Techaisle Blog

Channel and Vendors must shift from turnkey to ecosystem collaborative solutions by 2020

The core changes in the demands on different areas of the channel business are critical and challenging, but they can be seen as more effect than cause. In all aspects of channel business, long-held business tenets are being replaced by an emerging reality that has been ushered in by the move to cloud and amplified by many other trends – changes in buyers and buyer behavior, as well as management and process changes, and evolutions in service/technology delivery – that are reshaping how technology is acquired and used, and how suppliers need to act to meet buyer requirements.

NEXT channel

Techaisle has identified twelve areas where channel partners must abandon ingrained behaviors and move to new approaches that will enable NEXT (Networked, Engaged, Extended, Transformed) channel businesses.

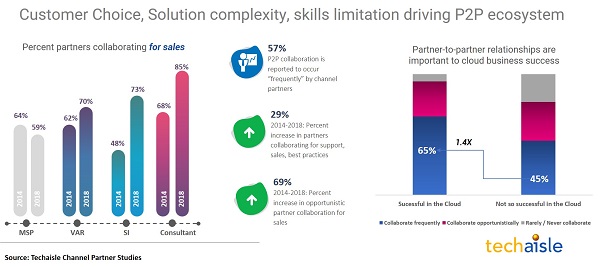

Partner-to-partner relationships are important to cloud business success

There are seven imperatives that impact all areas of channel business operations, there are two imperatives that relate to internal management/process items, two that impact service/technology delivery, two that affect go-to-market and customer relationship management, and one – the shift from ‘turnkey solutions’ to ‘ecosystem collaborative solutions’ – that touches on all three areas. Let us discuss this last imperative.

Solution packaging isn’t a ‘religious issue’, it’s a ‘customer choice issue’ – and customers are clearly choosing to move from turnkey systems to hybrid environments that can be aligned with their evolving needs; this will also require an accelerated frequency of partner-to-partner collaboration (not opportunistically but strategically).

The chart above illustrates an important feature of this migration: it increases both the scope of projects that the channel partner can engage in and the profitability of those engagements. As the chart demonstrates, 65% of channel firms that consider themselves to be “very successful” in selling cloud report that they frequently collaborate with other channel partners; firms that struggle with cloud success are much less likely to proactively work with peer channel firms.

Drilling into the data from 2014 to 2018, we find that the opportunistic collaboration has increased by 69%. There are many sporadic efforts but no single vendor is formalizing and enabling this P2P collaboration.

What is the new Turnkey solution:

The idea of delivering a turnkey solution – a combination of hardware and software, wrapped in advisory, implementation and management services, and delivered as a solution that allows the customer to simply ‘turn a key’ and begin obtaining benefit from the new technology – is embedded deep within the traditional channel’s DNA. It touches all of the areas that the channel is active in: it involves helping a business to identify and scope a new solution, it requires sourcing and set-up/configuration of hardware and software, it creates demand for implementation, training and management services, and it reinforces the position of the channel member as a trusted extension of the customer’s own business.

However, in the post-transactional world, the ‘new turnkey solution’ is based not on a defined hardware/software configuration but on orchestration of multiple on-demand services, integrated with existing legacy systems. In an important sense, this is a liberating factor for the channel. Most turnkey solutions address a specific window of requirement – for example, “a financial solution for mid-sized discrete manufacturing firms.” A solution based on combining capabilities from multiple allies within an ecosystem can be tailored to address a much wider set of requirements: “pipeline and inventory management and financials for a mid-sized discrete manufacturing firm,” “financials for a small process manufacturing firm” or “for a mid-market logistics firm,” etc.

What are key pre-requisites for channel and vendor:

- Target achievement year: 2020

- Primary focus: Internal management / process, service / technology delivery and go-to-market / customer relationship

- Key Channel requirement: Align flexibly to customer needs, incorporate digital transformation suite within offerings

- Key Vendor requirement: Enablement to include marketplace, alliances and standards

Established channel partners may find this new latitude somewhat threatening, as it eliminates traditional solution definitions and has an impact on transactional value. It’s essential, though, that channel partners looking to keep pace with the market not get derailed by this uncertainty.

It also means that channel partners have to increase their collaboration with other channel members, not opportunistically but frequently.

One of the core tenets of channel-ready products is that they are ‘designed for relevance, rather than elegance’ – that they predictably address a defined issue, rather than being designed so that they can be (with potentially complex and expensive customizations) applied to address a range of potential issues. Resellers then build these products into turnkey solutions that help a target audience to achieve a defined outcome. One result of this approach was that vendors connected to partners in what might be described as a ‘hub and spoke’ model, where multiple partners relied on one vendor for a component of a turnkey solution, and the vendor relied on multiple partners to deploy their products within well-defined (industry, geographic and/or account size based) target markets.

The turnkey solution approach worked well for customers, the channel and vendors for decades; but it is out of sync with a hybrid world focused on a continuous path towards ever-greater levels of digital business capabilities. Business users aren’t (or shouldn’t be) committing to static systems that manage defined tasks/processes – they are (should be) building approaches that allow for incremental deployment of new capabilities that increase reach and/or efficiency.

What will it take to pursue ecosystem business approach:

To address unique and evolving customer needs, channel partners will need to change their approach. They will need to understand business objectives and the ways that technology can support them, and will need to keep pace with changing customer expectations by identifying and deploying new incremental solutions that can be integrated within current environments.

Conceptually, this approach more closely resembles an ecosystem than a hub-and-spoke arrangement – it demands that the channel develop the ability to be flexible in its approach to customer needs, and that vendors support this flexibility, by creating marketplaces that include technologies which can extend the ways that their products can be deployed, adopting standards (such as APIs) that facilitate integration across these complementary offerings, and establishing alliances that help position these integrations as part of a strategy that is aligned with a digitally-transforming market.

It is worth noting that pursuit of this ecosystem business approach will require success in other areas, including changes in go-to-market strategies and in the ability to integrate around data rather than physical system components. This escalating requirement for advanced capabilities highlights the vulnerability of channel organizations (and vendors) that fail to keep pace with channel transformation imperatives: organizations that miss the initial steps in the journey will have accelerating difficulty in meeting evolving customer expectations/requirements.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.