Techaisle global research shows that 409 million SMB employees will still be in hybrid work mode at the end of 2021. As a result, SMBs are investing in processes, products, and policies to support hybrid workforces. Better hardware equipment and mobile devices are an essential component of remote work, but remote work enablement extends beyond hardware to applications, solutions, and work habits. Techaisle data also found that improving workforce productivity is among the top five business objectives for SMB and midmarket segments. Many factors drive productivity, including management approaches, processes and practices, and collaboration/synergy across activities and functions. But technology is a pivotal contributor to productivity directly and through its ability to affect operations and internal coordination positively. Moreover, as the chart below demonstrates, these benefits don't accrue to all SMBs equally. SMBs that are advanced in their approach to IT ("Enterprise IT") are about twice as likely to achieve the productivity-enabled benefits than lowest-performing firms and 30% more likely to realize productivity benefits than the average SMB. IT provides the tools to support greater employee efficiency and productivity. So what are the best ways to help the workforce to capture these benefits and be more productive?

Techaisle Blog

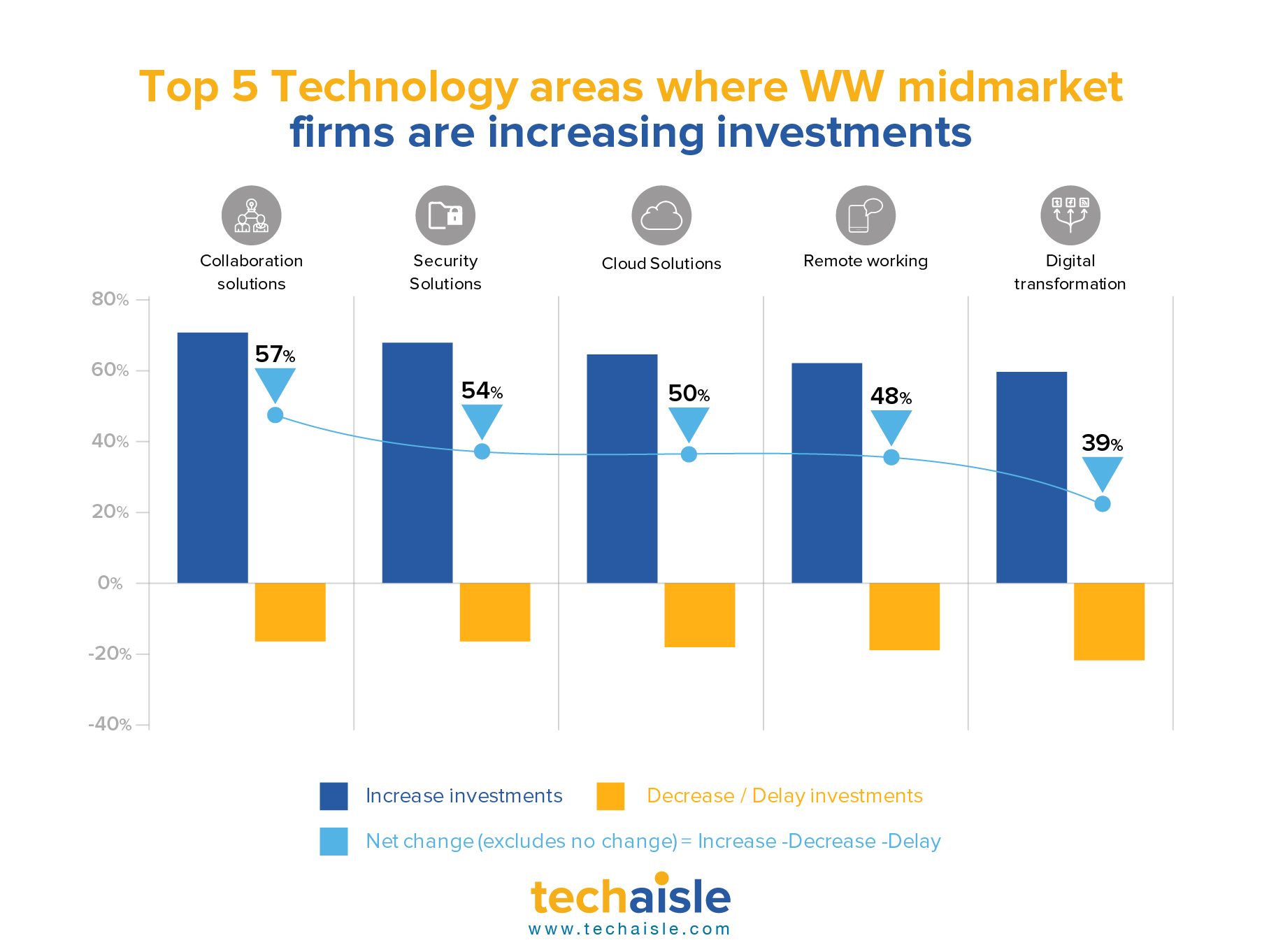

Techaisle worldwide survey of midmarket firms shows that collaboration, security, cloud, remote work and digital transformation are the top five areas where midmarket firms are increasing technology investments.

Collaboration: 72% of midmarket firms are increasing investments in collaboration solution as compared to 15% who are either decreasing or delaying investments. Collaboration is a central component to virtually all business activities and is evolving in response to new market conditions and those collaborative technology solutions are being acquired which are positioned as a framework that integrate and extend the value of discrete capabilities, rather than as a “first step” platform.

