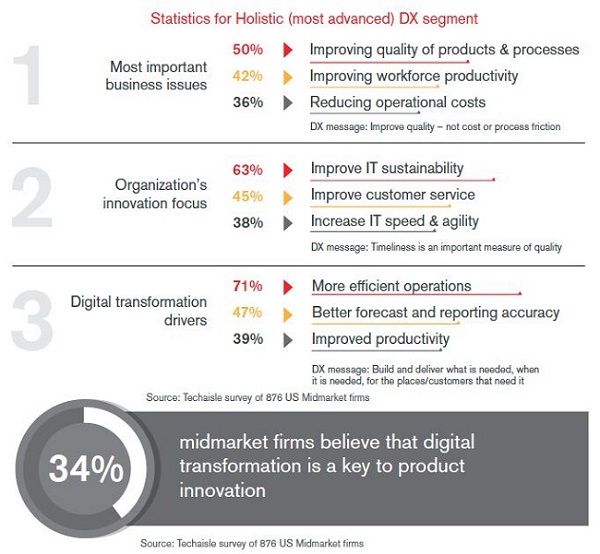

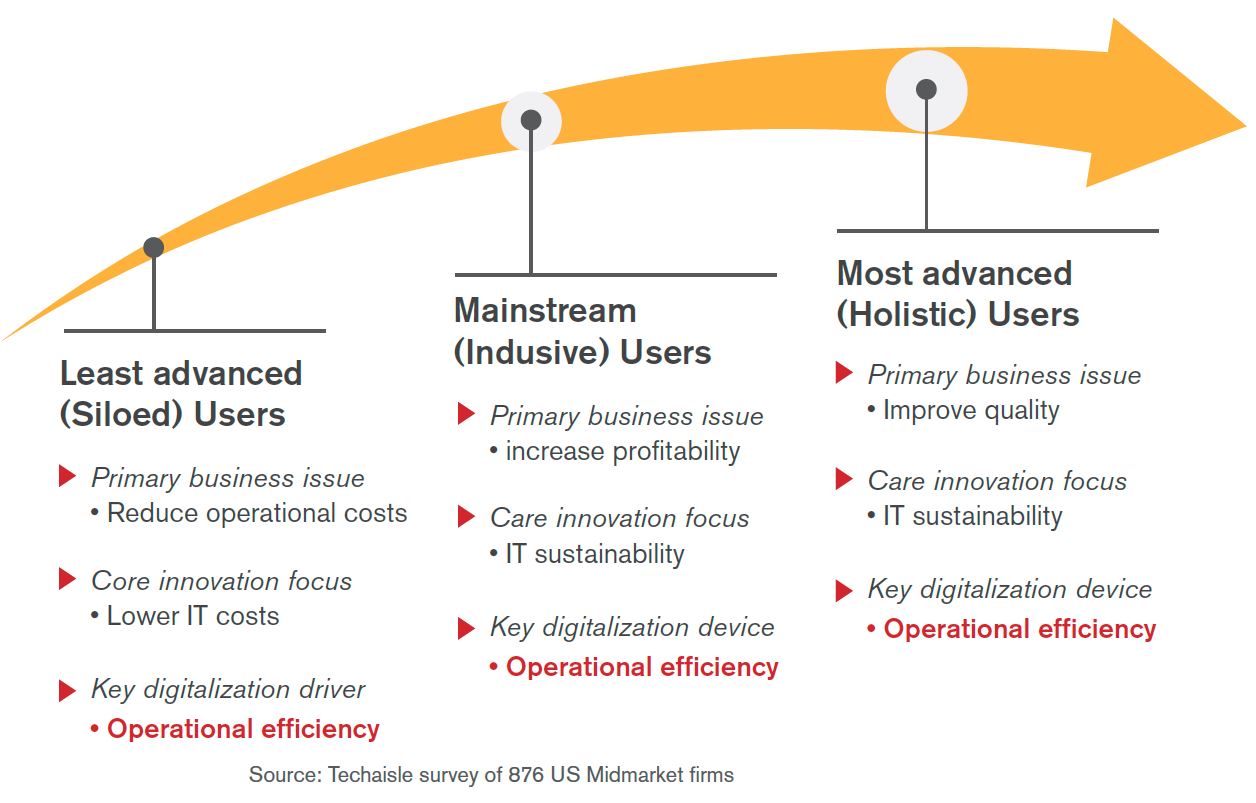

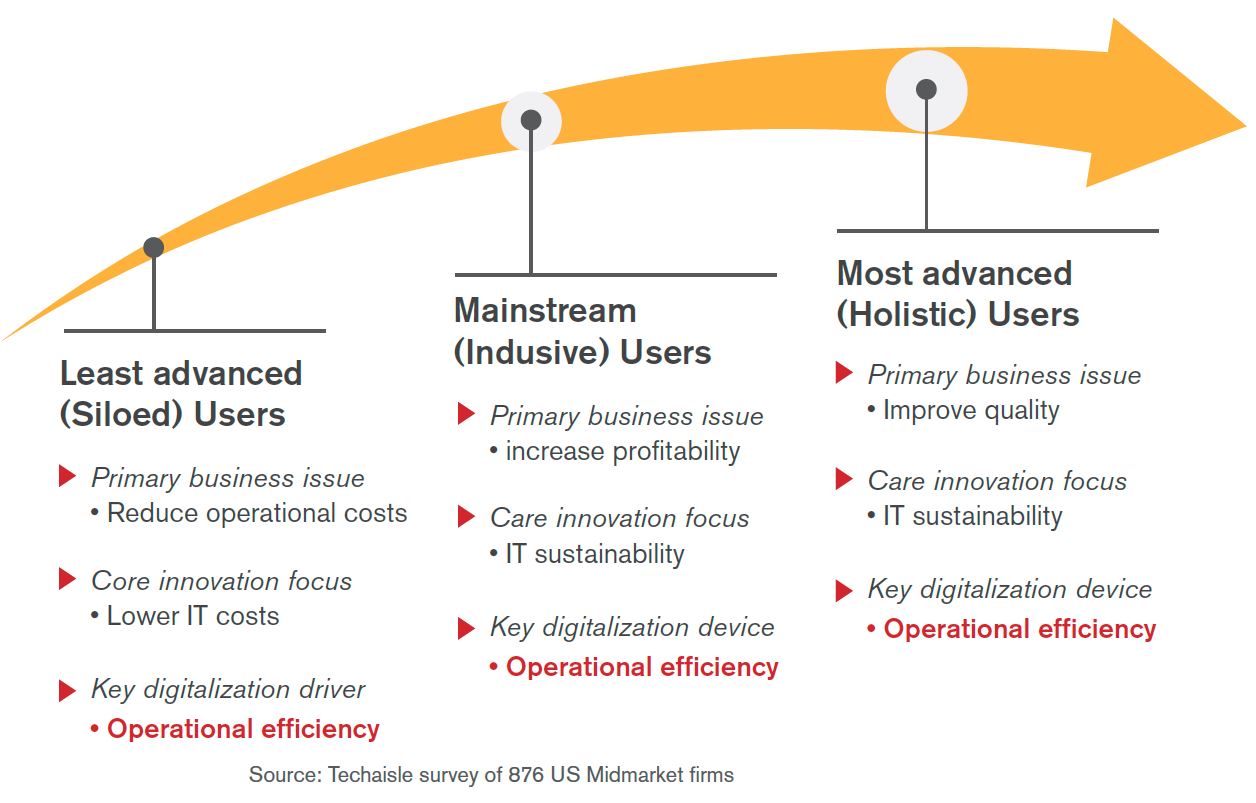

Senior executives in midmarket organizations care about digital transformation – and as a result, channel members can leverage their understanding of key DX objectives and roadmaps into long-term, sustainable relationships with senior decision makers.A Techaisle survey of nearly 900 midmarket firms in the US found that 59% believe that digital transformation is a key to operational efficiency, streamlining processes within the business. In fact, operational efficiency is the most important issue driving digital transformation for most advanced, mainstream and least advanced midmarket firms.

