Techaisle Blog

The Financial Control Plane: Xero’s High-Stakes Evolution in the Age of Agentic AI

The global small business technology landscape has reached a strategic tipping point. For much of the last decade, the digital transformation of the "back office" was defined by simple cloud connectivity. However, as we navigate 2026, the primary challenge for small businesses has evolved from merely possessing digital tools to integrating them into a coherent operational strategy. In an environment defined by persistent inflation and a global talent shortage, the most valuable asset for any business is no longer just data—it is velocity.

Xero’s H1 FY26 performance, highlighted by a Rule of 40 result of 44.5%, signals a business that has successfully moved beyond the "growth-at-all-costs" phase into a model of disciplined capital allocation. Yet, the recent US$2.5 billion acquisition of Melio and the launch of its AI financial superagent JAX (Just Ask Xero) represent more than just financial milestones; they are a high-conviction bet that the future of business management lies in owning the "Financial Control Plane."

The Velocity of Value: Why Fragmentation is the Real Competitor

Historically, a central critique of Xero was its difficulty in challenging incumbents' dominance in the North American market. The Melio acquisition serves as the definitive strategic answer. By transitioning from a standalone ledger to an integrated bill-pay platform, Xero has effectively bypassed years of organic development to buy market velocity. The result is a pro forma US revenue growth spike of 53% year-over-year—a direct outcome of this force-multiplier effect that finally gives Xero the specialized tools it needs to scale in the region.

For the small business owner, this is not a mere accounting upgrade; it is a direct solution to the "Frankenstein stack." Today’s SMBs are frequently over-tooled yet under-integrated, forced to juggle disparate payment gateways, bank feeds, and reconciliation modules that rarely communicate with one another. By embedding Melio’s technology directly into the core workflow, Xero is positioning itself as the connective tissue of the financial ecosystem. This shift moves the platform from a passive "System of Record" to an active "System of Agency," where the movement of capital occurs in the same environment where it is recorded.

Addressing the IT Priorities of the Modern SMB

In 2026, the technology priorities of small businesses have shifted from digitization to optimization. The infrastructure of the cloud is already laid; the new mandate is Autonomy. According to the latest Techaisle data, "Driving Profitable Growth" has surged to the #1 business issue, replacing the frantic hiring sprees of previous years. SMBs have realized they cannot simply hire their way to capacity; they must instead maximize the ROI of their existing tech stack to scale.

The core challenges of 2026—cybersecurity resilience, talent retention, and regulatory uncertainty—cannot be solved by fragmented, point-solution tools. Small businesses are increasingly wary of "SaaS fatigue" and rising subscription costs. They are looking for unified platforms that offer a secure data layer. Xero’s push toward an integrated ecosystem addresses this "Efficiency Paradox" by providing a centralized hub where security and compliance are built into the workflow rather than bolted on. For an SMB, this means that strengthening cyber resilience (#6 business issue) and ensuring regulatory compliance (#8) become automated byproducts of running their financial operations, rather than separate, manual burdens.

This drive for optimization and platform consolidation is not merely a strategic preference for the SMB; it is the primary catalyst for Xero’s evolving financial model. As small businesses look to extract more value from fewer, deeper relationships, the boundary between accounting software and financial services has effectively dissolved. This convergence is most visible in the changing nature of Xero’s top-line growth, where the focus has shifted from simple seat-based subscriptions to the high-value 'yield' generated by every dollar flowing through the platform.

The Revenue Mix and the Value of the Yield

As Xero leans into embedded finance, its Average Revenue Per User (ARPU) has climbed 15% in H1 FY26. This expansion is increasingly fueled by transaction-based payments, which grew 40% year-over-year. While transactional revenue is traditionally viewed through a cynical lens due to its sensitivity to macroeconomic volatility, Xero’s strategy effectively refutes this SaaS-vs-Fintech divide.

By weaving payment capabilities directly into a platform with a resilient 1.09% churn rate, Xero is essentially converting usage-based "yield" into a "recurring-adjacent" asset. For the business owner, this convergence translates to fewer vendors and superior visibility into end-to-end cash flow. At a time when capital preservation is critical and interest rates remain elevated, having a unified view of payables and receivables has shifted from a convenience to a top-tier operational priority.

Agentic AI: A Force Multiplier for the Modern Advisor

The most profound shift in Xero’s trajectory is the rollout of JAX. While AI is frequently discussed as a threat to human expertise, Xero’s agentic AI approach acts as a vital release valve for an accounting industry currently struggling with a severe talent deficit.

