Techaisle Blog

Capturing the Midmarket digital transformation business value map

IT trends belong to one of two main categories. Some, like Linux or cloud, refer to a product or product category that changes IT strategies by providing breakthrough capabilities. Others are statements of IT strategy, highlighting opportunities to directly connect IT capabilities to broader business objectives.

Digital transformation (DX) is an example of this second type of trend. DX, according to a report by global research leader Techaisle, is the integration of digitalized processes to achieve enterprise-wide automation spanning multiple functions; modernization of current processes and supporting infrastructure to achieve previously-unattainable or unimaginable business outcomes.

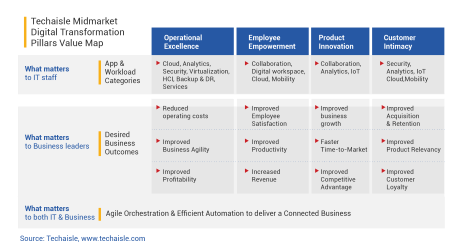

Digital transformation isn’t defined by a single initiative or end-point. DX describes an evolving set of capabilities that connect investments in core technologies to enhanced operational efficiency, employee empowerment, product innovation and customer intimacy – which in turn enable DX adopters to increase revenue, decrease costs, reach new markets, deliver better products and services, and ultimately, drive more profit and improve shareholder value.

Viewed from this outcome’s perspective, DX success is rooted in the ability to connect incremental investments in technology with milestone achievements, aligned within a roadmap that ties to the organizational vision of modern capabilities delivering new levels of business performance.

The channel will play a critical role in guiding midmarket firms through the DX transformation. This starts with helping IT and executives within client organizations to define their vision for the key competency areas: mapping the digital transformation pillars to business outcomes provides IT and non-IT management with a cohesive set of meaningful objectives for addressing business pain points.

Capturing the midmarket DX opportunity

What does the channel need to do to translate midmarket demand for DX and its attendant benefits into long-term customer relationships? To capitalize on the DX opportunity, channel partners need to develop deep understanding of how the DX platform is built – how this framework supports process evolution – and how to cleanly align the IT and process frameworks with a delivery plan that addresses midmarket executive care-abouts.

The DX platform

The DX journey cannot start without modern, flexible infrastructure. Systems that are out of date need to be upgraded to (or abandoned in favor of) technologies that are capable of being integrated into software-defined frameworks. DX can be seen as encompassing nearly every hardware and software asset in the organization, but it is best understood as a set of required IT capabilities, which support a three-level platform:

Level 1: The first level of the platform consists of foundation technologies, or “building blocks” – the software-based solutions that aggregate multiple discrete units or functions into a manageable, cohesive fabric. Mobility, virtualization, hyperconverged infrastructure and software-defined solutions (SDx) are examples of these building block technologies.

Level 2: Techaisle has labelled the second DX level “the Interwork platform.” It consists of connected solutions, with focus on several key areas: connected cloud, which provides the foundation for Interwork; connected edge, which completes that foundation; connected applications, security, collaboration and workspaces, which draw together assets and users, delivering increased benefit within each category while simultaneously extending and strengthening the core of the Interwork platform; and connected insights, the information gained/accessed through the platform, which enables businesses to address constantly-advancing expectations for speed (of operational decisions) and completeness (of strategic decisions).

Level 3: The top level of the DX platform is defined by digital transformation technologies – solutions that make use of building blocks and Interwork systems to provide transformative capabilities. The technologies associated with this top DX platform level – AI, IoT, AR/VR, autonomy and robotics.

Building the business outcomes ladder

Within the DX roadmap, technology and process definitions both specify escalating levels of functionality over time. For these capabilities to have value in the eyes of business management, though, they need to be connected to tangible business benefits. Techaisle’s definition of these outcomes maps to the three-level technology platform:

- At the first level, business process owners gain delivery of point automation. IT systems are used to reduce cost/effort associated with specific tasks, and/or to improve accuracy associated with basic processes.

- At the next level, businesses capitalize on the Interwork platform via connected systems that rapidly aggregate and/or distribute data across complex systems, and (especially) from the insights gained from analysis of this data. At this level, target business objectives usually involve improving the immediacy or breadth of decisions that are important to specific clients (such as account management or credit evaluation), functions (such as adjustments to the logic used to direct marketing activity or sales or customer service dialogues) or strategic decisions.

- The highest level, as mentioned earlier, is difficult to describe in generic terms; however, it includes augmented tasks (such as input to diagnoses), modified processes (like alternative production approaches in a manufacturing environment) or reinvented practices.