Techaisle’s 2015 SMB and Midmarket Mobility Adoption study shows that to emerge as leaders in the mobility solution market, suppliers will need to tailor their offerings and strategies to specific clusters within the SMB market. Successful suppliers will need to be cognizant of, and visible in addressing, key SMB selection criteria.

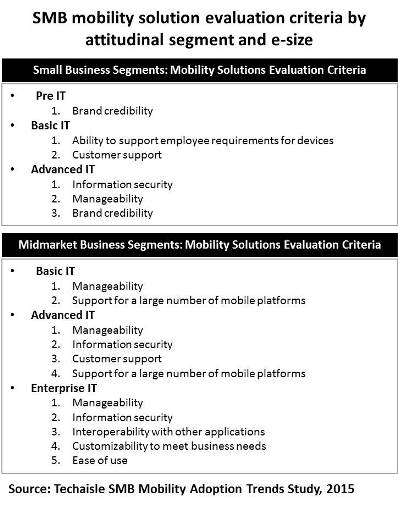

Figure below presents an analysis of SMB mobility solution evaluation criteria, tied to the attitudinal groups used for SMB segmentation analysis. This segmentation and perspective highlights how increased sophistication changes the requirements that SMB users have of suppliers.

Small Business Segments

Within the small businesses, the Pre-IT segment is looking first and foremost for a trusted brand. These small business buyers opt for horizontal suppliers for their first step into mobility solutions. Data from other segments suggests that increasing sophistication leads to more exacting expectations.

Basic IT buyers are looking for help with managing BYOD and for effective customer support, while Advanced IT buyers look for assurances of information security, for manageability, and for suppliers’ credible brands.

Midmarket segments

“Manageability” is the most essential attribute for suppliers targeting midmarket firms. The basic IT segment is looking for assistance in supporting a large number of mobile platforms as a means of dealing with the BYOD needs of a larger (relative to small business) workforce, and/or as a means of supporting customer access to public systems.

The midmarket Advanced IT group, like its small business peers, requires a combination of manageability and information security, and adds customer support and the requirement for multi-device/platform support.

The enterprise IT group –the largest spenders represented in this chart – have a few unique requirements. This group demands interoperability and customizability as it seeks to integrate mobility solutions within the broader IT infrastructure, and looks as well for ease of use as it rolls out mobility solutions to a (relatively) large and diverse workforce. Techaisle expects that over time, an increasing number of SMBs will pursue these capabilities as they, too, tie mobility into their overall IT/business architectures.

So what did I do that was so different? I went back to market research data. Almost all companies do advertising or brand tracking. The sample sizes in these tracks vary from 800 to 4000, every month. The tracks capture primarily the exposure to media, awareness of advertising and the brands, brand imagery and Intention to buy. They set up benchmarks against each parameter and take marketing decisions. For example: if the claimed exposure to TV in April is 30% and it was 40% in March, they call the advertising agency and ask them to change the channels. If the imagery is not improving then they will change the advertising. These decisions are ad hoc, because they have no clue on how each of these decisions will affect a priori. The marketing guy’s knowledge is always from hindsight. So, what we did was to pick up the brand track data with 800 or 4000 respondents and modeled it. The basic modules were:

So what did I do that was so different? I went back to market research data. Almost all companies do advertising or brand tracking. The sample sizes in these tracks vary from 800 to 4000, every month. The tracks capture primarily the exposure to media, awareness of advertising and the brands, brand imagery and Intention to buy. They set up benchmarks against each parameter and take marketing decisions. For example: if the claimed exposure to TV in April is 30% and it was 40% in March, they call the advertising agency and ask them to change the channels. If the imagery is not improving then they will change the advertising. These decisions are ad hoc, because they have no clue on how each of these decisions will affect a priori. The marketing guy’s knowledge is always from hindsight. So, what we did was to pick up the brand track data with 800 or 4000 respondents and modeled it. The basic modules were: