To meet the managed services needs of the SMB segment, Lenovo has introduced two unique offerings within the Lenovo Managed Services umbrella –

- CSP Managed Services - to help manage SMBs’ existing Microsoft-based cloud software and products.

- Endpoint Managed Services – to provide deeper levels of endpoint and security management along with Premier Support, or Premium Care, Accidental Damage Protection. It includes CSP Managed Services.

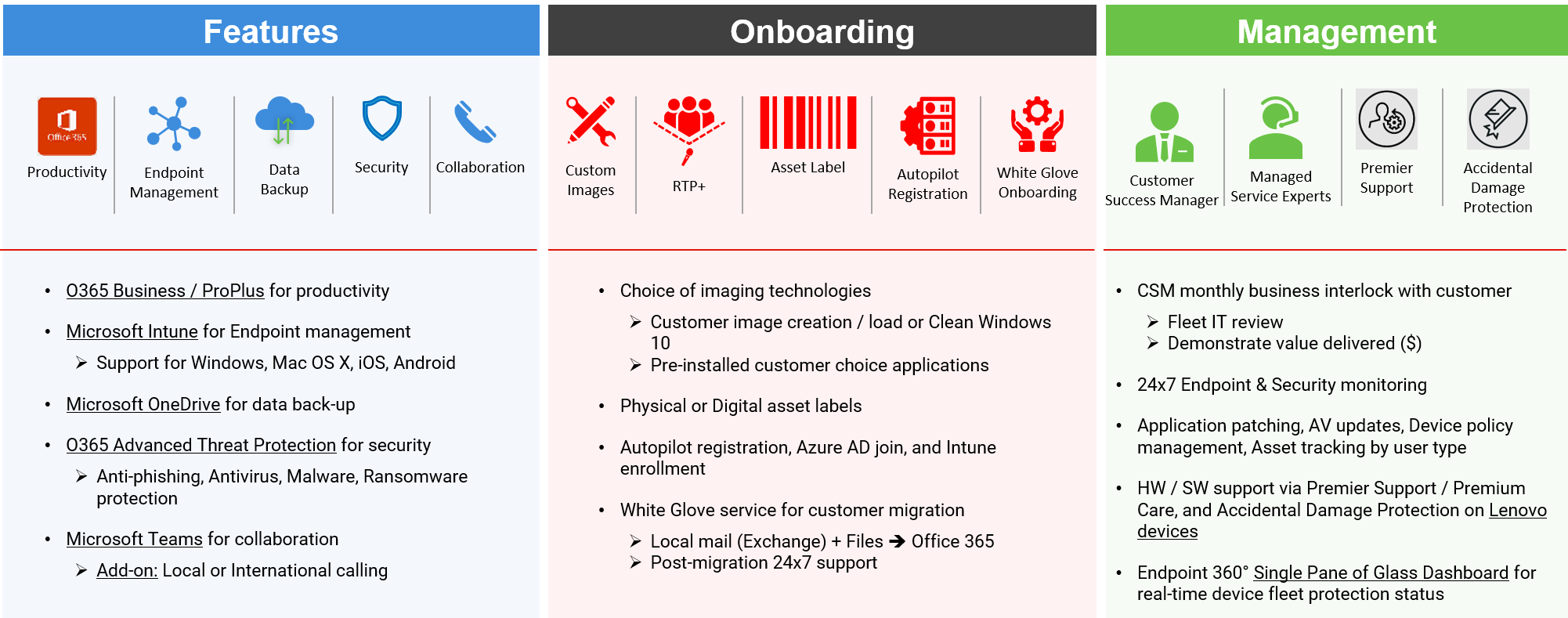

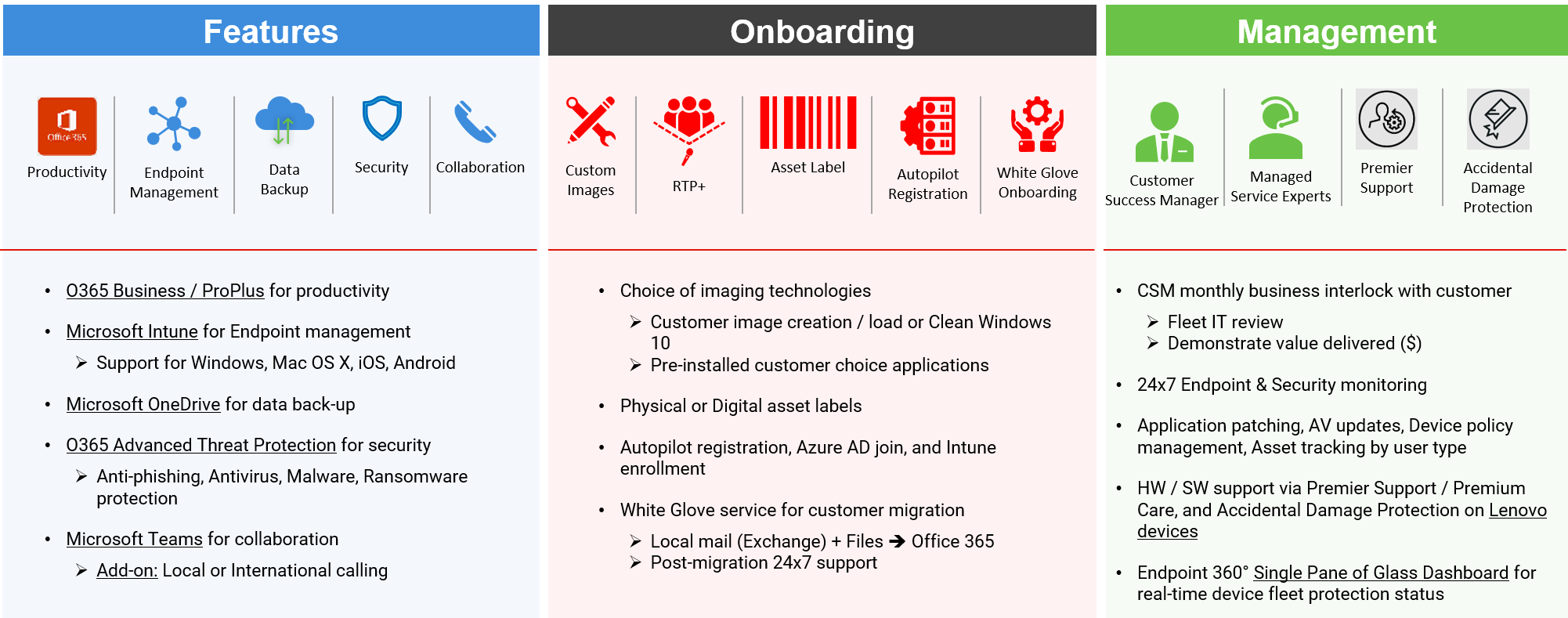

The two offerings cover three important components of an SMB’s managed services lifecycle.

- A bundled set of offerings providing full ground cover for employee productivity with M365, end-point management through MS Intune, backup using OneDrive, protection against phishing/malware with O365 Advanced Threat Protection and collaboration using Microsoft Teams.

- Right-sized and customizable onboarding solutions with white glove service for configuration using Windows Autopilot including imaging and asset tagging, deployment and file migration.

- Full suite of support and maintenance built on Lenovo’s Premier Support solution with end-to-end case management by a dedicated customer success manager thereby removing a significant burden from SMB IT teams freeing them to deliver business results.

Also included in the services are 24x7 Level 1 support via phone, email, and chat – Premier Support or Premium Care for both existing and new Lenovo devices and Enhanced Level 2 support to resolve email access, user authentication, calling or chat, and OneDrive / SharePoint data access issues.

Techaisle Take

IT support dialogue is dominated by discussions about time – cost of downtime, importance of uptime, response time and mean time to resolve a technical problem. The SMB user community, from executives to clerical staff, divide time in two: “our time,” which is when technology is used to support their business activities and increase market momentum, and “lost time” – the time that IT spends setting up accounts, configuring devices, changing permissions, upgrading systems, adding different security protections, finding lost data and fixing problems that can range from a forgotten password to a flattened PC. Lost time is seen as an obstacle to productivity, sales and business success. Despite increasing reliance on technology, SMBs are unable to staff for peak support requirements. IT staff needs to ensure that scarce internal resources are able to deliver technology efficiently, supporting innovation and transformation while responding immediately and effectively to lost time requirements and crises.

A recent study by global SMB and midmarket IT research firm Techaisle found that maintenance and support consumes 77% of SMB IT staff time, leaving only 23% of time for transformation initiatives. Nearly half of maintenance and support cycles are dedicated to PCs, making it difficult for staff to respond to issues relating to smartphones and tablets, servers and networks, and software and security systems.

SMBs find themselves in a tight spot when it comes to their IT functions. Their businesses are complex enough to warrant dedicated IT groups, yet lack the resources to manage everything asked of them. Teams are stretched to cover PC fleets, servers, networks, software and security – all while being expected to contribute to business growth, reduce costs and improve employee productivity. More than a decade of Techaisle SMB survey research data shows that only 3% of small businesses have full-time internal IT staff. Even within midmarket firms, average number of support staff is 22 which is 1/20th of an enterprise business.

Regardless of having scarce internal IT staff, SMBs are increasingly dependent on information technology. A Techaisle survey found that 78% of small businesses and 97% of midmarket firms consider technology to be important to their business success, and 37% report that they have become more dependent on technology in the recent past. These SMBs are dealing with an ever-expanding portfolio of increasingly-complex applications and platform technologies. At the same time, these firms are struggling to rein in IT-related expenditures, including staff-related costs. This combination of increased reliance on technology as a key element of business success, burgeoning complexity and cost constraint has created a ‘perfect storm’ for use of managed services.

This is where Lenovo is stepping in.

Lenovo has a come a long way from being a PC manufacturer to an IT vendor to a trusted advisor for the SMB segment. Lenovo’s offering is built on a simple promise: to deliver managed services by making the most of highly adopted Microsoft tools by deploying real solutions for everyday challenges and technology needs. Supporting this promise are three core pillars of Lenovo Managed Services offering:

Improving employee and IT staff productivity. Techaisle’s recent data shows that each year, SMBs experience 545 hours of lost staff productivity due to IT outages with employees spending nearly 30 minutes a week troubleshooting PC issues. An average of 225 hours of productive time is lost due to PC outages reducing IT efficiency.

Digging deeper into Techaisle’s SMB data on time spent on PC lifecycle management, research finds that 57% of time is allocated to deployment and repairs, with an additional 15% allocated to software-related management issues and 9% to OS migrations. Taken together, these statistics indicate that there is very little opportunity for IT to contribute to their time priorities.

Providing IT security. For 53% of SMBs cybersecurity is a pressing concern; 64% of SMBs experienced a security breach in the last one year and 37% suffered a cyberattack. Through its managed services offering, not only does Lenovo plan to provide a ramped-up level of service and support for various devices but also include automatic enrollment of devices into endpoint management, threat protection, information protection, remote wipe and restoration of devices, as well as OS and application patch management. In addition, Lenovo can help manage licenses, add and remove users, and assign user accounts to available licenses.

Enabling connected collaboration. Collaboration is a priority for 75% of SMBs, 58% of SMBs expect MS Office setup, 56% need data/file migration support, 55% want email and Teams configuration. SMB customers will receive Microsoft Cloud Migration support, where Lenovo teams can help configure online exchange and migrate customer mailbox, Teams application for chat and calling features. Lenovo’s services can also help in migrating files and folders to OneDrive or SharePoint.

