Techaisle Blog

SMB and Midmarket digital transformation needs orchestration

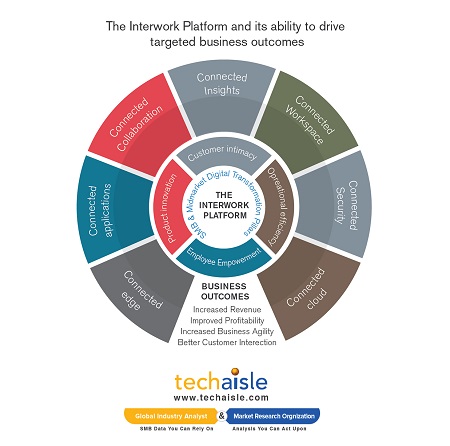

“IT and cloud orchestration” reflects the reality of a multi-platform world in the era of digital transformation. Techaisle research shows that within the SMB & midmarket segment, orchestrated connected cloud and technology will be the focus of substantial new investment over the next few years. Connected cloud itself forms the basis for an Interwork platform for successful digital transformation and is crucial for competitiveness and growth.

- Upper midmarket firms use an average of 2.5 of the four leading public cloud providers (AWS, Microsoft, Google, IBM) – a true multi-cloud environment

- For 25% of small businesses and 51% of midmarket firms, workloads and data migrate across cloud and/or on-premise platforms

- 89% of midmarket firms state that orchestration tools are critical to their ability to deploy workloads on hybrid platforms

- 46% of SMBs do not know which cloud services to use and in what order

- 47% of SMB/midmarket-focused channel partners are offering orchestration but only 24% are delivering, but 55% are expecting substantial revenue increases in the next 1 year

- Use of orchestration is poised for growth as 40% of midmarket firms and 15% of small businesses are implementing cloud connectivity

Using a large number of on-premise technology as well as cloud platforms is escalating complexity beyond reasonable manual management limits. In response to this conundrum, many SMBs & midmarket firms are turning to orchestration as a strategy for optimizing use of multiple platforms and multiple technologies (topic of another blog another time). But help and guidance are missing. Even Techaisle’s latest channel partner study shows that although 47% offer orchestration but only 24% are delivering, and that also partially. Their vendor partners are not helping because of intense focus on enterprise segment.

In the quest for digitalization and digital transformation there has been ad hoc adoption of technology – both cloud & on-premise - as responses to paint points within SMBs.

As a result, Techaisle research shows that US small businesses are currently using 2.1 types of environments (private cloud, public cloud, managed private cloud, colo, SaaS, hosted environments) beyond on-premise technology, and midmarket firms are currently using technology located in 3.2 hosted/managed/off-premise environments. This means that virtually all SMBs are wrestling with the challenge of meaningfully connecting these platforms – so that process data moves cleanly from one workload to the next across environments, so that provisioning is aligned with actual need and not replicated to excessive extents across multiple environments – an imperative for successful digital transformation.

SMBs don’t simply use one type of cloud – they use several different varieties, including public cloud, private cloud, virtual (hosted) private cloud and SaaS applications. And within each of these categories, SMBs often use multiple suppliers: Techaisle research finds, for example, that businesses with 500-999 employees have contracts with an average of 2.5 of the four leading public cloud providers (AWS, Microsoft, Google, IBM); these firms also have dozens or hundreds of different workloads running on separate instances hosted by one or more of these suppliers, and they additionally use dozens of different SaaS applications.

This scenario is complex enough from a resource management perspective. It becomes much more complicated when, as is the case in 25% of small businesses and 51% of midmarket firms today, workloads and data migrate across cloud and/or on-premise platforms. There is inherent tension in the use of multiple platforms: a specific platform may be ideal for a particular function, but complex workloads generally require data to be passed from one function to the next. Businesses add platforms linearly (one after another), but the number of potential connections between these platforms increases geometrically.

Clearly, limiting the number of platforms in use will reduce management complexity, but this approach restricts access to beneficial options: putting a hard limit on service delivery platforms might force a business to eschew beneficial SaaS applications, or prompt the use of a single public cloud provider, leading in turn to lock-in, reduced flexibility and higher prices. It is equally clear, though, that using a large number of platforms will escalate complexity beyond reasonable manual management limits.

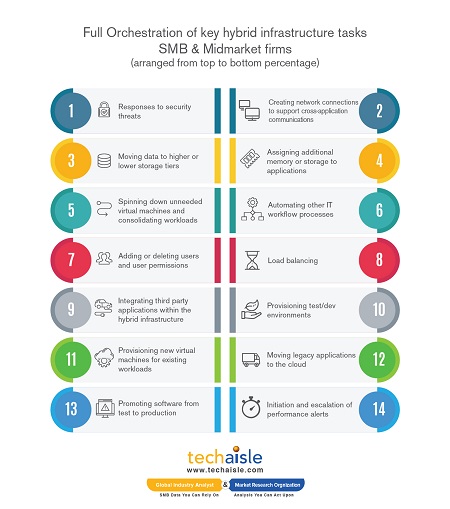

In response to this conundrum, many businesses are turning to orchestration as a strategy for optimizing use of multiple platforms. In a Techaisle survey of SMBs & midmarket firms currently using hybrid infrastructure in which workloads and data move between different cloud or on-premise platforms, 67% of small (1-99 employees) and 89% of midmarket (100-999 employees) organizations stated that orchestration tools are “critical” or “very important” to their ability to deploy workloads on hybrid platforms.

To be fair, use of these tools is still at an early stage. Just less than 40% of SMBs & midmarket firms rely on manual management of workloads and data for at least some workloads, and over half migrate workloads and data in response to capacity alerts. About one-third of SMBs using hybrid report that their workload and data migration are fully automated – but as figure below shows, small and midmarket firms have a long way to go before they can accurately claim that their environments automatically adjust to performance, demand, management and/or security requirements.

Use of orchestration is poised for growth: 40% of midmarket firms and 15% of small businesses are implementing cloud connectivity. Nearly half of SMBs are turning to cloud connectivity as a means of reducing cost and complexity; other key drivers include improved customer experience (45%) and increased business agility (44%).

Techaisle believes that by the end of the decade, all businesses with 20 or more employees will be committed to a connected cloud strategy, and will deploy (directly, or via third party managed service providers) the tools needed to automate connections facilitating resource optimization and workflow integration. Connected cloud will be the bedrock on which Interwork platforms are built. Interwork is the essential digital transformation platform.

Referenced Techaisle research:

- SMB & Midmarket digital transformation trends

- SMB & Midmarket cloud adoption trends

- Channel Partner Trends

- Upcoming: SMB & Midmarket Integration & Orchestration trends

Other Digital transformation blog articles:

- Digital transformation challenging the SMB buyers journey

- Integrated, interconnected business applications deliver better business outcomes

- Interwork - the next step in connected businesses

- Digital Transformation and the future of Reseller channel

- Techaisle midmarket survey reveals holistic digital transformation strategy yields better business outcomes

- Techaisle study reveals four midmarket segments by digital transformation strategy and vast untapped potential

- Techaisle study reveals four pillars of midmarket digital transformation

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.