The rapid pace of AI innovation, coupled with the complexity of implementation, creates challenges for many businesses. Concerns around data security, intellectual property, and the high costs of running and managing AI models further complicate their AI journey. This is where Dell steps in, leveraging its extensive expertise in AI and innovative solutions to help businesses navigate these challenges. The company focuses on developing data management solutions, launching powerful computing hardware, and building partnerships to ensure businesses are equipped for the demands and opportunities of AI.

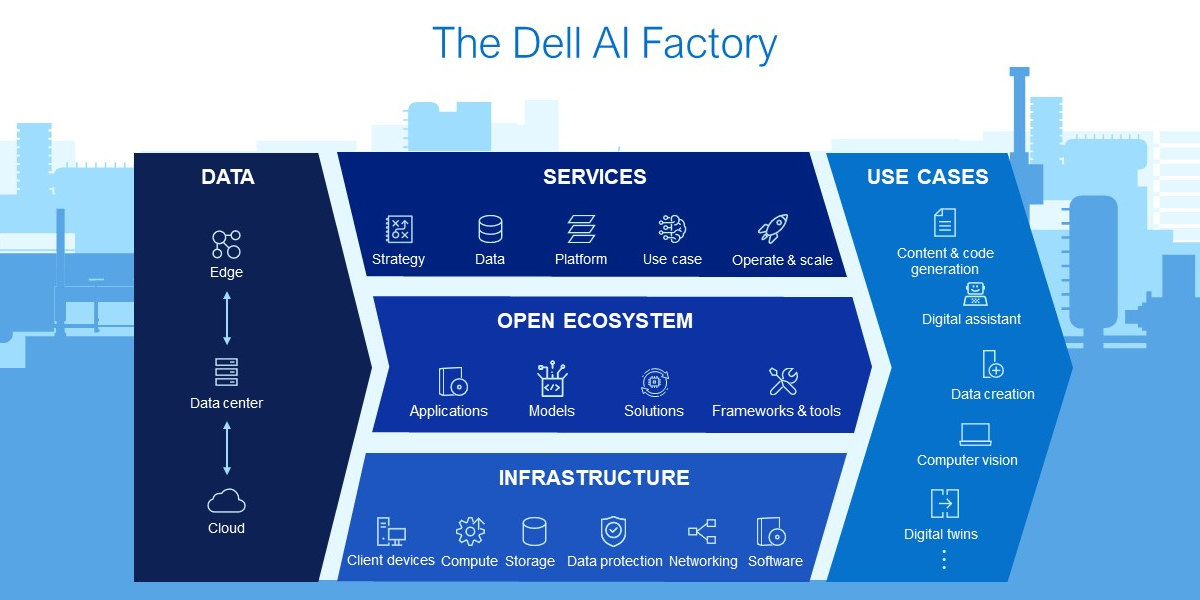

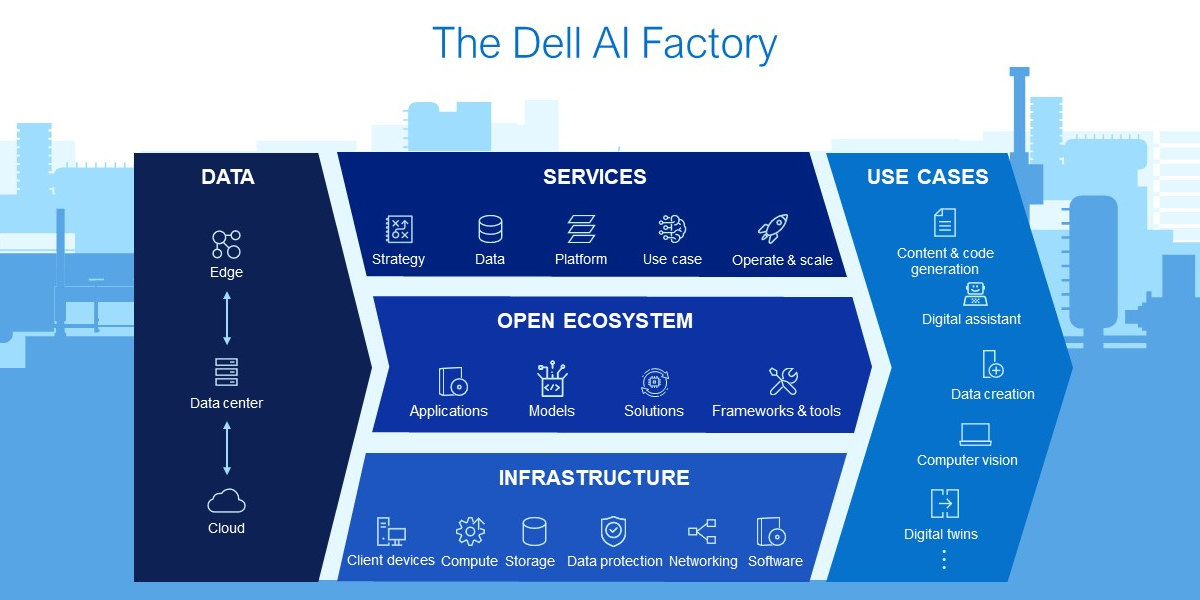

As part of its commitment to democratizing AI, Dell unveiled the Dell AI Factory at the recent Dell Technologies World (DTW) conference in May 2024. This unique initiative stands out for providing customers access to one of the industry's most comprehensive AI portfolio, from device to data center to cloud. The AI Factory, a distinctive combination of Dell's infrastructure, expanding partner ecosystem, and professional services, offers a simple, secure, and scalable approach to AI delivery. Its objective is to integrate AI capabilities directly within data sources, transforming raw data into actionable intelligence and thereby enhancing business operations and decision-making processes. In addition, Dell announced new channel programs to foster collaboration and accelerate AI adoption, recognizing the vital role of channel partners in driving revenue. With Dell's AI Factory, businesses can confidently embark on their AI journey, knowing they have a trusted partner to guide them every step of the way.

Understanding the AI Factory

To adopt AI on a large scale, a robust infrastructure is crucial. Conventional IT setups designed for regular computing often struggle to meet the complex demands of AI workloads. This is where the concept of an AI Factory becomes significant. Picture it as a specialized center with powerful computing systems, advanced data processing tools, and a team of AI experts. The AI Factory is designed to streamline AI solutions' development, deployment, and scaling, making it easier and faster. By consolidating these elements, an AI Factory ensures that AI innovations can be swiftly created and applied, reducing delays and increasing efficiency, thereby simplifying the complex process of AI deployment for businesses. With Dell's AI Factory, businesses can feel relieved of the implementation challenges, knowing they have a trusted partner to guide them every step of the way.

