A study by global IT research firm Techaisle found that PC maintenance and support consumes 77% of SMB IT staff time. Digging deeper into time spent on PC lifecycle management, the research finds that 57% of the time is allocated to deployment and repairs, with an additional 15% allocated to software-related management issues and 9% to OS migrations. These statistics indicate that basic PC-related maintenance tasks consume more than one in every three SMB IT staff hours.

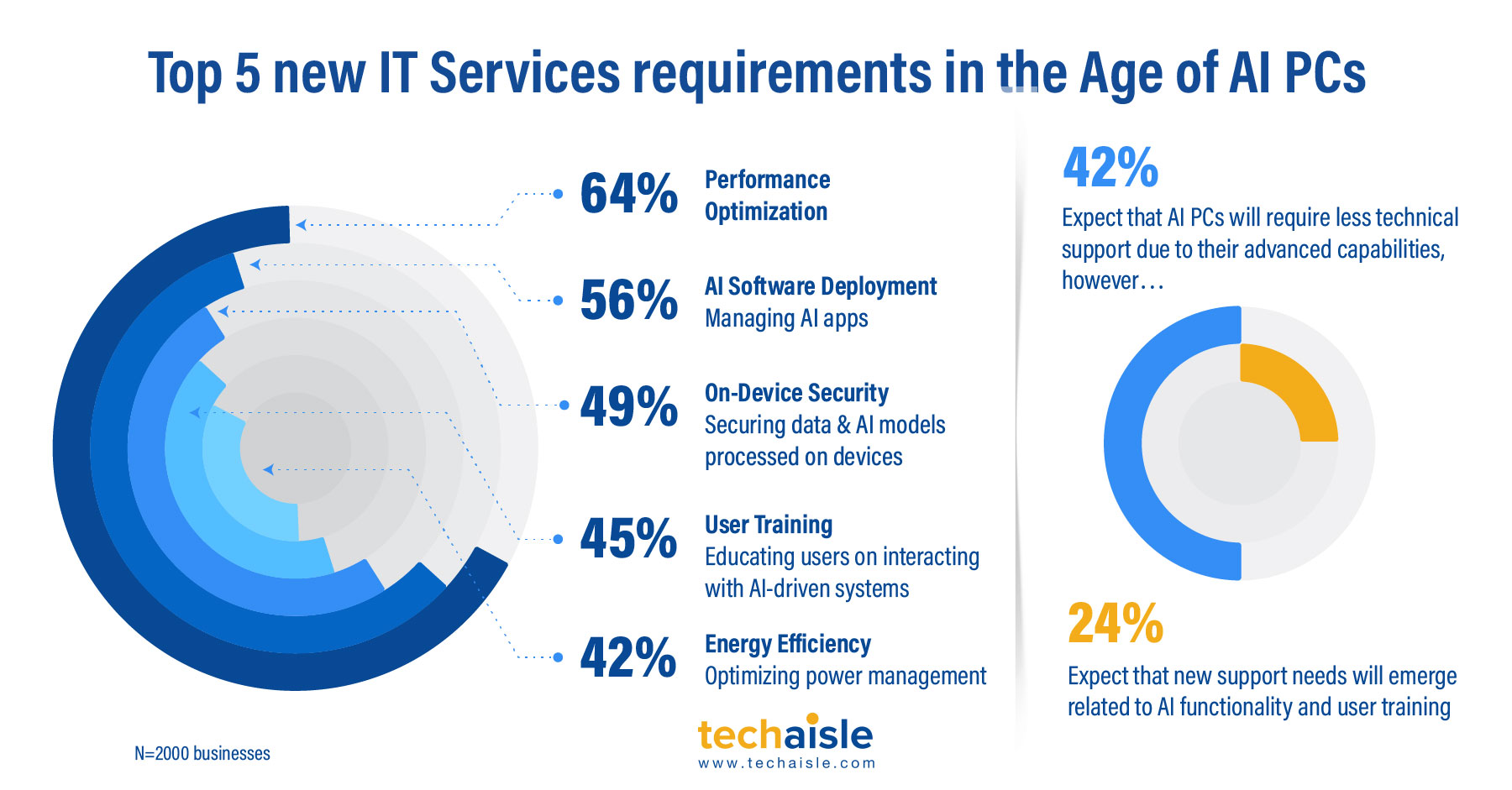

The rise of AI is revolutionizing workplaces across industries. As AI capabilities continue to evolve, businesses are increasingly adopting this technology to enhance productivity and gain a competitive advantage. A key area of this transformation is the emergence of AI PCs. According to Techaisle data, AI PCs are poised for significant growth, with 14% to 28% of all PC purchases in 2025 expected to fall into this category, depending on the business size. This rapid adoption presents both challenges and opportunities for channel partners, MSPs, and PC OEMs responsible for supporting and servicing AI PCs. While 48% of SMBs and midmarket firms anticipate reduced support needs with AI PCs, they are also concerned that new service requirements are emerging. This necessitates a shift in service offerings to effectively address the unique needs of AI-powered devices and their users.

