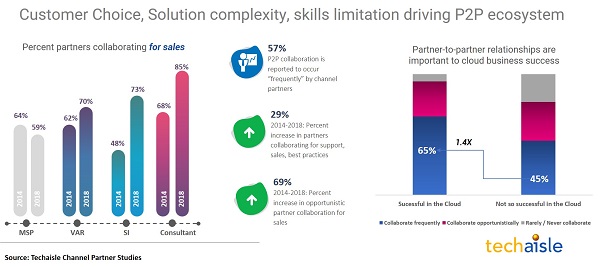

Management of P2P ecosystems is not a core focus of many vendor channel organizations – but it will be increasingly crucial to success in providing channel coverage for complex technologies. One distinguishing characteristic of a traditional channel firm is its ability and willingness to test, learn about, deploy, integrate and support new solutions as customers need them. However, increasing solution complexity has made it more difficult for channel partners to master all of the different technologies required by their clients. This has, in turn, led the channel to look at partner-to-partner (P2P) alliances as an alternative to the building (through training/certification) or buying (through new staff hires or acquisitions) unique expertise whenever required. Vince DeRose, President, PEAK Resources, Inc., said it very well, "it is difficult to staff engineering/delivery talent for every solution we sell. Training and certification are generally required to have a meaningful and relevant relationship with a manufacturer/OEM." Techaisle research shows that costs are high for staffing skills with certifications. In an increasingly complex market (e.g., IoT, hybrid IT), partners need access to many products – certainly more than they can afford to be certified. Certifications may work for some products, but they constrain options for partners dealing with configurable solutions. P2P collaboration is the panacea for delivering complex customer solutions.

The enduring issue of Partner-to-Partner

PEAK Resources, a 30-year-old DMR, actively believes in and participates in P2P to augment skill gaps – technical and geographical. Initially, most of its IT skills focused around IBM offerings, but now there are many prominent vendors in the market with varying solutions and platforms to meet changing customer demands, such as Cisco, VMware, Dell, and more. In addition, projects are becoming much more complex, requiring many different and complex IT skill sets to solve for the customer. Vince DeRose continues, "a P2P platform, like P2P Global, Inc. is vendor agnostic. It works specifically great for emerging technologies and vendors who have immature partner programs. Vendors are making efforts to develop their P2P enablement programs. Still, most see their platforms filling a gap in their portfolio instead of partners' preference for fulfilling a skills gap. "

Techaisle saw this trend start to take root with security, where deep and diverse protections (and threats) opened the door to mainstream channel collaboration with MSSPs and other specialized security providers. However, the channel partners could not immediately replicate the security experience in other areas. Channel partners often act as gatekeepers, reducing client exposure to other solution sources and internalizing as much of the IT-related business requirements as possible.

Still, though, with the industry-wide trend away from rigid solution definition and towards fluid, flexible configurations that integrate multiple components, P2P collaboration (and from a vendor's perspective, ecosystem alliances) is moving from opportunistic to strategic. In addition, the COVID-19 pandemic catalyzed technology and IT companies to become more flexible and quickly roll out more efficient and seamless digital solutions for partnering and completing projects.

CohnReznick, a 100-year-old firm specializing in tax and audit work and deep expertise in ERP core consulting for midmarket firms, has strategically jumped into P2P ecosystem participation. But, again, the pandemic was the great accelerator. It joined P2P Global, and whose "platform shines as it is laser-focused on curation versus throwing up matches like a job board type solution," says Reed Dailey, Director, Strategy, Technology, and Transformation, CohnReznick.

Partnering To Be Efficient

Techaisle sees solution packaging as a customer choice issue – and customers are choosing to move from turnkey systems to hybrid environments that can align with their evolving needs. In many cases, this requires an accelerated frequency of partner-to-partner collaboration. Real-world demands for predictable, rapid responses to customer demands requires that channel businesses be proactive in building effective relationships with trusted allies.

