Techaisle Blog

Influencing the SMB non-IT C-level buyers requires careful marketing mix

Over the past decade, there has been an explosion in the number and types of information sources available to SMB IT and business decision makers. It is no longer the case that these ITDMs and BDMs can be moved predictably through a process that starts with an initial inquiry and progresses through education to qualification and to a sale. Instead, technology buyers are increasingly self-educated and make contact with a supplier, not with an initial inquiry, but with a fully-formed request.

Techaisle’s survey of 1120 US SMBs, 360 on Balance of Authority: decision cycle, shows that SMBs engage with IT supplier at 50% decision stage. In fact, worst still, the IT supplier’s and channel partner’s role begins in when price, deployment & support are the only points left to discuss.

Techaisle’s corresponding survey of 1246 US SMBs, Influencing the SMB buyers’ journey, shows that “Campaign marketing” has become a relic of an earlier age, replaced by a content marketing brew combining “thought leadership” (to engage new prospects) and ‘digital discovery’ (to ensure visibility for the thought leadership).

At a higher level, the notion of a marketing funnel has been supplanted by focus on buyer personas and the buyer’s journey, as marketers look to map ‘sticky’ content to digital pathways traversed by high-priority targets. This is a particularly onerous task in the SMB market, since many vendors lack direct experience with customers and prospects, managing them programmatically rather than individually.

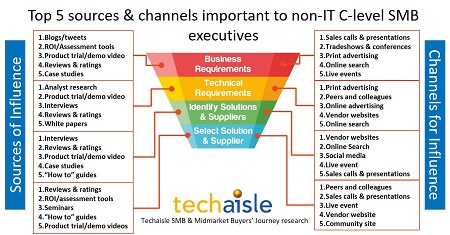

Techaisle’s research into non-IT buyers’ information sources, channels and KDFs spans seven groups: three with C-level titles (CEO, CFO/COO, CMO) and four with management responsibility in departments aligned with these C-level executives (sales VPs/directors, sales managers, finance directors/managers, and operations/admin directors/managers). Techaisle studied 13 different modes of influence and 14 different points of influence. Figures below illustrates the Top 5 modes and points of influence that are preferred by the C-level group.

Influencing during business requirements purchase decision stage

- CEOs: The sources of influence reflect a policy of being 'generally aware' than an active, research-oriented interest. CEOs generally find that recommendations for new technology addressing business requirements are raised by their staff. CEOs adopt a more reactive than proactive approach to identifying business requirements for new technology solutions.

- CFOs/COOs: are focused on evaluating fit (via blogs, case studies, demos, reviews, whitepapers) and payback (ROI tools are the top-ranked source). Results for this group represent an almost complete reversal of CEO preferences. Clearly, this stage is more of a CFO/COO than a CEO responsibility. Note – vendor resources (via sales calls or websites) have very little impact.

- CMOs: Like CFOs/COOs, CMOs are primarily interested in understanding ROI and potential use of new technology. Unlike CFOs/COOs, CMOs prefer personal interaction through sales meetings, presentations, intense interactions at events. Having a penchant for media, they themselves pay attention to printer advertising.

Influencing during evaluation of technical requirements purchase decision stage

- CEOs: prioritize sources offering depth. It also seems clear that CEOs rely primarily on others in the business for in-depth technical insight.

- CFOs/COOs: are looking for expert guidance and this group uses relatively unsophisticated channels; technology assessment is not a core focus.

- CMOs: are mostly interested in understanding fit and opportunity; feature/function/value (demos, ROI) are a secondary consideration. It's unlikely that gathering technical information is a core function for CMOs - four of the top five channels cited are content-light sources originating from vendors.

Influencing during potential solution and supplier identification purchase decision stage

- CEOs: The top sources for identifying potential solutions and suppliers are reviews & ratings and interviews – sources that help identify fit between solutions and potential use – followed by visuals (such as infographics), “how to” guides and case studies. Priority given to online search, social media and vendor websites provides evidence of CEO self-education on potential investments.

- CFOs/COOs: prioritize case studies, reviews and news articles – sources that provide a demonstration of value to business. Survey findings suggest that identifying potential solutions and suppliers is probably not the primary focus of this group; this group probably doesn't have much direct responsibility for this task.

- CMOs: are looking for demonstration of value to business, including (via demos) some hands-on experience with new products. They look for a mix of peer opinion and vendor input when identifying solutions and suppliers, emphasizing community sites, direct email, sales calls, live events and social media. CMOs do not look to advertising at this stage in the process.

Influencing during solution and supplier selection purchase decision stage

- CEOs: rely primarily on others in the business for insight needed to select solutions and suppliers. At this stage, CEOs are looking for references and feedback.

- CFOs/COOs: primary focus is on understanding path to benefit. Survey findings indicate that this group vets rather than makes purchase decisions. It is interesting to note the disinterest in vendor websites - technology specifications don't matter to this group.

- CMOs: Sources used by CMOs indicate that the decision on solutions and suppliers is based largely on supplier's ability to demonstrate value. Data indicates that “how to” use new technology (reflected in low ratings for how-to, case studies, articles) is complete at this stage. As is the case with identifying business requirements and potential solutions, CMOs lean heavily on direct sales calls to help inform solution/supplier selection. This is the only stage of the purchasing process where CMOs rely on peers and colleagues and vendor websites.

If there is one thing that we have learned in 30 years of research on the IT industry, it is that where change is constant, clarity is essential. With 360 on Balance of Authority: decision cycle and Influencing the SMB buyers’ journey, Techaisle is providing an important point of insight into how vendors can develop awareness and intercept demand in the absence of traditional campaign marketing options.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.