Security: 69% of midmarket firms are increasing investments in security solutions. IT security is no longer being viewed as a necessary and unwelcome cost, rather as an enabler of business solutions, a viewpoint that is reinforced by a clear need for IT security in the face of increasing threats to information security and business continuity. Effective security practices are going beyond merely “raising the shields” around users, data and networks – they are being seen as enabling innovation throughout the IT/business infrastructure.

Cloud: 66% of midmarket firms are increasing investments in cloud. Cloud addresses real-world IT issues and business challenges. Cloud represents a powerful way of addressing budget constraints: cloud infrastructure can be deployed quickly and at low cost. Cloud is linked with mobility solutions, particularly security solutions, as data that is accessed via a mobile device can be available anywhere/anytime via cloud, but remain separate from the devices themselves, protecting corporate information from loss or theft or malware. And cloud’s pay-as-you-go approach meshes very well with the need to align IT investment with business benefits.

Remote work: 65% of midmarket firms are increasing investments in remote working. Mobile devices, technologies and services are perhaps the most exciting space today, remaining resilient even in a downturn. Midmarket firms are investing to automate control of sprawling mobile assets. The list includes security solutions (MDM, mobile app security, secure mobile data sharing) that address widespread concern over the exposure that accompanies mobility, as well as methods of automating management (mobile network control, enterprise mobile management) and of deploying infrastructure tuned to the needs of mobile workers (Windows-as-a-Service, VDI, DaaS).

Digital transformation: 61% of midmarket firms are increasing investments in digital transformation. Mature cloud adoption does not equate to high digitization of the business. Data shows that only half of the 47% of mature midmarket cloud adopters are holistic adopters of digitalization. It is true that these firms believe in cloud and its effect on digitization but they also believe that true digital transformation requires advanced adoption of multiple technology solutions. The roadmap to successful digital transformation begins with the creation of a sound physical infrastructure - the ‘building blocks’ or ‘foundations’ of business infrastructure.

IT provides the tools to support greater efficiency and market engagement. What are the best ways to help the workforce to capture these benefits, and be more productive? The workspace isn’t defined by windows and walls and common area couches. For millions of SMB and midmarket employees, the “workspace” isn’t a physical location – it’s a virtual space defined by access from multiple screens which are used from multiple locations. This is especially true of mobile workers, a category which is increasingly indistinguishable from “workers.” Techaisle data shows that 72% of SMB employees are mobile, 87% of SMB employees use mobile devices to access corporate information.

Workforce enablement

Techaisle global survey found that improving workforce productivity is the second most important midmarket business objective for 2019 and among the top five objectives of small businesses. Data shows that for 42% of SMBs’ improving employee productivity is a priority and 43% of SMBs are using digitalization initiatives for employee empowerment.

There are many factors involved in driving productivity, including management approaches, processes and practices, and collaboration/synergy across activities and functions. But technology is a key contributor to productivity – directly, and through its ability to positively affect processes and internal coordination.

Techaisle research shows that these benefits don’t accrue to all SMBs equally: SMBs that are advanced in their approach to IT (“Enterprise IT”) are about twice as likely to achieve the productivity-enabled benefits than lowest-performing firms, and 30% more likely to realize productivity benefits than the average SMB.

The statistics quoted above show that IT is seen as a source of productivity-enhancing capabilities – meaning, in some way, that IT has ‘permission’ from the business to help drive higher levels of workforce performance. However, improved performance requires a strategy, and in technology matters, this strategy should be driven by IT management. It is important that the IT function be responsive to business requirements, deploying requested technology and delivering user training. There is another role, though, that IT management can and should play: focusing on technologies that are proven to contribute to workforce enablement, deploying these technologies within the organization and working with business staff to ensure that the benefits inherent in the technologies are recognized and captured. This advances the IT function from simply responding to requests to providing leadership in enabling the SMB and midmarket workforce.

Techaisle’s research has identified a number of solutions that are seen as driving productivity within SMBs and midmarket firms – approaches that IT managers can and should explore as they seek ways to connect the potential of IT to demonstrable increases in productivity. Three of these solutions - unified workspace, collaboration, and mobility, are especially important in a technology-dependent economy, and each contributes meaningfully to enabling the workforce.

Unified workspace

‘Distributed,’ ‘remote,’ ‘mobile’ – these are the realities of today’s workforce. In many economies, roughly half of workers are remote for at least some part of the work week.

Increasingly, SMBs and midmarket firms are using technology to provide cohesion within the workforce. Unified workspace solutions, which (in Techaisle’s definition) “provides secure anytime, anywhere, any device access from any web browser with single sign-on and password management for all public and private applications, services and file sources used to run the business” help SMBs to organize workers into connected groups. Techaisle research has found that over 75% of firms deploy unified workspace to support the needs of multilocation and full-time remote or travelling workers. These systems also help IT to deliver on key goals of data protection and mobility enablement. Businesses that have adopted unified workspace technology believe strongly that it contributes to productivity by providing a single workspace from which employees can accomplish majority of their daily work, delivering better access to applications and resources.

Although much of the public debate around mobility involves hardware brands and feature sets and overall penetration rates, the real business benefit of mobility is delivered via applications that address specific task requirements within the business, and mobility solutions that overlay the management and security structures needed to integrate these apps with corporate IT systems.

Data drawn from the Techaisle 2017 SMB & Midmarket Mobility adoption survey shows that 2017 will see an explosion in the number of mobility application types used by US SMBs. The data presented in figure below shows that small businesses will go from a current average of seven mobility application categories in use to 14 in 2017, and midmarket firms will increase from an average of about six mobility app categories to 13. This 100%-ish growth pattern is demonstrated across most employee-size segments, with all but the 250-499 group anticipating a 2017 net increase in mobile app categories used of 86% or more.