In the course of Techaisle’s SMB & Midmarket IT Decision Making Authority: IT vs LoB, BDMs (business decision maker) and ITDMs (technology decision maker) were asked to identify the “greatest benefits” and “key attributes” of both cloud and mobility solutions.

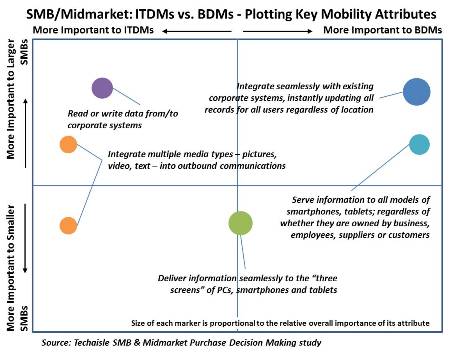

There is an interesting pattern apparent in the survey research findings. When adopting mobility solutions small business BDMs are focused on addressing near-term pain points: attracting new customers, improving accuracy, addressing work/life balance. The ITDMs appear to be taking a longer view, focused on applying automation to bring structure to business processes – improving the quality of interaction through application of mobility solutions, improving the quantity of those interactions, increasing process efficiency.

Midmarket BDMs are looking to mobility to help increase business process efficiency and customer interaction quality. Midmarket ITDMs, on the other hand are focused on increasing the quantity of customer interactions, which would logically impact other core areas (such as business user productivity and process efficiency) as well.

When discussing the mobility solution attributes that BDMs and ITDMs consider important to delivering on mobility benefits BDM and ITDM buyers have similar and common perceptions across all business sizes. “The ability for the mobile solution to be integrated seamlessly with existing corporate systems” – ensuring consistency across devices – is ranked as the most important mobility solution attribute by small business BDMs, and the second-most important attribute by midmarket BDMs. The ability to create and sustain secure connections for remote workers and the ability to deliver seamlessly across the “three screens” of PCs, tablets and smartphones are also priorities for BDMs in both small and midmarket businesses. ITDMs also have some key common areas of focus: the ability to integrate multiple media types into outbound communications and the ability to read or write data from/to corporate systems are the two top-ranked attributes in both employee size categories.

It is clear that each IT and business professional’s perspective on the mobility journey is shaped by their context – by their business objectives, and by the requirements imposed by the size of their organization. In the figure below we have taken the results from the Techaisle survey and plotted them in three dimensions.

A look at the findings from parallel questions on cloud also reveals differences between ITDMs and BDMs, but similarities between small and midmarket firms. Looking at cloud benefits, BDMs, especially in small businesses, view cloud as a means of introducing capabilities that would have been cost or time prohibitive, and of reducing business process costs. ITDMs, on the other hand, view cloud primarily as a means of reducing IT costs. ITDMs in both small and midmarket businesses recognize that cloud can enable their organizations to be more agile, which connects well with a theme expressed by BDMs.

When analyzing the key attributes leading to realization of the above cloud benefits, data shows some differences in emphasis between small and midmarket firms. The most important difference between BDMs and ITDMs is the BDMs’ emphasis on collaboration: BDMs in both small and midmarket businesses are more likely than their ITDM counterparts to view support for collaboration as a key cloud solution attribute. BDMs are also more likely than ITDMs to look to the cloud for detailed reporting and for support of features – disaster recovery, on-demand data access, and mobility support – that may be lacking in their current environments. ITDMs, on the other hand, are focused on technical attributes (scalability, integration, IT management capabilities) that are difficult and/or expensive to develop without third party support.

Understanding the requirements, preferences, success metrics and areas of focus of BDMs and ITDMs within both small and mid-sized businesses is critical to structuring an effective SMB sales and marketing strategy. The findings open the door to an important issue: the requirements in structuring and communicating messages to ITDMs and BDMs within small and midmarket businesses. To effectively engage with and manage the increasingly-diverse decision making unit, IT suppliers will need to structure messages that address the "care-abouts" of BDMs and ITDMs, and deploy those messages through the channels that are most effective at reaching each community.