The Dell AI Factory simplifies AI deployment by offering essential components like servers, storage, and networking in one place. This streamlined approach eliminates the need for businesses to find and combine these components separately – and ensures they work well together, saving significant time and resources. Customers also gain access to Dell's AI expertise and a reliable ecosystem of partners. This comprehensive solution empowers businesses to choose from individual products or create custom configurations to fit their AI needs. The Dell AI Factory also offers different consumption models, including purchases, subscriptions, and as-a-service options, providing businesses the flexibility to adopt AI at their own pace. With Dell's comprehensive AI portfolio, businesses can feel secure knowing they have all the tools they need for successful AI adoption.

The Dell AI Factory is not just a collection of products. It is a comprehensive solution designed to simplify AI integration for businesses of all sizes. Whether a business, like SMBs, is starting small with PCs or deploying AI across a server network, the Dell AI Factory equips the customers with the tools and expertise to achieve real-world results.

This powerful combination of high-performance infrastructure, industry-leading services, and deep AI knowledge can empower businesses to embrace AI confidently. The Dell AI Factory goes beyond just hardware, offering a complete package that simplifies the entire AI adoption process, making Dell a key player in accelerating real-world AI applications.

Dell AI Factory Infrastructure

Training and deploying AI models require significant computational power and vast datasets. While convenient for many businesses, public cloud solutions can become expensive for these resource-intensive tasks and introduce security risks and the potential for IP infringement. Businesses increasingly seek on-premises solutions for greater control over data and resources and cost optimization. The Dell AI Factory addresses these challenges by providing a robust foundation built on Dell's core strengths in infrastructure solutions—servers, storage, data protection, and networking. This robust infrastructure delivers the necessary computational muscle and storage capacity for AI workloads.