Until a few years ago a set of scary questions used to be debated in many business board rooms. “Fire the CEO, CFO or SAP?” Nobody dared to fire SAP. Fast forward today, are we reaching the same set of questions with a difference - replacing SAP with Salesforce.com? Recent Dreamforce 2014, Salesforce.com’s annual gala event firmly established the company’s foothold in the industry and its increasing grip on the enterprise and businesses of all sizes. This year, there was also an increased focus on SMBs, a “back-to-the-roots” story, the backbone on which Salesforce.com launched its “no software” business but somewhere along the way lost sight of SMBs. But then Salesforce.com is no longer a software company, it is a platform company. Is the “no software” logo still valid? Is the company still suitable for SMBs?

The Best

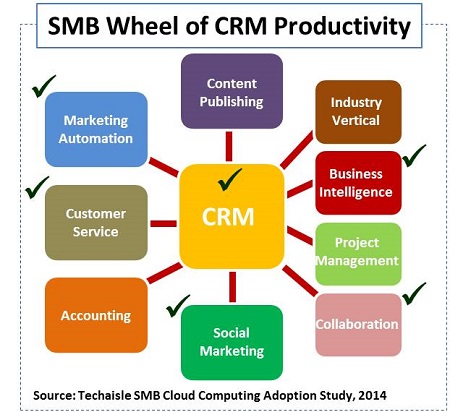

Over the last three years, Salesforce.com has successfully added solutions to its portfolio and has checked off an important spoke in the SMB Wheel of CRM Productivity with business intelligence, one of key elements in the overall CRM productivity suite. Many of the other issues are addressed by the rich Salesforce.com partner ecosystem that connects via Force.com. Combined, these applications provide a 360 degree view of the sales and marketing process. Experience shows that as a software category matures, suite providers eventually win out against point product players. And Salesforce.com is winning.

As Salesforce began its foray into the enterprise world, it seemed that it neglected its SMB market, which grew almost in spite of Salesforce’s lack of attention. However, from 2015 onwards, SFDC promises change as it is committing to doubling its investments in SMB education and driving growth. In fact, this year’s Dreamforce had nearly twice as many sessions for SMBs as in 2013.

Techaisle’s SMB segmentation, based on cloud and mobility adoption, finds that there are six major SMB segments:

- Smart Investors

- Growth Aspirers

- Dynamic IT

- Productivity-centric,

- Innovation-Driven, and

- Passive Followers

Of these, Dynamic SMBs, followed by Smart Investor SMBs, are most likely to benefit from CRM suites.

The Good

The new Wave analytics platform, announced and demoed with fanfare at Dreamforce 2014, is one of the most important products to have been introduced by Salesforce.com recently. It gives some credence to Salesforce’s newly christened Analytical Cloud. But is it really that impressive beyond the flashy demo at Dreamforce 2014? Is it really analytics or a series of reports cleverly put together?

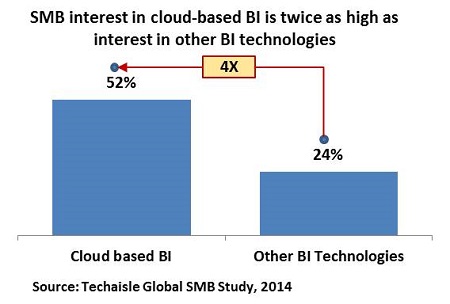

Let us set the context first. Business analytics is fast becoming an integral technology investment for an SMB organization, directly contributing to its revenue growth and reduction in operating costs by enabling informed decision making. Techaisle’s survey of SMBs across numerous countries shows that number of SMBs using one or more type of business intelligence is nearly doubling each year. Business Intelligence tools have matured and become more widely available through cloud-based services. As a result, enterprise-grade ETL, analytics, reporting, collaboration, dashboards and other functionalities are now within affordable reach of SMBs.

We are also in a transformative time for mobility and thereby mobile business Intelligence. The move to mobile BI has largely up until now been accomplished by migrating existing functionality to a mobile environment by using new technologies on top of the old. Companies such as Oracle, IBM and SAP are doing this through acquisition of smaller companies and integrating them into existing products. On the other hand, in a classic build vs. buy fashion, smaller companies, not hampered by existing architectural constraints are offering SaaS BI services and building new offers from scratch. Smaller BI vendors in many cases have gained a timing advantage, using native technology to bring existing mobile functionality to BI. Instead of simply providing mobile links to server data, these new products offer the rich, interactive capabilities, with the ability to use rich interactive screen manipulation, i.e., pinch and squeeze or geo-location awareness, as part of the data exploration and visualization experience. True mobile business intelligence includes ability to interact with data objects on the screen, such as filters, check-boxes, search, drill-down and drill-through to the record level and other interactive functions. Of course, being able to then use built-in device communications capabilities is also of importance once the information has been identified – SMS, email and Internet forms for dissemination of the information, as well as secure access to collaborative destinations.

