Techaisle Blog

Influencing the SMB Cloud buyer’s journey

There are many differences in the cloud outlooks of large vendors and niche suppliers, startups and Fortune 500 firms, traditional channel members and online markets, but there is one common issue that firms across the cloud spectrum face: the need to find an effective way to attract and engage prospective SMB cloud customers. What are the best ways to reach SMB buyers as they make cloud decisions?

Techaisle’s SMB Cloud Computing Adoption survey research shows that there is no one method that will engage cloud buyers within the small business or midmarket segments: in both markets, buyers use a mixture of multiple reach and multiple depth vehicles to understand and evaluate options.

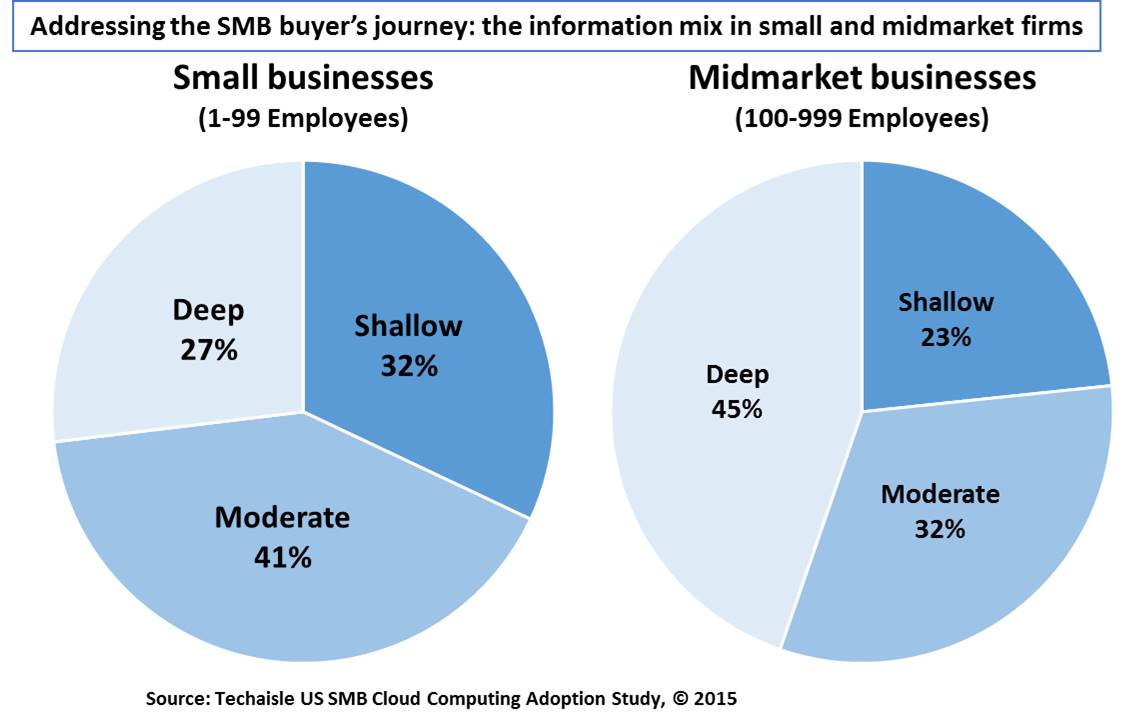

As a means of providing some meaningful clarity to the question of how to allocate resources across the buyer’s journey and to help indicate where buyer time is spent today – and where marketers will need to invest Techaisle looked at fifteen different influencer options and segmented them into one of three categories:

- “shallow” (TV and print advertising),

- “moderate” (technology websites, IT magazines, brochures/fact sheets/newsletters, catalogues, search), and

- “deep” (vendor websites, recommendations, personal sales calls, conferences, webinars, case studies, white papers, blogs/forums)

The findings show that “shallow” vehicles represent about one-third of overall sources used by small businesses, and just less than 25% of those used by midmarket buyers; that “moderate” vehicles capture 41% of total small business attention, and about one-third of midmarket buyer interest; and that “deep” options represent just over 25% of the information mix in small businesses, and 45% in firms with 100-999 employees.

It is of course true that different vendors (and buyers) use similarly-named options in different ways – for example, visits to a supplier website can be cursory or can be an intrinsic part of a detailed supplier evaluation, and “blogs/forums” encompasses both some of the most superficial and some of the deepest content on the web. Survey research data provides several important perspectives on the challenges facing technology marketers generally, and cloud marketers in particular, who need to attract new SMB customers to their offerings.

The first issue that jumps out is the sheer number of vehicles used by buyers in both the small and midmarket segments: in each case, the data suggests that they use an average of more than five sources of information when evaluating potential solutions and suppliers.

The second issue that is evident from the data is that marketers need to use a mix of mass-market tactics to attract initial interest, transitional marketing options to deepen and shape that interest, and in-depth materials to establish preference within buyer accounts.

Clearly, there is a “buyer’s journey” that needs to be overlaid across these many marketing vehicles, to manage the process from initial interest to sale.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.