Techaisle Blog

SMB and Midmarket IT maturity segments – cloud adoption challenges

Techaisle’s SMB & Midmarket IT maturity segmentation reveals that 52% of midmarket firms and 16% of small businesses (down from 31% two years ago) belong to Advanced IT segment and 37% of midmarket firms (up from 14% two years ago) and 0% of small businesses are in the Enterprise IT segment.

IT products are often described as having ‘a market’ – but ‘the’ IT market is comprised of many segments, each of which has its own approach to IT adoption. Some industry sectors (e.g., aerospace) tend to move faster than others (e.g., retail) and different countries and regions invest in new technologies at different rates. Until they are supplanted by new solutions, mature IT products are acquired at about the same rate by all buyers. These technologies generate the majority of ‘run rate’ revenue in the IT industry. When IT industry growth opportunities are discussed, the focus often turns to earlier-stage technologies. Sellers of these technologies tend to focus on advanced segments (large accounts, particularly in leading-edge industries). SMBs are generally viewed as a secondary market.

Four IT Maturity Segments

However, the SMB market is not a monolith. Techaisle research has identified four attitudinal/behavioral segments that have different approaches to IT adoption. Suppliers who understand the scope and characteristics of these segments are able to expand their target markets and develop strategies geared to reaching high-potential SMB prospects. These suppliers ultimately have access to an expanded TAM, and have the insight needed to align marketing investments with priority customers.

Techaisle research shows that there are four sophistication-defined buyer segments found within the SMB market. The first segment, “Pre IT,” represents firms that have not embraced IT as part of their business operations. The second segment, “Basic IT,” is the largest of the four segments, and most closely resembles the approach that is commonly thought of as ‘the SMB IT market’. These firms invest in mature technologies, but lack the internal business demand and IT understanding to expand into more advanced solutions. In the small business market, Techaisle categorizes these firms as “old-fashioned yet entrepreneurial” – firms that are not sophisticated in their use of IT, but who will buy proven solutions to address clearly-defined impediments to business success. In the midmarket, Techaisle classifies these organizations as “proactive yet cautious” – committed to investment in technologies that have been proven to enhance individual productivity or firm-level capabilities.

The third segment, “Advanced IT,” represents the approach that is often considered to be characteristic of leading-edge SMBs. These firms are actively exploring advanced solutions. The fourth segment, “Enterprise IT,” functions like the IT operations within large accounts. In an SMB context, Enterprise IT refers to organizations where IT is run as a business, providing support for IT-enabled innovation across all functions and processes.

