Techaisle Blog

Techaisle midmarket study shows cloud maturity does not always equal high digitization

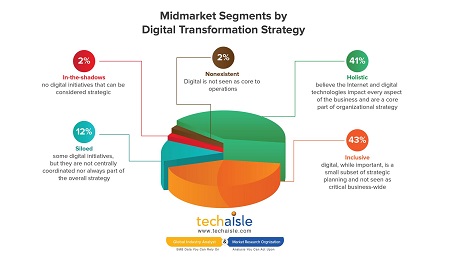

Techaisle’s US midmarket digital transformation trends study shows that maturity of cloud adoption does not equate to high digitization of the business. Study data shows that only half of the 47% of mature midmarket cloud adopters are holistic adopters of digitalization. It is true that these firms believe in cloud and its effect on digitization but they also believe that true digital transformation requires advanced adoption of multiple technology solutions. Data also shows that the midmarket firms that have a siloed strategy of digital transformation are intermediate adopters of cloud, mostly driven by non-IT business units which need cloud to further their business objectives.

However, it is also clear from data that the Holistic segment includes a disproportionate number of mature cloud adopters, and mature cloud adopters in turn are much more likely to be Holistic in their approach to digitalization than firms in the intermediate category. A smaller (7% of total) third group of midmarket businesses, ‘born in the cloud’ (i.e., have all IT resident in the cloud) largely echo the patterns of the mature cloud users.

From a digitalization product/service marketer’s perspective, this is an important finding: it shows that those who can identify mature cloud adopters are likely to find greater receptivity to their messages and offerings than those that engage equally with the similarly-populous group of intermediate (in terms of cloud adoption) midmarket businesses.

High adoption of diverse technology solutions determines digitalization success

Even considering planned adoption, Siloed midmarket digital segment is likely to remain far behind the Holistic midmarket digital segment. The Siloed segment even lags being in the technology areas which midmarket firms see having the most impact in their business for the next 5 years.

Firms in the Holistic segment are more likely than peers to have already adopted virtualization, managed services and IoT, and have more aggressive plans for embracing VDI/DaaS, Big Data and converged/hyper-converged infrastructure. Marketers targeting Holistic users are urged to explore alliances with leaders in these segments, and to look for opportunities to connect digitalization benefits messaging to attributes of potential partners’ product offerings.

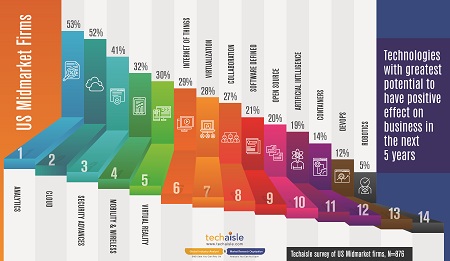

Technologies that align with midmarket digital transformation initiatives

Another way to approach the subject of potential alliances is to look at the technologies that align with midmarket digital transformation initiatives. Data shows, data analytics and cloud are the two categories that are most closely associated with digitization; providing these solutions (directly and/or via alliances) will be critical for suppliers looking to position themselves as digitalization solution leaders. Security and mobility/wireless are also ‘must have’ capabilities for organizations looking to address buyer needs.

The next two technologies on this list, VR and IoT, are future options for most midmarket firms – and not necessarily ‘near future’. Still, their prominence on this list suggests that suppliers should be able to advertise the ability to integrate IoT and VR into digitalization roadmaps.

Virtualization and collaboration are IT building blocks that are already deployed, at least to some extent, in a majority of midmarket IT environments. Techaisle believes that their inclusion here indicates that suppliers will benefit from explaining how they can incorporate (or enhance) these technologies into/with digitalization frameworks. Software defined and open source represent realistic next-stage objectives for firms that are building the core skills needed to support enterprise digital transformation.

The final four items in the data, AI, containers, DevOps and robotics, are (with the possible exception of DevOps) future or ‘aspirational’ capabilities. In most contexts, simply observing that a provider can weave these into a digitalization strategy (rather than providing a detailed plan for adoption) is probably sufficient for midmarket digitalization messaging purposes.

What are holistic and siloed segments?

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.