On Monday, 10th June, Salesforce announced a definitive agreement to acquire Tableau bringing Salesforce one step closer to empowering analytics-driven digital transformation for its customers, enabling enterprise performance management, driving connected businesses and hurtling itself on a collision course with Microsoft and SAP. Microsoft’s Power BI is rapidly dethroning many analytics platforms including Tableau and SAP is taking giant leaps towards customer experience management with Qualtrics.

Besides adding to topline revenue of Salesforce, the acquisition will likely not have any significant material effect on revenue growth rate as Tableau’s revenue is less than 10% of Salesforce’s revenue with Q/Q growth rate only slightly more than half of Salesforce.

Salesforce began as a SaaS company in 2000 with its famous “No Software” logo and attention-grabbing advertising of a fighter jet striking a biplane. In the last seven years it has transformed into a leading cloud SaaS company with creatively created and strategically segmented solution offerings – Sales Cloud, Marketing Cloud, Services Cloud, Commerce Cloud and Analytics Cloud. But collectively these are only customer-focused applications that operate within the Salesforce platform. But the scope of SaaS impact mirrors the scope of activity in the enterprise itself. SaaS is being meaningfully applied to IT operations, to core business functions (finance, HR, business operations, ERP) in addition to customer-facing tasks (customer service, marketing and sales). There are dozens of discrete SaaS application categories and thousands of applications that address part or all of the requirements in a specific area, or which bridge across process requirements.

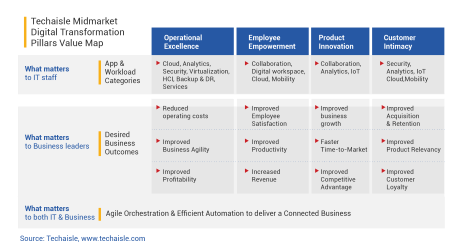

The true benefits arise when cloud applications are connected to each other. Connected applications provide businesses the benefits of agility, efficiency, collaboration, alignment, customer intimacy and innovation. This cross-functional visibility is important to diagnosing issues within the business and formulating enterprise strategy. Almost all businesses, from small to enterprise are on their digital transformation journeys. Frequently, a key step in the digital transformation process is to automate related tasks within and across business process. In the absence of adjacent SaaS applications such as ERP, HR, financial management - Salesforce was forced to acquire MuleSoft, the integration solution to help businesses of all sizes create connected applications.

But a key missing piece from Salesforce’s portfolio has been analytics. Regardless of the business issue, analytics provides an answer. Businesses are prioritizing a wide range of improved outcomes: improvement within existing operations and processes, expansion of customer base, profitability, creation and accelerated delivery of new offerings, reduced cost, and enhanced ability to manage the unknown. Remarkably, each of the issues can be addressed with analytics solutions – and indeed, businesses are using analytics to address each today. This provides analytics vendors with a powerful ability to link product/service capabilities with critical ‘care-abouts’. And exactly this capability was missing from Salesforce’s portfolio. Its AI-led analytics platform Einstein was not proving to be a true analytics solution but rather a collection of dashboards. And for that matter, neither is Tableau (which leans more towards data visualization than analytics). However, with some of its recent announcements such as Ask Data and updates of VizQL, when combined with Salesforce platform may prove to be very useful for new and common customers.

If connected cloud applications is a logical starting point for connect businesses then connected insights is the logical destination. A fact that I feel is being pursued by Salesforce. Most businesses are developing an understanding of the power of advanced analytics, and many are well along the path of installing a “data culture” in which facts are used to identify options, not simply to justify decisions based on instinct or anecdotal feedback. Many cherished but complex metrics, such as return on marketing investment or lifetime customer value, can be established by providing analysts and data scientists with rich data and sophisticated tools. Both MuleSoft and Tableau bring Salesforce closer to delivering an Enterprise Performance Management (EPM) system which will allow businesses to have a new attitude and culture that values and uses data analytics as the quickest way to gauge overall performance and specific areas of interest at a glance. And a key reason why SAP purchased Business Objects many years ago, Oracle acquired Hyperion and IBM absorbed Cognos and SPSS, but some fell by the wayside.

Most businesses including SMBs and midmarket firms that have used CRM and ERP systems within the past few years are familiar with the dashboards that are available with many of these applications, either embedded or purchased/developed separately. Dashboards will continue to evolve and be dynamic in several ways; the way they use data from subsystems like ecommerce and other real time feed sources, the way users can personalize the layout of their dashboards, and the ability to build KPIs “on-the-fly” by calculating variables on the screen and saving the result in a meta-repository for all to use. While several SaaS vendors allow this kind of metric building and start the user at a dashboard, we have yet to see anything targeted to the mid-market or SMBs that connects the performance across front office, production, fulfillment and customer service almost out of the box – so the future has been here for a while and we are waiting for the market to catch up. Microsoft fired the most recent salvo with Power BI and now Salesforce is responding. If only Salesforce bought an ERP firm or HR or collaboration or virtual workspace or customer experience/survey. It would certainly be a game-changer.