Techaisle Blog

Red Hat Partner Program accelerating partner business velocity

Markets behave logically, and therefore channel partners exist for logical reasons. Channel partners are essential to intercepting demand, connecting technology to business outcomes, enabling efficiencies, and providing customer relevance. A sizable majority of IT industry sales are concluded through partners and are not likely to slow down soon. As we emerge from the pandemic, it is clear that the cloud has transformed the IT industry by its ability to provide agile transformation, resiliency, and adaptability. The market has shifted from discrete purchase-and-deploy deals aligned with refresh cycles to a 'hybrid IT' approach that blends a limited number of on-premise assets with a growing range of on-demand services. Application modernization, migration, cloud consulting services, and cloud managed services. Containers have become the PoC beachheads, small to enterprise firms are building the Edge. Techaisle data shows that the need for updated understandings of channel management imperatives has expanded beyond the tactical questions of sales or management metrics or marketing activities. There is a reason why I have written a long preamble before unfolding the main point of the Techaisle Take.

Red Hat is a platform company whose goal is to continue to deliver platforms and the relevant pieces around it that enable a customer to have the maximum flexibility and core capabilities for security, stability, and resiliency. In addition, these customers should be able to deploy applications faster and at scale. Therefore, its open hybrid cloud initiative has to have as broad a partner ecosystem as possible to deliver on Red Hat's promise. Red Hat is still Red Hat retaining its independence and neutrality, but its partner program is changing to tackle the ecosystem challenges. Red Hat has been listening to its partners. Red Hat's Stefanie Chiras, Sr. Vice-President, Partner Ecosystem Success is focusing on partner success. She and her team recognize that partners contribute to creating, shaping, defining demand – in some cases by making customers aware of a new category or product, in others by helping to define solution requirements or specifications. In the hybrid world, the solution deployment is based not on a specified hardware/software configuration but the orchestration of multiple on-demand services integrated with existing legacy systems - a liberating factor for the partner ecosystem in a meaningful sense.

Red Hat recently developed and implemented a three-year corporate strategy plan, split into four focus areas. These areas expand the reach and ecosystem transformation, provide easy-to-use cloud services and edge solutions, drive optimal customer outcomes, and foster an open and inclusive culture. In addition, there is an increased focus on digital engagement within the marketing teams and improved enterprise and midmarket customer segmentation under the leadership of Jennifer Heard. The partner program fits into that strategy. Stefanie's words, "the partner gameplan, aligned with corporate strategy, is filled with journeys, and the journeys do not end." For example, a journey from VMs to containers, RHEL to OpenShift, automation with Ansible, deployment paths and orchestration tracks, and many other examples.

Techaisle research shows that partners and customers work with all hyperscalers but have one preference. Recognizing the strong trend, Red Hat has built partnerships with the hyperscalers. ROSA (Red Hat Open Shift Service on AWS) and ARO (Microsoft Azure Red Hat OpenShift) are two good examples of product innovations. Techaisle's latest commercial segment research shows that 76% of firms know ROSA, and 80% are aware of ARO. And 36% of the developers are seriously investigating using ROSA, and 46% are evaluating ARO. One practitioner told Techaisle, "OpenShift is an excellent product. OpenShift UI, just the interface to manage the containers, is a step ahead of what the cloud providers offer." Therefore, Red Hat is building partner initiatives to leverage its partnership with the hyperscalers and bring value to its partners regardless of their business models – GSIs, RSIs, ISVs, resellers, and consultants.

Partner strategy begins with the end-user. Generally speaking, it is terrible to think first about what Red Hat sells and work from there to create a partner strategy. However, it is crucial to put a 'stake in the ground' by outlining the customer use cases, the partner requirements, and the vendor offerings underlying critical cloud delivery and consumption models. How do the customers plan to consume cloud, on-prem, or public? Do they want to bring their subscription and prefer to purchase from a hyperscaler? Do they wish to purchase via the marketplace private offerings? Red Hat is expanding its consoles and marketplace presence with the singular goal of introducing simplicity of procurement, deployment, and management on both on-prem and public clouds. Red Hat is deploying learnings and use cases for partners to address each type of customer journey and container entry point to have a revenue multiplier effect, from cloud re-architecture to cloud-native. Red Hat's newly formed customer success organization works closely with the partner teams.

Partners who establish positions as 'meaningful partners' deliver solutions that drive innovation within their customers' operations and share the benefit resulting from technology-enabled business improvements. Red Hat has been very technology and innovation-heavy to date, but it is now working to drive a broader set of value propositions to its partners. In the process, Red Hat aims to be a source of innovation that brings value to its partners and helps them participate in the dialog in the hybrid journey of the customers. Techaisle's research shows three partner business velocity enablers: sales, profit, and simplicity. Each of these is on Red Hat's partner program management team's list.

The simplicity starts with improved partner experience and an ecosystem mindset. Red Hat is accomplishing both through one ecosystem team, allowing Red Hat to make quick decisions, previously made in different parts of the organization, to deliver programs in a unified way. Consistent customer segmentation allows for a programmatic engagement with partners. The rules of engagement are being made clear to every seller. The sellers' compensation now ties into working with ecosystem partners to deliver on trust and transparency expected by the partners, a big move for Red Hat and eliminates a pivotal bias to go direct. With this, the path to co-creation becomes frictionless.