Karl Kleinert, Director, Advisory Services, CohnReznick, adds, "typically, the vendor solutions are closed ecosystems to their network, but end-customers are not only buying or using solutions from one vendor. We are in a heterogeneous world. The vendor platforms break down pretty quickly in terms of their partner networks as soon as a partner has a project with even a minimal level of complexity that requires ancillary and adjacent technologies. We are very particular about the partnerships that we enter into and make sure we have a route to market model that fits us and that we have good rules of engagement and well-defined roles and responsibilities. Customers are demanding new technologies, which exposes new skill gaps within the partners. A vendor agnostic P2P collaboration platform gives us the kind of flexibility that is important for business success. A good example was a rollout of Infor's Birst data analytics solution supporting a global ERP deployment. CohnReznick owned the overall implementation, and we leveraged another partner for the data migration."

Informed by end-user and partner survey research, Techaisle sees substantial and increasing demand for solutions integrated around data rather than physical system components. The escalating requirement will require changes in channel go-to-market strategies. Channel businesses that are not actively developing P2P capabilities will be vulnerable to gaps in their ability to meet customer expectations, reducing their ability to maintain solid and profitable relationships with existing clients. Results from the 2021 research indicate that channel businesses that are effective in P2P are more likely to experience growth – and higher growth – than those that rarely collaborate with other channel members. Vendors with solid ecosystem management programs with a platform that helps facilitate P2P collaboration have an opportunity to help engaged partners to obtain above-average returns, strengthening the vendor and its partners alike.

The Benefits of a P2P Ecosystem

Connectria, a 20-year-old managed services and cloud migration services provider with 180 partners, is "getting its feet wet" in the P2P ecosystem collaboration space by recently joining P2P Global. Jeff Swartz, Director, Channel Sales, Connectria, said, "our objective is to glue our partners together so not only do they get the benefits of doing business with us, but they also get the benefits of doing business with all of our other partners." For ten plus years, Connectria has been in IBM Power hosting business but has been branching out into managed services for AWS, Azure, and Google Cloud. Connectria is successfully conveying the message to its customers that it is essentially bringing them more value. P2P Global allows it to expand on the relationship that it has with existing customers. "Particularly over the last year, customers want to see more value from the suppliers they are doing business with, not value addition but value creation. Value addition is akin to selling hardware which is a race to the bottom with very little money,", says Jeff Swartz.

One of the core tenets of channel-ready products is that they are 'designed for relevance, rather than elegance' – that they predictably address a defined issue, rather than being designed so that they can be applied to address a range of potential issues. Resellers then build these products into turnkey solutions that help a target audience to achieve a defined outcome. One result of this approach was that vendors connected to partners in a 'hub and spoke' model, where multiple partners relied on one vendor for a component of a turnkey solution, and the vendor relied on numerous partners to deploy their products within well-defined target markets.

Ecosystem Partnerships

John Guido, CEO, and Founder, P2P Global Inc., has a great perspective on the IT channel and provides valuable insight, saying, "We developed P2P Global to help facilitate P2P engagements for channel partners – to help them solve for skill gaps. In the end, while our platform is easy to use and very efficient, it is only a tool. If a solution provider believes they can deliver more customer value and competitive advantage by leveraging an ecosystem approach, then they will also need to create a company culture that embraces scaling partnerships. While we know our platform can help deliver ecosystem value, we also know continuing to scale membership will be critical to further our value proposition. I believe vendors and distributors will be key to scaling and enabling their channel partners to participate in platforms like ours."

In the "as-a-service" world, a solution is based not on a defined hardware/software configuration but the orchestration of multiple on-demand services integrated with existing legacy systems. In an important sense, this is a liberating factor for the channel partner. However, it also means that channel partners have to increase their collaboration with other channel members, not opportunistically but frequently, similar to what PEAK Resources (a DMR), Connectria (an MSP), and CohnReznick (a consulting firm) are doing.