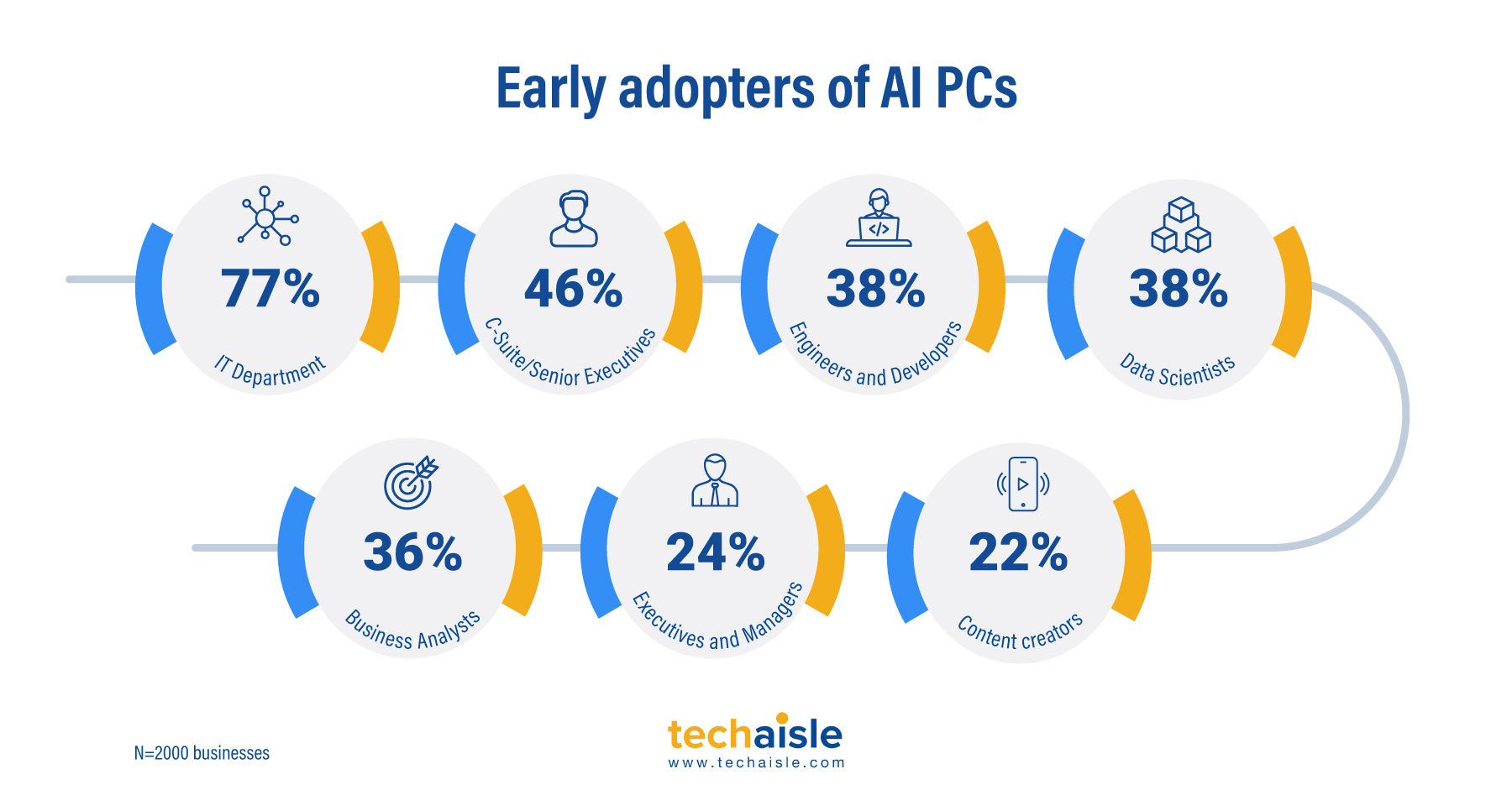

AI is rapidly transforming the business world, and its impact extends beyond the realm of large enterprises. Small and medium-sized businesses (SMBs) and midmarket firms are increasingly looking to leverage AI to gain a competitive edge. One key area where this is becoming evident is in the adoption of AI PCs. A recent Techaisle survey sheds light on the early adopters of AI PCs within this market segment. The findings reveal a diverse range of professionals eager to harness the power of AI to enhance their productivity and efficiency.

The early adopters of AI PCs within small and medium-sized businesses (SMBs) and midmarket firms represent a diverse array of professionals. This group includes IT decision-makers, C-suite executives, engineers, data scientists, business analysts, executives and managers, and content creators. These individuals recognize the transformative potential of AI and are keen to harness its capabilities to increase productivity and drive innovation. As the adoption of AI PCs continues to grow, organizations must offer their employees the necessary support and guidance to utilize this technology effectively. By doing so, they can fully unlock AI's potential and secure a significant competitive edge in the forthcoming years. The early adopters of AI PCs are leading the way toward a future where AI is seamlessly integrated into the workplace. By embracing and using this technology proficiently, SMBs and midmarket firms can achieve a considerable competitive advantage and flourish in the digital era.

IT Departments: The Vanguard of AI PC Adoption

Unsurprisingly, IT departments are leading the charge in AI PC adoption, with a remarkable 77% of IT decision-makers within SMBs and midmarket firms embracing this technology. This early adoption can be attributed to several factors. IT professionals are well-versed in emerging technologies and understand the transformative potential of AI. They also play a crucial role in evaluating and implementing new technologies within their organizations, making them natural early adopters of AI PCs. Furthermore, IT departments are responsible for ensuring the smooth integration and management of AI PCs across the organization. By proactively adopting these devices, IT professionals can gain valuable experience and insights into their deployment, maintenance, and security. This knowledge will be invaluable as AI PC adoption expands within the organization.