies tend to focus on advanced segments (large accounts, particularly in leading-edge industries). SMBs are generally viewed as a secondary market.

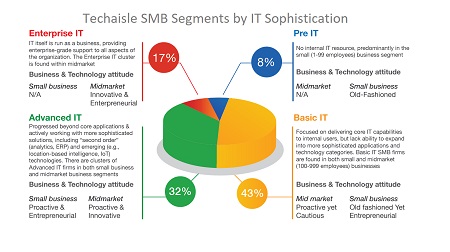

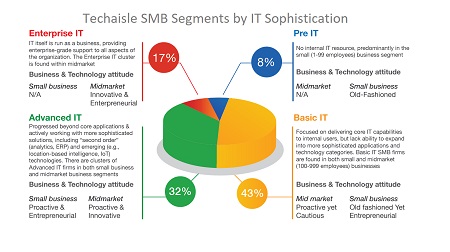

IT sophistication segmentation

However, the SMB market is not a monolith. Techaisle research, SMB & Midmarket IT Sophistication driven technology adoption trends has identified four attitudinal/behavioral segments that have different approaches to IT adoption. Suppliers who understand the scope and characteristics of these segments are able to expand their target markets and develop strategies geared to reaching high-potential SMB prospects. These suppliers ultimately have access to an expanded TAM, and have the insight needed to align marketing investments with priority customers. Sophistication is a crucial issue in SMB technology adoption – but it is often overlooked, and even when it is not, it is poorly defined and quantified. This report provides the insight needed to align SMB targets and strategies with highest-potential segments.

The above chart provides a high-level illustration of the four IT sophistication-defined buyer segments found within the SMB market. The first group, “Pre IT,” represents firms – all of which are found in the small (1-99 employees) rather than midmarket (100-999 employees) market – that have not embraced IT as part of their business operations.

The second group, “Basic IT,” is the largest of the four segments, and most closely resembles the approach that is commonly thought of as ‘the SMB IT market’. These firms invest in mature (run-rate) technologies, but lack the internal business demand and IT understanding to expand into more advanced solutions. In the small business market, Techaisle categorizes these firms as “old-fashioned yet entrepreneurial” – firms that are not sophisticated in their use of IT, but who will buy proven solutions to address clearly-defined impediments to business success. In the midmarket, Techaisle classifies these organizations as “proactive yet cautious” – committed to investment in technologies that have been proven to enhance individual productivity or firm-level capabilities.

The third group, “Advanced IT,” represents the approach that is often considered to be characteristic of leading-edge SMBs. These firms are actively exploring advanced solutions: ‘second-order’ applications (such as analytics and ERP) that build on the more basic capabilities that are already deployed within the organization, and emerging applications (such as IoT) that provide entirely new, IT-enabled expansion opportunities to their businesses.

The fourth group, “Enterprise IT,” functions like the IT operations within large accounts. In an SMB context, Enterprise IT refers to organizations where IT is run as a business, providing support for IT-enabled innovation across all functions and processes. This group, which is found only in midmarket accounts, represents about 17% of the SMB market total.

Technology progress creating segment separations

Comparing the latest 2017 analysis with similar segmentation analysis conducted in 2015, we see that in 2015, 10% of small businesses were classified as Pre-IT, 59% as Basic IT, and 31% as Advanced IT. Over the next two years, IT complexity spiked at a historically high rate: cloud and mobility went from PoCs to essential infrastructure, analytics (and increasingly, Big Data) moved swiftly from early adopter to early mass market status, IoT is rapidly following this path, AI is migrating from science fiction to data centers, and entirely-new options like Blockchain are having real impact on IT strategy in advanced IT environments. Against this backdrop, small businesses see that their capabilities are not adequate for this increasingly-complex world: nearly 70% are in the “Basic” category, and the proportion that can claim to be “Advanced” has halved, from 31% to 16% and the Pre IT has increased.

At the same time, analysis shows that more sophisticated segments are able to grow with this expanding constellation of options. One-third of midmarket businesses were categorized as “Basic” in 2015; by 2017, this group had shrunk to just 11% of midmarket firms. At the same time, midmarket firms boasting “Enterprise” level capabilities grew from 14% to 37% of midmarket organizations.

Taken together, the data illustrated in the research reinforces the need to understand ‘the SMB market’ at a more detailed level. The ability to identify buyer segments within this dynamic environment is critical to a supplier’s ability to adequately scope and target SMB opportunity.