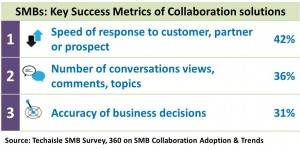

Key success metrics for collaboration systems center on speed of response to customers/prospects and business decision timeliness and accuracy.

Techaisle’s global SMB survey results show that 42 percent of SMBs assess the success of collaboration solution initiatives in terms of improved speed of response to customers and prospects. In the SMB survey Techaisle asked respondents “which metrics does your organization use to measure the business benefits of collaboration technologies?” Small and midmarket business responses to the question show that the success of collaboration systems is primarily gauged by improvements in response time to customers or prospects. However, this is where the similarity between small and midmarket businesses’ measurement of key success metrics for collaboration solutions stops.

Small business View

Apart of speed of response, 36 percent of small businesses report that conversation views, comments and topics are used to evaluate collaboration solution success; Techaisle believes that while this makes sense from a couple of perspectives (it provides an indication of system use/adoption, and metrics can be easily collected and compared), it does not make sense from an important standpoint of “does this metric measure an important business outcome?”

Techaisle believes that counting conversation views, comments and topics is a relatively weak success metric for collaboration systems, one that will gradually give way to measurements, like decision timeliness, that are tightly coupled with key business outcomes. Somewhat surprisingly, internal response times, that is, speed of response to employees, is also an important measurement criterion for small businesses with 20-99 employees.

Midmarket View

Decision accuracy, a key evaluation criterion, is rated as the second most important collaboration solution success metric by 43 percent of midmarket businesses and the third-most important by small business respondents. Midmarket businesses are also focused on decision timeliness, which strikes Techaisle as a reasonable measure of collaboration success.

Further analysis of the midmarket data shows that speed of customer/prospect response is more firmly positioned than small businesses as the key determinant of solution success. Survey data also shows that midmarket businesses with 100-249 employees also view a reduction in the cost of collaboration as a key success metrics. This is interesting because it is the only employee size segment to include cost among the top three measures of collaboration solution success.

Techaisle Take

It is always difficult to measure the impact of technology, especially when that technology has a broad purpose, rather than a narrowly-defined technical objective. One can measure the impact of a faster processor, network or database in response time, even if one is uncertain of how to assess the business relevance of better response time. But what is the best way to evaluate the success of collaboration solutions that are deployed to create corporate information repositories, to connect geographically-dispersed staff, to improve innovation or teamwork, to overcome constraints on decision speed, and/or to address corporate mandates?

Techaisle believes that the survey findings, reported in 360 on SMB Collaboration Solutions Adoption Trends contain important messages for collaboration solution providers. Marketing material aimed at SMB business management should emphasize, in clear and measurable terms, how investment in a solution will improve the timeliness of responses to customers and prospects. The messaging should also include information (again, in clear and preferably measurable terms) on how a solution can enable better decision timeliness. And while cost is always important, survey data indicates that reduction in the cost of collaboration should not be a central facet of solution positioning. Instead, suppliers are urged to look for ways (via case studies, perhaps) to illustrate how better collaboration solutions leads to more accurate business decisions.

Related blogs:

34 percent SMBs want out-of-box Collaboration within SaaS/Cloud applications

SMB and Midmarket File Sharing & Collaboration Adoption to Grow by 52 percent

SMB Content Management & Collaboration Solutions Adoption: Seven Key Trends