US SMB & Midmarket Communications & Collaboration Adoption Trends

Techaisle Reports are available for a fee, either individually or as part of Techaisle's annual subscription services. Detailed table of contents of the report for review can be downloaded below.

Given below is a brief table of contents:

Executive Summary

Collaboration in the context of IT solution priorities

Differences between small and midmarket businesses

Growth objectives drive collaborative solution investment

BDMs are more likely to see collaborative technologies as driving growth

Current and planned use of collaboration solutions

The essential link between mobility, communication and collaboration

What’s needed to deliver on collaboration?

Small and mid-sized businesses have similar collaboration needs

Understanding the pattern of collaboration technology adoption

Deployment scope further impacts buyer requirements

The connection between SaaS applications and collaboration

SaaS workloads underscore the importance of collaboration

Workloads explicitly focused on collaboration

Workloads where collaboration is a key differentiator, attribute or outcome

Workloads where better collaboration or reporting within/across departments/functions and/or with external stakeholders is a key outcome

Current and planned use of communication solutions

Trends in email & voice communications

Software-based communication channels usage trend

Current & planned use of video conferencing

Current & planned use of Hosted VoIP

Video conferencing & hosted VoIP usage by IT sophistication segments

Video conferencing & hosted VoIP adoption by managed & unmanaged IT

Current & planned usage of unified communications as a service

Business issues driving adoption of communication & collaboration solutions

Business drivers for collaboration solution adoption

Success metrics for communication & collaboration solutions

Purchase process, buyers journey and points of influence

Sources & channels of information – points of influence

Buyer ‘care-abouts

Key decision factors

Role of stakeholders

Aligning marketing messages with the acquisition process

Communication & Collaboration buyers – balance of decision authority

Primary buyers of communication & collaboration solutions

Targeting the lead buyers: focusing on the BDM

Future SMB trends in collaboration solution adoption drivers

Difference in approaches between small & midmarket business

Waves of collaboration adoption

Unified collaboration & communication workspace

Concluding observations

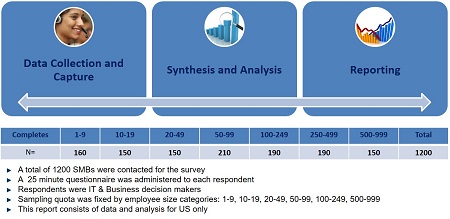

The survey was conducted in the US with SMBs and midmarket firms. Techaisle defines small businesses as 1-99 employees and midmarket firms as 100-999 employees. Sample quota was set by employee size categories as well managed and unmanaged IT. The survey was administered to both IT decision makers and business decision makers to understand the differences in attitudes and objectives dricing use of communication and collaboration solutions. A 25 minute questionnaire was administered to each respondent.

The report is delivered in Word/pdf format, approximately 60 pages and consists of charts, figures and extensive analytical narrative.

The US report is available for purchase for US$4500. Pricing includes 2 hours of inquiry time. For annual subscription service buyers the report is include in the relevant purchased subscription service. Individual reports can be purchased eithe via credit card or purchase order or payments can be amde via check.