Techaisle survey data also shows that the right information for SMBs centers on intelligence that helps them make sound financial decisions. This is reflected in the top three analytics areas reported by SMB respondents:

- Financial analysis (47% of SMBs)

- Sales tracking (44% of SMBs)

- Business activity monitoring (43% of SMBs)

These findings show that SMBs are looking to analyze data that helps to manage DSO (Days Sales Outstanding, the core accounts receivable issue), maximize inventory turns, determine the return on marketing investment for a new route to market, and/or examine the potential lifetime value of a customer through various distribution channels. SMB business intelligence/analytics tools need to deliver across this set of expectations.

What Wave Analytics is not

Wave analytics is mobile business intelligence and not analytics. It can answer one question at a time, but can’t analyze a set of questions based on multi-dimensional data and queries allowing a small business executive to make informed decisions across multiple business factors. Wave analytics cloud offers some but not all of the above functionalities. And Wave’s capabilities are tied to Salesforce.com data unless an SMB is willing to invest in the customization needed to extend analysis across other data sets, thereby increasing TCO. And that is where the bad begins. As one SMB told Techaisle, “Business intelligence and analytics is big need for an SMB, but the platform must provide easy to build reports and dashboards capabilities. If you need to hire a developer for everything, we are back to square one”.

The Bad

To quote Marc Benioff’s tweet, “What skills do you need to find a job today? #5 Salesforce”, quoting an article in Infoworld. Is it SAP redux - was there not a complete industry that had popped up and thrived for SAP developers? In many cases, the level of complexity and cost of deploying Wave solutions, beyond parametric reporting, may be out of reach for many SMBs and may instead be more attractive in the enterprise segment.

Dashboards with ad hoc exploration and structured reports are becoming the ‘new normal’, empowering the SMBs to look at information within the right context depending upon the demands of the business. Right context is not just about driving new user experience, something that Salesforce.com has focused on; it is about driving new business models as well by increasing the value of business intelligence tool to the point where it informs and supports the creation of new SMB revenue models. There are some excellent examples of embedded analysis capabilities that allow very flexible use of KPIs by SMBs across all areas of their business, including creating and analyzing the impact of new KPIs on the fly. Out-of-the-box Wave analytics cloud falls short and does not adequately address SMB BI/analytics needs.

At the outset, the Wave analytics cloud looks like it is targeted towards dashboard-saturated executives who have not been exposed to new technologies. It looks great because it is on Salesforce.com platform and it is mobile. For a CEO, running a company means determining what he/she must track and what he/she can safely de-emphasize. For this, a CEO typically requires multiple dashboards delivering “what-if” analysis capabilities; these CEOs need the ability to generate KPIs quickly and easily, measure them and refine them with time. Keeping true to “no software” rule, there should be either no or very little customization required. It’s clear that Wave needs more IT involvement – and the Wave platform partners announced at Dreamforce were all ‘big names’ such as Accenture and Deloitte, which are not the typical developers for SMBs. The expectation that an SMB has programmers sitting around eager to extract, integrate, and develop dashboards to provide one view of the business is clearly mistaken – and it certainly stretches the limits of “no software” rule.

The Ugly – Have we seen this movie before?

Mark Twain said history does not repeat itself but it does rhyme. The evolution of Salesforce.com represents a remake of a movie and we are not sure it ends well for SMBs. SFDC, which was the SMB champion ten years ago, is starting to look like Napoleon from Orwell’s Animal Farm novel.

Marc Benioff’s Dreamforce keynotes always showcase large enterprise customers, and no SMBs. However, on the 2nd day, in an SMB keynote by Tony Rodoni and Brian Millham there were three case studies of SMBs. However, all three were “born in the cloud” SMBs, not representative of over 90 percent of small businesses. Even Tony Rodoni, SVP of Small Business, Salesforce.com referred to high-growth, scalable small businesses (read startups) in Silicon Valley – again not representative of most of the world. Where have the real-world examples gone? One VP of information technology for an SMB aptly observed that, “SMB for them (SFDC) is always the next Facebook”.

In a Techaisle survey of 2155 SMBs (US, Canada, Germany) to understand cloud adoption, 42 percent mentioned that they are afraid of losing control of their data and another 31 percent said that they are fearful of vendor lock-in. These businesses worry about vendor control of data as they have neither the technical expertise nor the purchasing power to extricate themselves from supplier relationships if they experience difficulties. This concern extends to Salesforce: as the CIO of a financial services SMB said, “SFDC does not play nice when you have to import data from non-cloud solutions, and it is a challenge even with cloud applications.”

With Salesforce.com an SMB could experience both the fear factors – lock-in, loss of control on data - the concerns that are common to enterprise software suites. When software becomes a platform it develops a tendency to move over to the ‘dark side’: It unconsciously forces a lock-in, reduces the pace of innovation, limits price protection and restricts future proofing. SFDC SMB customers are already experiencing this; as one said, “They (SFDC) list per-month prices, but the contracts are executed in years’ terms”. Taken as a whole it flies in the face of everything that is cloud. Is it time for SMBs to find a new champion? And can they, or is the Salesforce grip already too tight? As a platform, Salesforce.com is like a runaway train, very difficult to stop by numerous point solution players.