Looking at the figure above, there is a clear progression as firms move from ‘siloed’ to ‘holistic’ DX strategies. The focus of innovation moves from containing IT costs to establishing IT sustainability – the ability to effectively manage IT delivery into the future. And primary business objectives also evolve, moving from a need to control operational cost to focus on profitability and product/process quality. IT advisors who can ‘connect the dots’ from tactical to strategic DX outcomes earn the opportunity to work with executive sponsors on long-term transformation roadmaps.

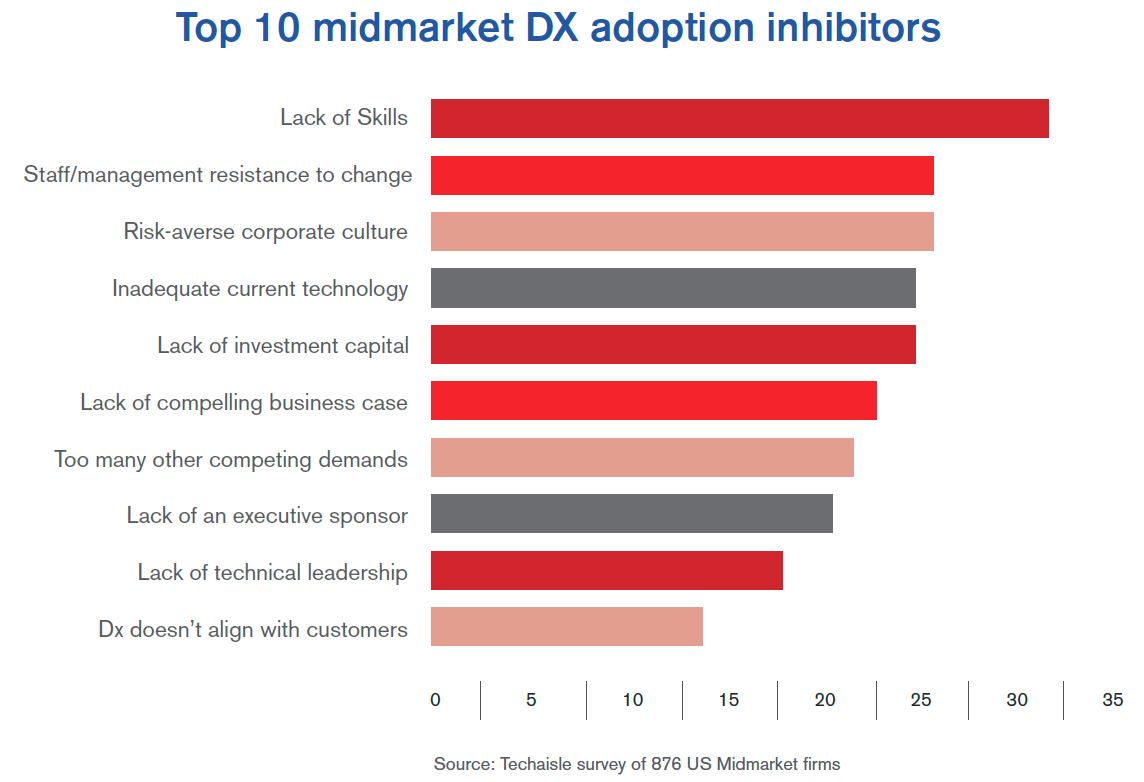

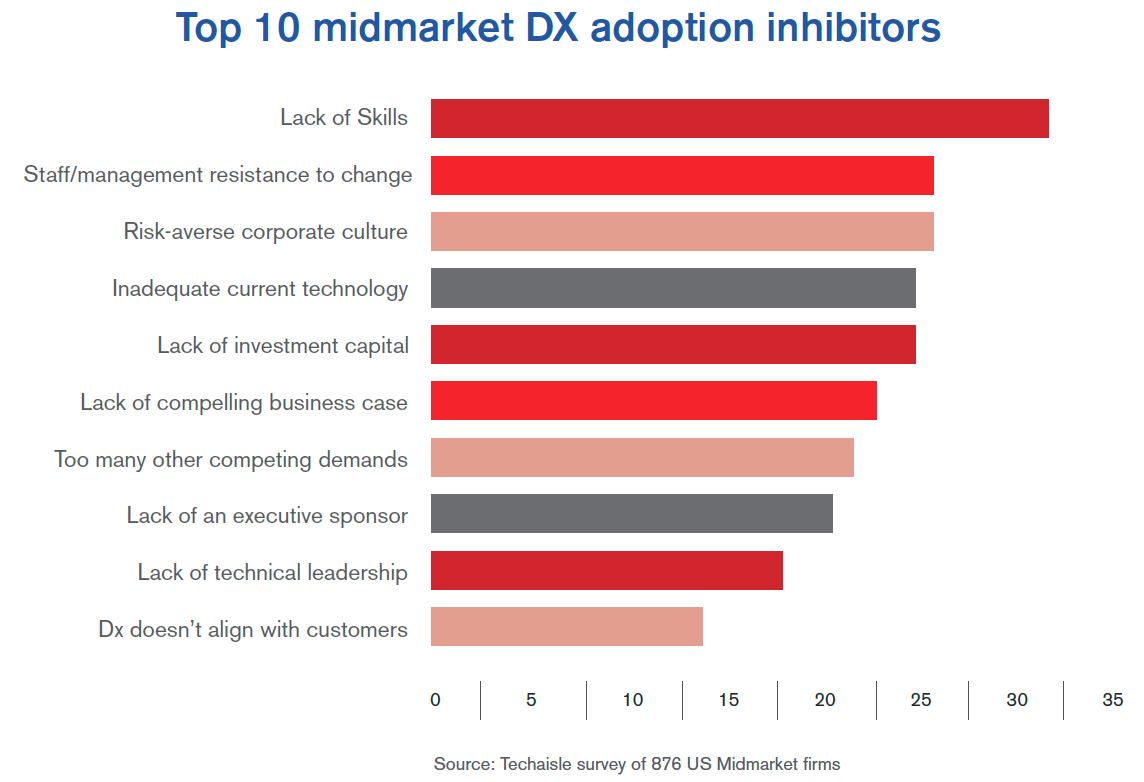

It is important that the channel step up to helping clients to build DX strategies – because midmarket firms are wrestling with a wide range of obstacles to digital transformation adoption. The ‘top 10’ list of midmarket DX inhibitors includes a lack of skills (the #1 impediment, cited by 31% of midmarket firms), reluctance to change current practices and corporate risk aversion, inadequate installed technology and a lack of investment capital for new systems, and an inability to build a compelling business case; lack of an executive sponsor and of technical leadership to support adoption of DX are also significant constraints.

Trusted channel members can help executive clients to address at least half of the top DX impediments. By working with executives to plot a DX path to operational excellence, the channel can provide the business case that underpins executive sponsorship for DX initiatives. And by investing in the technology skills needed to facilitate digital transformation – by delivering technical leadership – the channel can bridge the gap between the capabilities needed to achieve the DX vision and the constraints imposed by legacy systems and change-wary staff and management.

It’s said that Henry Ford once claimed that “If I had asked people what they wanted, they would have said faster horses.” But that’s not really true. Ford knew that people wanted to move faster and farther – they wanted to see and do things that they could not previously achieve. He was responding to the underlying, driving desire, and moving beyond the current constraints.

The midmarket is clearly looking for its own innovative suppliers – firms that are able to deliver the operational excellence associated with digital transformation by finding ways to move beyond current constraints. In collaboration with suppliers who are capable of supporting the whole journey from legacy to DX, channel leaders will establish the technical and operational roadmaps that their clients need to make the leap into the ‘next stage’ of competition – helping the clients who depend on them to build capabilities that are attuned to the needs of the digital business world.