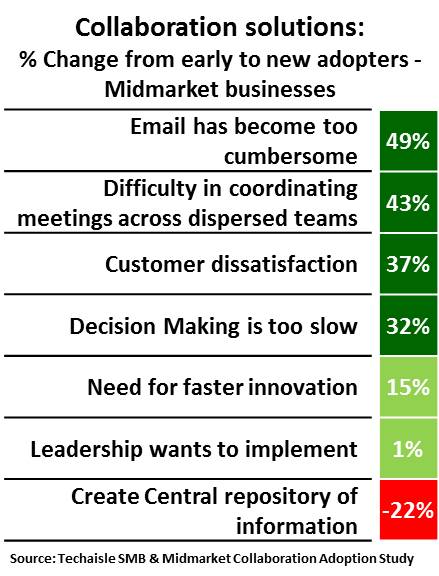

Techaisle’s SMB & Midmarket Collaboration adoption survey research shows that collaboration is already entrenched within many midmarket businesses. While the creation of a central information repository was the most important business driver for collaboration solutions adoption to the “first wave” of midmarket users, it is not so for the new buyers. Leadership’s desire to move forward with collaboration initiatives was the second most important driver for first wave of adopters, the need to meet leadership expectations is widespread within future adopters as well but this issue has been surpassed by the need to enable faster innovation within the new adopter group.

Key business drivers for collaboration are changing within SMBs and midmarket businesses. Specifically, within midmarket businesses, future collaboration adoption efforts will be driven by demands for decision agility, speed of innovation, customer intimacy and faster time to market.

Early midmarket collaboration solution users tell Techaisle that they were frequently investing in these solutions because a lack of teamwork was impacting productivity. New adopters are saying that they are having difficulty coordinating meetings (as a consequence of increased employee mobility, dispersed team members, ad hoc scheduling), and that they need to address slow decision-making within their organizations. In the Techaisle survey midmarket businesses also rated “need for faster innovation” as the third most prevalent driver for collaboration solutions.

The figure below shows the changes in adoption drivers from early adopters to the new wave of adopters for whom collaboration is one of the top IT priorities for business success.

The first wave of users focused on asynchronous file-sharing cloud services. Looked at as a whole, there are several distinct generations of collaboration solution drivers within midmarket businesses. The first wave, reflected in the early users within the midmarket business segment was reacting to a requirement to create a central repository of information, to leadership mandates and to the need to coordinate geographically-dispersed teams. The next generation of midmarket business collaboration solution adopters will emphasize collaborative responses to specific pain points – slow decision making, difficulty in coordinating meetings, faster innovation – more than their predecessors.

A deeper review of the midmarket data in the Techaisle study provides additional context for the discussion of collaboration solution benefit metrics. Speed of customer/prospect response is very firmly positioned as a key determinant of solution success, and the importance of meeting deliverable timelines and decision accuracy are also underscored. Data also shows that businesses with 100-249 employees view a reduction in the cost of collaboration as a key success metrics.

The type of collaboration solution adoption data shows that the next stage in the collaboration platform/framework is the ability to enable richer online interaction by allowing simultaneous sharing and editing of files from PCs and mobile devices, to enable multiple simultaneous communication modes, mobile video collaboration and to integrate social networks thereby extending collaboration initiatives from file sharing to more interactive solutions.

Mobility is a key driver and a key support requirement for collaboration. There is a sound basis for believing that mobility has extended demand for collaboration solutions and collaboration investment priorities emphasize inclusion of mobile devices. It is expected that mobile video will drive the highest proportion of new technology needs. Data also shows that enabling teamwork and dealing with new mobility/geographic challenges will be a key investment driver and that individual employees will have a greater voice in shaping solution demand. For the IT staff deploying support for multiple simultaneous communications modes (text, chat, voice, and video) will be a key technology requirement.

Techaisle believes that this reflects a couple of broad trends: the initial centricity of file sharing to a more interactive communications in collaboration strategies, a recognition that there are now many different ways to connect midmarket employees beyond email and a move away from collaboration solutions as a stand-alone platform (like email) and towards collaboration solutions as a framework for integrating multiple capabilities.