A recent Techaisle survey of 2,000 businesses revealed some key insights into the evolving needs of SMB services in the age of AI PCs. Most respondents (64%) believe performance optimization will be a critical service requirement. This is not surprising, as AI PCs often handle complex tasks and large datasets, demanding high levels of processing power and efficient resource management. IT service providers will need to develop specialized expertise in AI performance optimization to ensure that these devices operate at peak efficiency and deliver the expected business value.

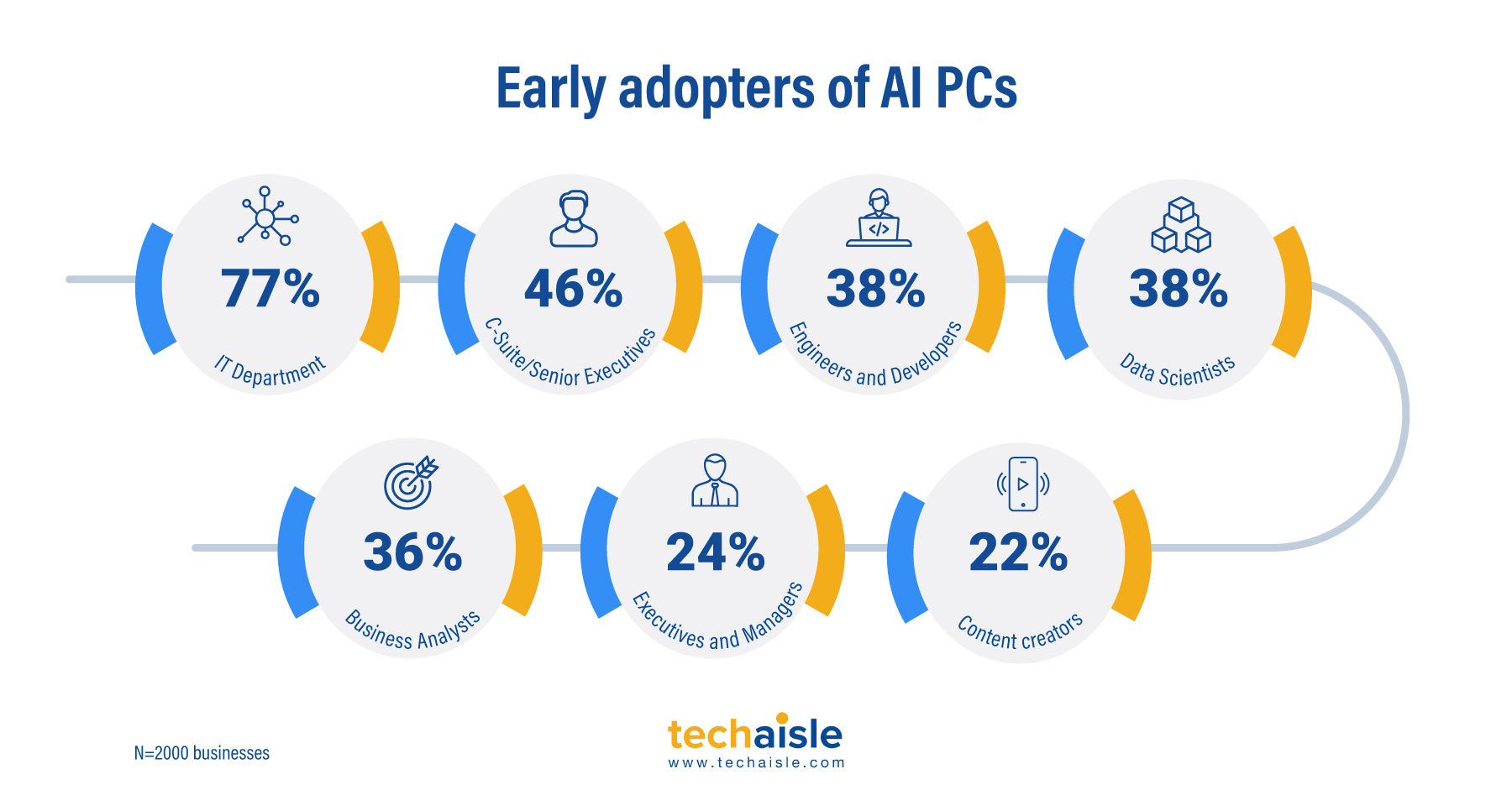

The introduction of Dell AI Studio, Lenovo AI Now, and HP AI Companion marks a significant shift in PC capabilities, creating new demands for specialized support and services within businesses. These AI-powered tools are designed to enhance productivity, streamline tasks, and provide personalized experiences, but they also introduce complexities that many organizations may not be prepared to handle. As businesses adopt these AI-enhanced PCs, IT departments will need to develop new skills and expertise to manage and troubleshoot AI-related issues. This includes understanding how to optimize AI models for specific business needs, ensuring data privacy and security when using local AI agents, and managing the integration of AI tools with existing enterprise applications. Additionally, SMBs and midmarket firms may need to create new roles or teams dedicated to AI PC management, focusing on AI model curation, performance optimization, and user training. These changes will likely lead to an increased demand for AI-specific IT support services, specialized training programs for staff, and potentially new partnerships with AI consultancy firms to help businesses fully leverage the capabilities of their AI-enhanced PC fleets.