Techaisle Blog

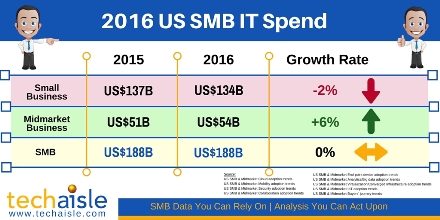

2016 US SMB IT spend growth rate to remain flat at US$188B

Techaisle forecasts that US SMB IT spend growth rate could very well remain flat at US$188 billion in 2016 as compared to 2015. However, the US midmarket spending growth will likely increase by 6% whereas the small business spending will fall by 2 percent in 2016 from 2015. In early 2015, Techaisle had forecast US SMB IT spending to be US$180B by end of 2015 – based on most recent Techaisle SMB surveys the actual spending for 2015 came in at US$188B. Techaisle survey data shows some very interesting patterns for planned SMB 2016 IT budgets across different employee size businesses. Small businesses show progressive fall in IT budgets until they reach a certain size whereas midmarket businesses show budget increases until they reach a certain size.

To download graphic click here

Although 52% of small businesses say that technology helps drive the direction of their business, the very small businesses (less than 50 employees) have lowered their IT budgets for 2016 varying from -2% to -6% depending upon size of business. This is primarily because of less spending on end-point devices and IT services. Especially within the micro-businesses, spending on mobility is likely to fall by as much as 10%. Survey data shows that IT spending by small businesses is shifting to cloud, managed services, analytics and even IoT as indicated by planned budget increases in each of these technology categories. Only the 1-4 employee size businesses are planning to keep their 2016 cloud budget same as in 2015 as these businesses are reaching a theoretical limit of paid cloud usage.

Small business IT spending is effected by restrained growth in 1-49 employee sieze category businesses. The 50-249 employee size segment is expected to have the IT spend growth rate in 2016 and should be the sweet spot for most IT suppliers.

Technology purchase is not an easy decision for SMBs, where most use their existing budgets and in many cases they have to deal with ad hoc purchases due to changing business conditions. In such a scenario, role of financing is becoming increasingly critical to technology acquisition decisions for 59% of midmarket firms, twice that of small businesses. With an explosive move to cloud, 35% of midmarket businesses indicate that they are moving to OPEX-based agreements. Small businesses are leaning towards leased-based purchases for infrastructure solutions.

Techaisle surveys (cloud, mobility, IoT, security, managed services, end-point device, virtualization, analytics/big data, buyers journey) show that midmarket businesses have increased their IT budgets in all categories. The primary driver of budget increases are the line of business executives (as opposed to IT department) who are focused on improving quality of products/processes, managing inventories, managing uncertainty, improving workforce productivity and driving innovation. (see 2016 SMB business issues, IT priorities, IT challenges; 2016 Midmarket business issues, IT priorities, IT challenges).

Although technology is very important to improve operational efficiency for 70% of midmarket businesses, it is still perceived as a cost center for 51% of midmarket businesses. Techaisle survey data also shows that there is 35% more millennials in midmarket businesses than small businesses which is helping drive increased adoption cloud, analytics, collaboration and mobility solutions.

Even with an overall flat growth rate in 2016, SMB is a more attractive market than enterprise segment where the spending is forecast to be negative. The SMB market is where IT suppliers should really focus their marketing efforts, it is one of the most agile segments, receptive to new technology offerings and has as quiker decision making process and timeline. For SMBs, increasingly "tech" means "cloud" which lowers the barrier of technology adoption across groups, departments and geographies within the same SMB organization. Techaisle survey data also shows that percent of shadow IT spend is poised to grow in 2016 from 2015.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.