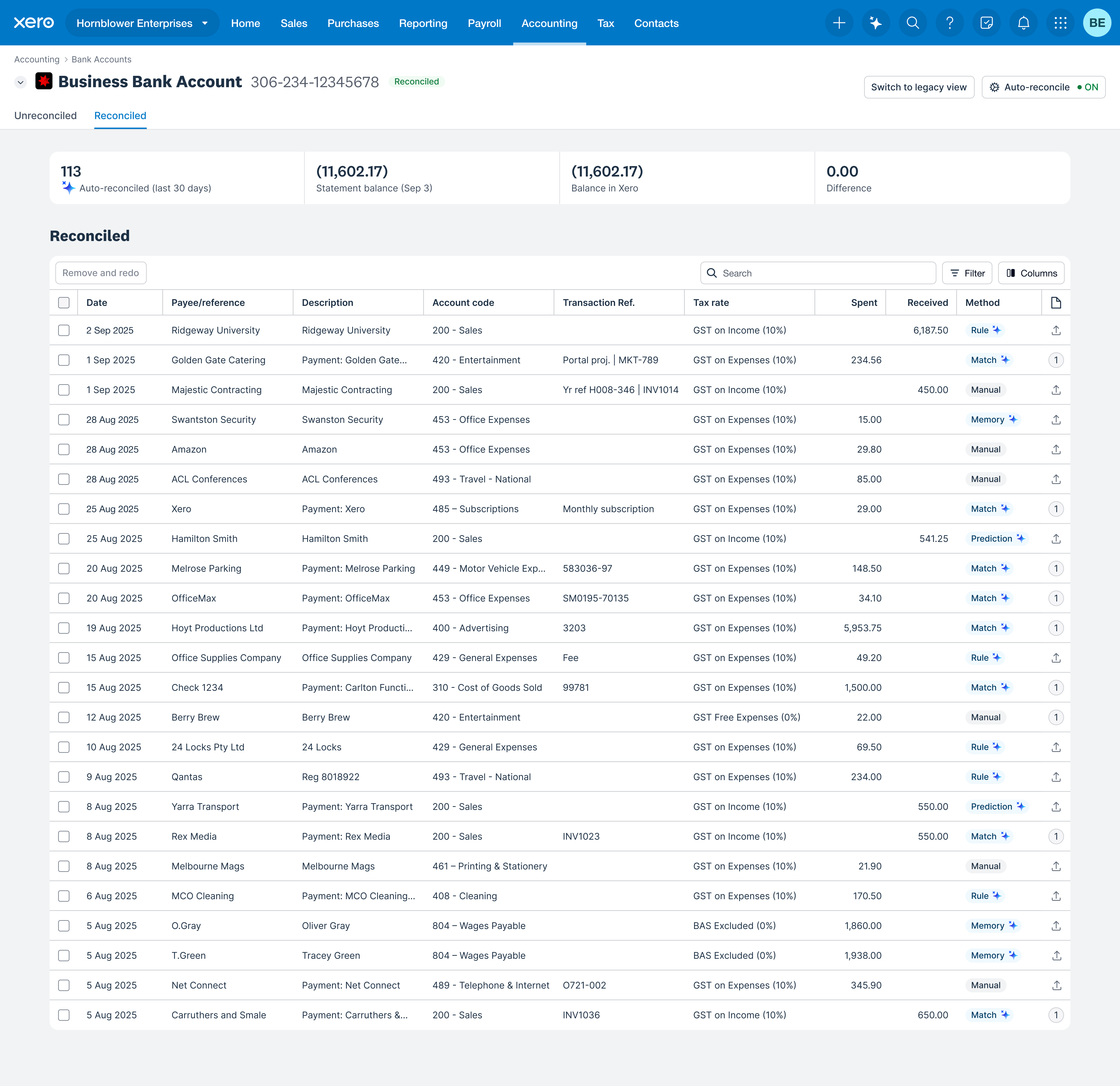

By leveraging AI to handle the "heavy lifting"—automated bank reconciliation, invoicing, and routine data entry—Xero is providing its partners with what amounts to a digital workforce. This isn't about the commoditization of the accountant's work; it is about the evolution of the advisor's business model from hourly compliance to high-value strategic advisory. When JAX handles the busywork, it empowers the accountant to provide high-level guidance on tax optimization and cash flow forecasting—the exact services that drive tangible growth for the SMB.

The Competitive Reality: A Defensive Specialist

While Xero’s roadmap targets SMB fragmentation, it faces a steep climb against competitors with broader horizontal reach. The integration of Syft Analytics to provide business health scores and enterprise-grade insights is a necessary defense. However, it arrives in a market where players like Zoho already offer a more cost-effective, all-in-one business operating system, and Intuit leverages a much deeper data lake for predictive AI.

For Xero, this democratization of data is a strategic attempt to remain relevant to growing businesses that have outgrown basic tools but are not yet ready for the complexity of full-scale ERP. Xero is betting that its specialized depth in financial reporting and its "Accountant’s Choice" status will outweigh the all-in-one convenience offered by horizontal market leaders. It is a play for the "Serious SMB"—those for whom financial precision is the primary driver of success.

Setting the Benchmark for the Next Decade

Xero has reached a definitive inflection point where high-velocity innovation meets rigorous financial discipline. The progress reported in H1 FY26 is undeniable: the company has successfully transitioned from a regional leader into a global contender with a sophisticated capital structure. This evolution is anchored by the Xero "Aspiration," where the combined business gives Xero the opportunity to more than double FY25 group revenue in FY28, supported by a clear path to operational leverage and a projected reduction in the FY26 operating expense-to-revenue ratio to ~70.5%.

The focus now shifts from strategic positioning to pure execution. If the latest results are any indication, Xero is not merely meeting market challenges—it is setting a new benchmark for what a specialized financial platform can achieve. By providing the tools to reinvent the accounting profession for an automated age, Xero ensures its most critical distribution channel remains both profitable and relevant.

Why Xero Remains the Ideal Pivot for the Scaling SMB

For the small business owner, Xero is the ideal choice because it recognizes that the ledger is no longer the destination—it is merely the starting point. In the current economic landscape, success is reserved for firms that can automate administrative "noise" to focus on high-impact, strategic decisions.

By unifying payments, payroll, and accounting into a single "Financial Control Plane," Xero provides the structural integrity a scaling business needs to navigate economic headwinds. According to the latest Techaisle research, small businesses are increasingly favoring this trajectory because it directly solves the "Efficiency Paradox." For the entrepreneur who demands financial precision without the overhead of an enterprise-sized finance team, Xero offers a direct path to sustainable, profitable growth.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.