Cloud Challenges

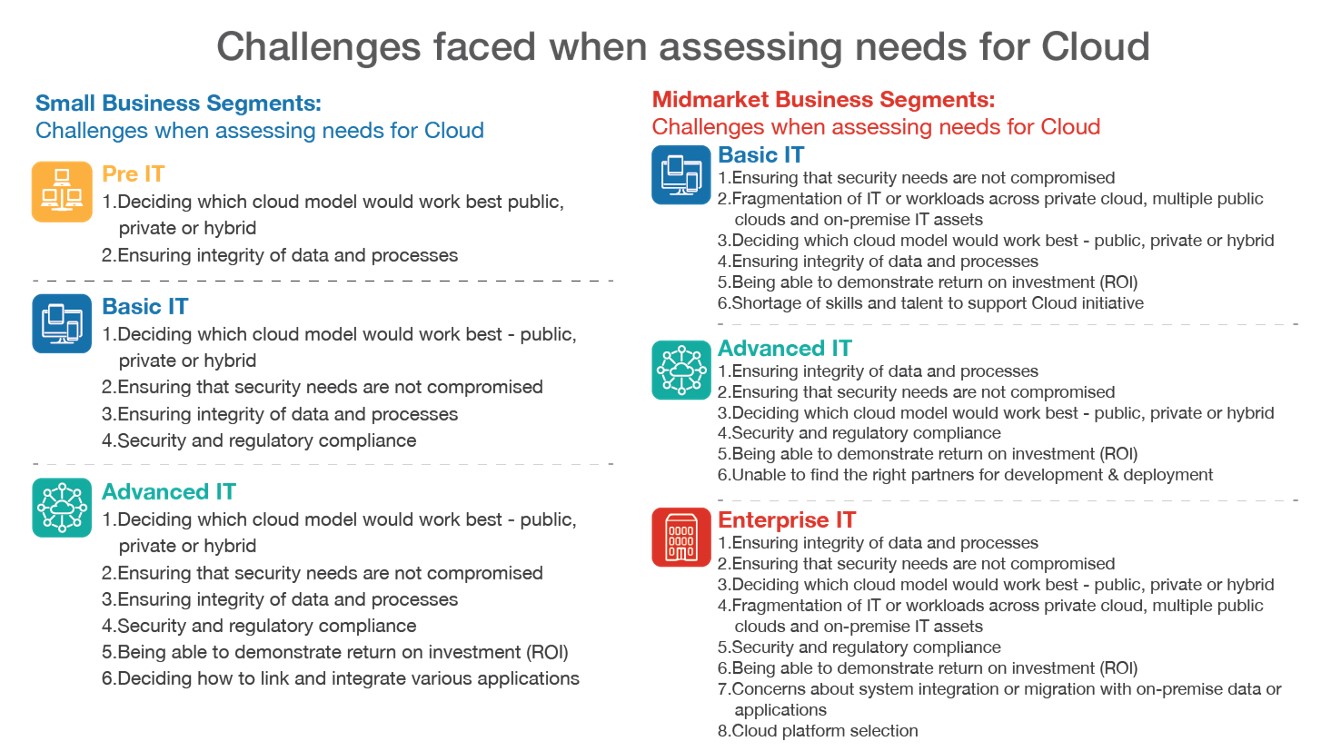

If the benefits anticipated from cloud & virtualization are relatively common across IT sophistication segments, the challenges faced by SMBs in these segments differ, reflecting both experience and increased complexity of cloud deployments and requirements.

Pre-IT organizations report that they face only two primary challenges: platform selection and data/process integrity. Both of these challenges are common to all of the SMB IT sophistication segments. The latter requirement, which is a consequence of adopting a multi-platform approach to IT service delivery, is driving a related need in the channel to focus on data rather than system integration.

The Basic IT segment adds concerns about security to the two core challenges articulated by the Pre IT segment. Security, too, is a common source of worry with cloud; all three of the more advanced user segments echo this concern.

The small business Advanced IT segment shares all four of the Basic IT segment’s challenges, and adds two others: the ability to demonstrate ROI, and a need to link/integrate various cloud-based applications. These concerns are consistent with the demands placed on an IT organization that has increased reliance on and investment in cloud delivery of business-critical applications.

In the midmarket segments, we see longer lists of challenges, reflecting increased scope and complexity. In addition to concerns voiced by the small business sector, the midmarket Basic IT segment is especially concerned with fragmentation of workloads across different platforms and with the ability to attract the skilled resources needed to manage a complex cloud environment.

The midmarket Advanced IT segment repeats five challenges voiced by less-sophisticated peers (data/process integrity, security, platform selection, compliance, ROI) – though, we believe, with a deeper level of understanding and a more complex set of requirements. This Advanced IT segment adds one new concern: the ability to find the right partners to support development and deployment of cloud systems. This indicates that the midmarket Advanced IT segment is outstripping the capabilities and understanding of the channel community that SMBs generally rely on for IT management support.

Finally, the Enterprise IT segment is focused on the same core issues that trouble its less-sophisticated peers – though again, at a level of complexity that is very likely unique to this segment. Enterprise IT is also the only segment that raises the challenge of connecting cloud and on-premise environments – an essential set in creating a hybrid IT environment.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.