Techaisle forecasts that US SMB IT spend growth rate could very well remain flat at US$188 billion in 2016 as compared to 2015. However, the US midmarket spending growth will likely increase by 6% whereas the small business spending will fall by 2 percent in 2016 from 2015. In early 2015, Techaisle had forecast US SMB IT spending to be US$180B by end of 2015 – based on most recent Techaisle SMB surveys the actual spending for 2015 came in at US$188B. Techaisle survey data shows some very interesting patterns for planned SMB 2016 IT budgets across different employee size businesses. Small businesses show progressive fall in IT budgets until they reach a certain size whereas midmarket businesses show budget increases until they reach a certain size.

Techaisle Blog

For all the talk of a world predicated on software-defined resources, there is still need for capable, reliable, scalable physical infrastructure to support these software layers and the features and applications that sit atop them. The rise in virtualization has been driving an accompanying demand for converged infrastructure: products that combine processing, storage and networking into a robust and scalable unit that can support and respond to the options inherent in virtualization.

While the migration from separate server, storage and networking products to converged infrastructure is still in its early stages, the Techaisle SMB & midmarket converged infrastructure survey and corresponding Techaisle SMB & midmarket virtualization adoption trends survey shows that it is beginning to gain traction, especially within more sophisticated accounts. Data shows that 10% of small businesses and 27% of midmarket businesses (weighted data) are planning to adopt converged infrastructure. Current midmarket adoption rates for converged infrastructure are below findings for VDI but differences readily become apparent when analyzing the data from the lens of Techaisle’s segmentation by IT sophistication. Converged infrastructure adoption rises steadily with increased buyer sophistication in both the small and midmarket segments. As the market matures, we expect to see accelerated adoption of converged infrastructure across the SMB market.

What is driving converged infrastructure adoption?

While there are technical advantages that make converged infrastructure products more effective virtualization hosts than traditional servers, Techaisle’s research shows that SMB buyers adopt converged infrastructure for one or more of five primary reasons:

- to benefit from converged infrastructure’s integrated design and efficiency,

- to tap into its ability to enable centralization/management of resources,

- to capitalize on performance/time-to-benefit advantages,

- to improve IT agility and its ability to meet business needs, and

- in response to core requirements for cost savings and improved security.

Drilling down into the data Techaisle finds that core requirements inform many converged infrastructure strategies, and the benefits and efficiency of integrated solutions are also frequently cited as a driver of converged infrastructure adoption.

Inexorably, the market is shifting from one defined by discrete purchase-and-deploy deals aligned with refresh cycles to one where businesses take a ‘hybrid IT’ approach that blends a limited number of on-premise assets with a growing range of on-demand services. Recent work by Techaisle shows that the need for updated understandings of channel management imperatives has expanded beyond the tactical questions of sales or management metrics or marketing activities. This work has identified twelve fundamental areas where conventional wisdom has not kept pace with the business needs of the channel. In each area, policies based on conventional wisdom will lead channel organizations away from the practices needed to compete successfully in the post-transactional cloud market.

The channel transformation accelerator enablers, as laid out in the point-of-view white paper document (free), Channel Imperatives for 2020: The Changing Channel for a Post-transactional IT Market will be gut-wrenching but necessary. [Click on the image below to download the white paper or click on the link]. Within the white paper, Techaisle has developed the “Conventional Wisdom vs. Emerging Imperatives” table to illustrate ways that channel organizations must alter basic attitudes towards the business of the channel in order to be successful in the current and future IT market.

In the report “The SMB Channel and the Cloud”, Techaisle uses findings from in-depth surveys with US-based channel firms deriving at least 50% of revenue from sales to SMBs to illuminate conditions within the US SMB cloud channel, and to develop perspectives that suppliers (and the channel itself) can use to construct successful cloud channel strategies.

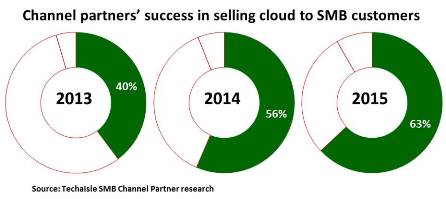

From 2013 to 2015, the percentage of SMB-focused channel partners that have become very successful in selling to SMBs has increased from 40% in 2013 to 63% in 2015. On the flip side, the percent of partners who are unsuccessful has increased by 60%. MSPs are the most successful partner type in cloud, while consultants are struggling to gain traction in the cloud market.

Highlights from the research include: