Techaisle research shows that the US SMB spend on security (including managed security services) is likely to be US$8.4 B in 2017. Within the entire SMB (1-999 employees) segment it is easy to point to a lack of budget as a reason why US small businesses (1-99 employees) are not proactive when it comes to addressing security (or other IT) issues, but that may not be the whole problem, or perhaps even the greatest obstacle to small business adoption of security technology. Techaisle data illustrates, relative to midmarket (100-999 employees) firms, small businesses have limited internal IT security staff, are not generally working with a managed service provider capable of managing security needs, are about one-third less likely than larger peers to work with outsourcers delivering Security-as-a-Service, and are about 50% less likely to embrace external vendors’ software-based security solutions. While microbusinesses could theoretically pursue the same strategies that are used by larger competitors, they lack experience and skills needed to identify, deploy and manage the products and relationships used to develop shields protecting valuable corporate data, application and human assets.

Techaisle Blog

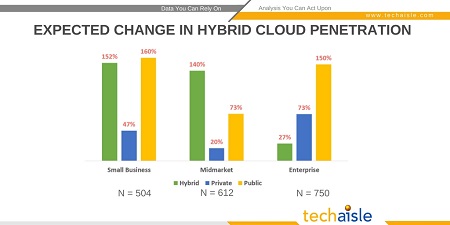

Techaisle SMB & midmarket cloud adoption survey shows that if US businesses follow-through with their plans for adopting hybrid cloud or for that matter, different types of cloud, then hybrid cloud penetration will have the highest jump within the SMBs, by over 100 percent while the Enterprise segment is likely to see a huge jump in public cloud adoption.

However, it is not a “gimme”. While it can be said that a hybrid model for IT service delivery is the reality for most organizations, it can also be said that smaller business may find reliance on public cloud services a simpler option. This is because hybrid IT, or hybrid cloud environments, are also the most complex to manage: while legacy systems, processes and thinking may inhibit cloud adoption, different business segments that are increasingly involved in procurement decisions may opt for siloed cloud application delivery without regard for the organization’s broader technical or overall process goals. And use of hybrid cloud will continue to increase as both a conscious strategy and as a reaction to use of both public and private resources within a single infrastructure.

A surprising outcome from the above chart is the decision trend of enterprise customers to embrace public cloud as the enterprise segment is finally finding that public cloud offers various benefits such as IT cost reduction, increased agility in business operations, increased scalability and flexibility. Public cloud, private cloud and hybrid cloud approaches each offer unique business benefits to the adopting organization. While public services can deliver rapid scale for temporary workloads or support smaller businesses that find appeal in OPEX procurement models, private cloud can deliver scale at better cost in some circumstances, while hybrid cloud offers better, faster access to formerly siloed sources of information.

Another view of the data collected in the surveys provides fascinating insight into the extent that cloud users are willing to align different delivery methods with internal requirements. When responses are taken from the small, mid-market and enterprise respondents and graphed in terms of cloud delivery method usage, Techaisle finds that there are pockets of demand (and overlap in these pockets) that exist for public, private and hybrid models in each market segment.

Related Research

360° on Cloud Computing in SMBs

US Businesses – Hybrid Cloud Adoption Trends

US Enterprise Cloud Adoption Trends

SMB & Midmarket Buyers Journey

SMB & Midmarket Cloud Computing Adoption Trends

The SMB Channel and Cloud: Success Metrics

For more details on Techaisle's Cloud research reports please visit or to see all of Techaisle's Cloud coverage please visit