Techaisle Blog

Buyer journey marketing framework – SMB and Midmarket

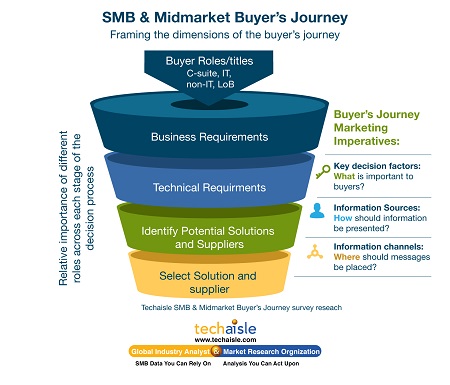

Today, there are several different frameworks that are being used. One of the most common is a six-step process from awareness to purchase. Techaisle’s view is that a buyer-centric marketing framework should consist of four stages which can be easily understood and actionable. Techaisle’s four-stage framework begins from the stage when a business need is generated within a firm and search begins for a technology solution. These four stages are:

- Identification of business requirements / needs,

- Determination of technology requirements to meet business needs,

- Identification of potential solutions and suppliers,

- Selection of solution and supplier

In each of the above stages it is important for the marketer to understand the decision-making unit, the decision makers and their care-abouts.

Consider these facts from Techaisle’s SMB and midmarket buyer’s journey research:

- 275% increase in number of decision makers in the last decade

- 87% of firms search for partners to help simplify technology

- 74% of IT purchases are triggered by an acute business pain point

- 70% of the buyer’s journey is complete before first meaningful contact with a potential supplier

- 56% of buyers are millennials and Gen-Zs are not far behind

- 24% of firms use six or more information sources

Next step in influencing and having a meaningful impact on the buyer’s journey is to determine information needed to fully support new marketing initiatives and what is required for planning and investment. Techaisle’s influence map outlines content and modus operandi that marketers need to evolve from the ‘old world’ of campaigns focused on a limited group of ITDMs managing a tightly-controlled IT acquisition process to the current reality in which a large constellation of BDMs and ITDMs interact in various ways to deploy different types of technology addressing discrete needs within an essentially-unmanaged IT priority queue.

The influence map and care-abouts change with product, market segment, buyer persona and region. Let us look at a few insights obtained from survey research.

- C-Suite buyers usually seek out information through reviews/ratings, news articles, analyst research. Besides online search being a key channel for relevant information they also rely heavily on their peers/colleagues as well as tradeshows/conferences. In the European region, C-Suite decision makers gravitate towards news articles, reviews, product trials/demos, seminars, case studies and sales calls/presentations. In other words, European c-suite buyers are more hands-on than their US counterparts. Analyst research is missing from their top information sources. Asia/Pacific C-suite buyers have a dominant reliance on case studies, white papers, live events, peers and third-party websites. When data is drilled-down into care-abouts, Techaisle finds that although price and reliability are important for C-suite in all three regions – support is more important in US and Asia/Pacific whereas security is leads in Europe.

- Cloud buyers in the US find analyst research, seminars and case studies through online search, direct emails and tradeshows to help form their purchase decision and selection. Europe cloud buyers prefer to attend seminars, use “how-to-guides” and use trials/demos to determine how the product features fit with their business requirements. Asia/Pacific cloud buyers are more “in-person” interaction driven and focus on interviews/meetings, seminars, conferences, presentations to create a picture of their needs vs. offerings.

- In Europe, support and brand are the top ranked decision factors for midmarket firms. When data is combined with ranks 1 and 2, we find that that reliability becomes the most important criterion. Similarly, when top three ranks are taken together, data shows that reliability and support become important. All factors being equal, the data gives a pathway to suppliers to tailor their marketing strategy based on one or more criteria that they want to lead with. It is not surprising that within midmarket, the decision making authority lies within the IT management, however, during business requirements stage of purchase process, business management involvement is higher than IT and even the executive head is involved as much as the IT.

The above examples tell us that while it is important to understand the sources and paths to influence in each stage of the marketing framework, there is also, a need to know the overall dominant and common sources, paths and care-abouts for different technology solutions and various decision-making units.

By aligning information with the business needs of decision makers across IT and business operations, suppliers have an opportunity to fully articulate the reasons for investing in their offerings – and in so doing, begin the process of building a long-term, outcomes-based relationships that sustains customer success.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.