Training, a sales velocity enabler, is vital for 61% of partners, as per Techaisle partner research. Red Hat is creating a knowledge base for its partners and making it easy to consume. It recently introduced Red Hat Training courses for free to partners, with plans to expand course availability throughout the year. In addition, it has set up a dedicated support team, desired by 47% of partners. Red Hat has also introduced co-marketing and sales benefits, the second top priority for 58% of partners.

Cloud technology is kinetic, complex, and sometimes risky. Many mainstream vendors have attempted to provide cloud enablement guidance but face a significant impediment: vendor guidance generally ties to partner business activity focused on the vendor's products or the latest trend, such as SaaS. However, much of the direction required by channel partners is operational rather than product-focused. They need specific product-tied enablement offerings such as Ts and Cs aligned with customers' cloud purchases. They also need co-marketing support, development of cloud sales compensation models, cross-vendor/product initiatives, marketplaces that increase reach and provide options for business velocity. Channel partners say that increasingly vendor programs position them as an agent for the vendor rather than a provider of needed cloud services to the customer.

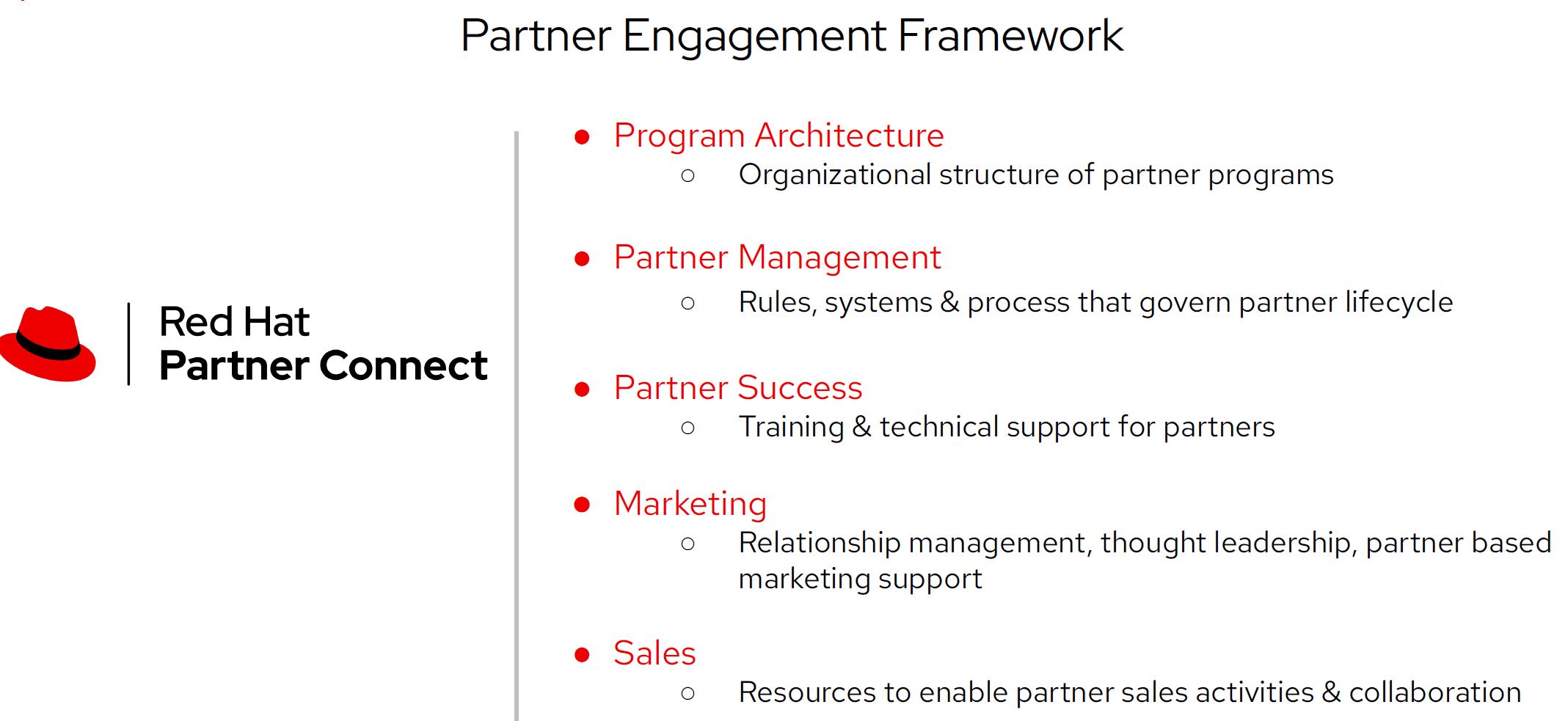

On the contrary, Red Hat has built a partner engagement framework to cover all aspects of partner success. A robust and unified organizational structure, rules to manage partner lifecycle, ensuring partner success through training and support, relationship management and thought leadership support, and resources to enable sales and collaboration. Red Hat's partner program is a journey through many roads joining a freeway that empowers partner business velocity.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.