Business decision makers (BDMs) are an intrinsic force in most midmarket organizations and are the primary decision makers in some high-growth technology areas, including collaboration, social media and analytics – meaning that increasingly, BDMs are ‘the boss of IT’. These BDMs view IT as a component of business processes, rather than as a stand-alone silo. Techaisle SMB & Midmarket Decision Authority data shows that twice as many BDMs as ITDMs (IT decision makers) in midmarket businesses say that it is critical for IT to understand how technology contributes to overall organizational success. These BDMs have specific objectives for technology usage, clear perspectives on adoption drivers and impediments, and tend to be influenced by information sources that are different from the inputs used by ITDMs.

This pressure from business managers leaves IT leaders scrambling to stretch limited budgets to meet seemingly limitless requirements, striving to deliver predictable, secure systems that respond to the increasingly varied needs of their business users and competitive environments. The growing divide between IT authority and responsibility, exacerbated by the fact that business perspectives on IT are shaped by information channels that are not part of the IT professional dialogue, has created an environment where businesses are struggling to develop the cohesion needed to promote or embrace new IT capabilities to achieve business objectives within existing IT and business process structures..

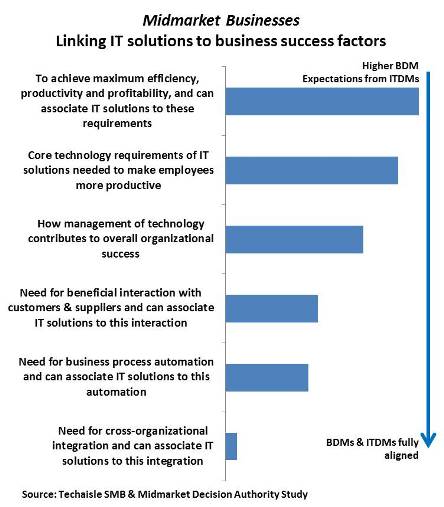

In a unique survey, Techaisle posed the same question, “expectation of associating business success factors to IT solutions” to both BDMs and ITDMs and probed to identify what each expected from the other. Techaisle data shows that BDMs tend to have higher expectations of IT; while business decision makers and technology decision makers are reasonably well aligned in some areas, there is a wide expectation gap in others, which may explain (at least to some extent) the continued proliferation of non-sanctioned, “shadow” IT.

The figure above provides a simplified view of differences between BDMs and ITDMs across several different factors. Although there is a tacit agreement that both business and IT management should understand business related success imperatives and should be able to associate IT solutions to achieving those objectives, closer examination of the data shows some important differences between the two groups:

- 53 percent of upper midmarket BDMs say that it is very critical for business success that ITDMs are able to identify and associate IT solutions with business efficiency, productivity & profitability. On the on the flip side, only 30% of IT executives in these upper midmarket businesses say that business executives should be able to associate IT solutions with business efficiency, productivity and profitability. Responsibility for delivery clearly rests with IT, and BDMs have very high expectations from ITDMs.

- Data also clearly shows that BDMs again have high expectations for support in using technology to build customer connections. Over 40 percent of BDMs believe that it is critical that IT has a grasp of solutions that enable beneficial customer & supplier interactions. In contrast, only 1/4th of ITDMs say that BDMs should have a grasp of such solutions.

- Employee productivity is an important aspect of business and in most cases businesses are expecting IT to understand and deploy core technology solutions to make employees more productive.

- Business process automation is an area where there is better alignment between IT and business. However, automation is a dominant need within the 100-499 employee size segment; nearly 40 percent of BDMs in the segment say that it is critical that IT can identify requirements for automation and associate IT solutions with these needs.

- Cross-organizational integration is recognized as being important by both BDMs and ITDMs in mid-size businesses: over 50 percent of both groups agree that it is critical for both business and IT to associate technology solutions with business demands. This is an area where both BDMs and ITDMs are fully aligned.

The trend towards increased BDM involvement in IT decisions is likely to accelerate further. BDMs are already active in shaping demand in core IT markets, and they are the dominant force in high-growth areas like collaboration, social media and business intelligence/analytics. ITDM and BDM divergence will continue and although there is cross-pollination they may as well continue to operate from different pods. Although it may be tempting to try to bring the various parties together, IT suppliers cannot successfully act as intra-corporate matchmakers: they have to come to grasp with the reality of selling to two different constituencies which have different expectations.