Techaisle Blog

SMBs find that cloud addresses real-world business pressures

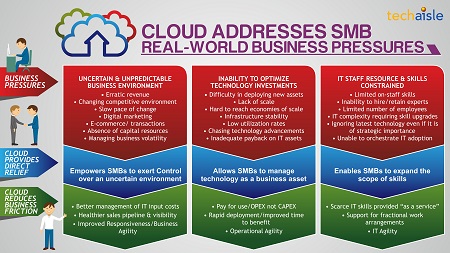

SMB Cloud is no longer a trend that is discrete from mainstream IT. Data presented in Techaisle’s cloud reports shows that cloud is viewed as an IT priority by 96% of US SMBs, by over 85% of European SMBs and nearly 65% of Asia/Pacific SMBs. Within Asia/Pacific if very small businesses are excluded then cloud as a priority jumps substantially. Cloud is not a future issue – it has become an essential component of SMB IT and is the new IT reality. Techaisle’s surveys of SMBs not only found a strong link between cloud and IT – it also found a strong link between cloud, IT and business success. The research data shows that technology is viewed as critical to the success of SMB businesses and that cloud provides a compelling response to SMB business issues and cloud also addresses constraints within the SMB market.

SMBs are sometimes seen as small fish in a pond that is also home to much larger creatures. They are subject to tides and actions that tend to derail their businesses and are strongly felt: when business lags, when orders grow sparse, when supplier costs increase, when the competitive environment changes. Cloud offers direct relief for several of these business pressures.

Cloud delivers a degree of certainty and control over cost/performance and time. Cloud infrastructure and applications can be deployed rapidly, shrinking the time between decision and benefit. Analytics that are embedded in cloud systems and the analytics applications that are available via cloud further reduce business uncertainty.

Adequate ROI or payback on IT assets purchased and deployed is another classic issue within SMBs. Small businesses have trouble utilizing all of the capacity of installed IT systems and often end up paying for resources they are not fully utilizing. Those that do get to full utilization often have a different problem, unable to expand and scale as they are not geared towards rapid deployment of new servers, storage and networking equipment and they are unable to purchase volumes needed to obtain large scale discounts. Cloud steps in and provides relief. An SMB using cloud works with a provider capable of sustaining high utilization levels, which reduces the per-cycle cost of the underlying IT assets. And a cloud provider is able to purchase new systems in greater volumes than an SMB – qualifying it for greater scale-based discounts – and is attuned towards more rapid, "just-in-time" deployment of new systems. By centralizing workloads from multiple SMBs cloud makes economies of scale attributes to businesses that cannot not attain these benefits individually.

It is common knowledge that most SMBs are constrained by the staff they can engage. It is mostly a money issue and manifests itself in many different ways. SMBs lack funds to hire as many people as they would like, lack funds and business scope to hire and fully engage specialists with important domain knowledge, and/or lack funds to employ or develop more skilled staff across their organization. The reality of cloud and cloud-based systems helps to reduce some of the frictions that impede SMBs from addressing these staff issues. Because cloud is delivered "as-a-service", important functions are handled by the supplier, so that the SMB doesn’t have to dedicate employee budgets to IT staff with specialized skills that support core systems but don’t meaningfully differentiate the company.

It is clear that SMBs are heavily committed to cloud – because it addresses many high-priority business and IT issues – cloud is likely to become even more ingrained within SMB operations, and that there is increasing interest in developing integrated platforms that span on-premise and remote cloud resources. A market described in these terms will attract a wide range of suppliers: IaaS services vendors, firms that offer SaaS (or data management as a service, business process as a service, disaster recovery/business continuity as a service, etc.) that are looking to run on top of these core cloud offerings, and software and service vendors targeting opportunities to enhance or accelerate cloud or hybrid IT activities. What should these firms consider, when they are formulating the SMB strategies? Techaisle research probed three essential areas:

- Key technology trends that influence cloud adoption, use and management

- The sources used by SMBs to procure cloud services

- The positioning of leading platform suppliers within the SMB market

By understanding SMB objectives and concerns in these areas, prospective suppliers can build marketing approaches that are aligned with buyer needs, and which are most likely to resonate in the market.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.