Lenovo’s thoughtfully designed SMB-focused managed services solutions aim to deliver real value by helping SMBs increase their productivity by supporting time consuming tasks like Microsoft tenant onboarding, Microsoft Cloud migration, and supporting Microsoft software-based issue resolution, provide security against business-critical threats through real-time threat protection, resolution, and information and data loss prevention, saving SMBs from valuable downtime, and providing peace of mind.

Customer Success Manager & Endpoint Dashboard

Techaisle managed services research data shows that 74% of SMBs expect a single point of contact from their managed services provider. To that extent, one of the most important aspect of Lenovo’s Endpoint Managed Service is the feature that SMBs will be assigned a Customer Success Manager, who works as the customer’s advocate within Lenovo, working to create a truly great customer experience. The Customer Success Manager owns a monthly business review with the customer, discuss device fleet health checks, suggest productivity and security improvements to enhance the SMB’s business operation, and work with technical experts to manage issues escalation.

Lenovo has partnered with Microsoft to develop Endpoint 360° dashboard which provides near real-time visibility of SMB’s device fleet and IT ticket status.

Channel Partner participation

Channel partners are essential in managing an SMB customer’s IT infrastructure. Lenovo’s CSP Managed Services and Endpoint Managed Services are available to Lenovo partners selling Microsoft SaaS products via Lenovo. Partners have a choice:

- Delivery of services by Lenovo: Channel partner sells and Lenovo provides all levels of service

- Partner and Lenovo co-delivery of services: Lenovo provides day-to-day endpoint productivity and security management but channel partner acts as the customer success manager and owns monthly business reviews, issue escalations on behalf of the SMB customer. Partner gets access to Lenovo’s Endpoint 360° dashboard Customer Success Manager role, and

- Partner can deliver all levels of service: Channel partner will get access to additional roles in Lenovo’s Endpoint 360° dashboard providing the partner with information that helps take proactive actions to prevent productivity and security impacts to SMB customer’s device fleet. Lenovo will provide Level 3 technical engineering support for Endpoint 360° dashboard, billing & ITSM platform issue support, and Microsoft platform issue escalation and resolution.

- Lenovo Cloud Marketplace: Lenovo has partnered with AppXite to deploy an ITSM platform which will allow partners to sell Microsoft 365 offers and Lenovo Managed Service packages, customize look and feel of the platform to meet their own design choices, create their own product bundles that include their own offers with Lenovo offers, manage customer subscriptions and recurring billing, get visibility to customer issues and their real-time status.

As per Techaisle channel partner survey research, 47% prefer delivering all levels of services and 40% believe in co-delivery or support and services provided by the vendor. A majority of smaller channel partners want vendor to provide all levels of service. Smaller MSPs profitability lies in their ability to scale and if are only focused on growth, MSPs lose their ability to develop a consultative practice enabling digital transformation within their SMB customers. Lenovo is bringing pre-configured, pre-packaged solutions that MSPs can offer, and directly provide the service. MSPs can also sell the offers and let Lenovo provide services on a platform with a single pane of glass dashboard, along with a customer success manager. This becomes extremely useful, which will allow the MSP to focus attention on delivering new business outcomes for their SMB customers.

Final Techaisle Take

Lenovo Managed Services checks all boxes for a vast majority of SMBs. Techaisle’s research highlights a list of priority outcomes that SMBs use to plot the best path in deploying managed services within their organizations.

- Minimize downtime and workforce productivity interruptions

- Reduce time spent on case management

- Focus on highest-value initiatives

These illustrate the ways that SMBs can use Lenovo Managed Services to drive better productivity within the IT department and across the entire organization. Remedial support, system failures and security incidents are major sources of ‘lost time’ incidents that can impede SMB business success. However, SMBs can reduce time lost to outages, and focus on ‘our time’ objectives – increased productivity and better collaboration on transformative projects – that deliver accelerated business success.

Download Techaisle Take report free