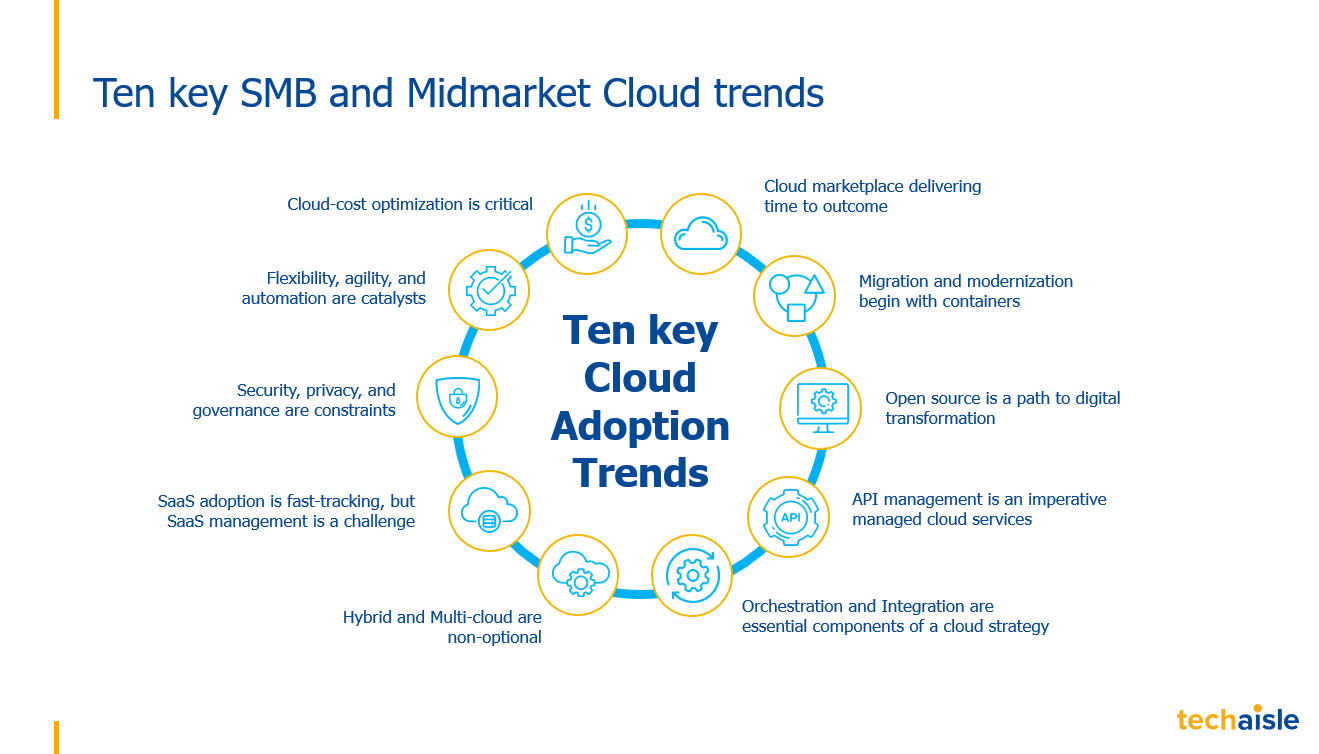

Techaisle’s research of 2150 SMB, core midmarket, and upper midmarket firms reveals ten key cloud trends. The importance of cloud cost optimization, automation, and orchestration cannot be understated. Techaisle’s research of 2150 SMB, core midmarket, and upper midmarket firms reveals ten key cloud trends. The importance of cloud cost optimization, automation, and orchestration cannot be understated. Techaisle survey data shows that cloud cost optimization has moved from 2nd priority to 1st in cloud initiatives for 59% of SMBs and 55% of upper midmarket firms. In addition, it is the top consulting services priority for 100% of firms.

The explosion in cloud use has led to considerable increases in the extent of automation within SMBs and midmarket firms. SMBs are absorbing cloud systems at a very rapid rate: many core infrastructure requirements, systems of record, and systems of engagement either are or soon will be cloud-based, and the cloud is paving the way for new automation in these areas, and in systems of insight (analytics) within SMBs.