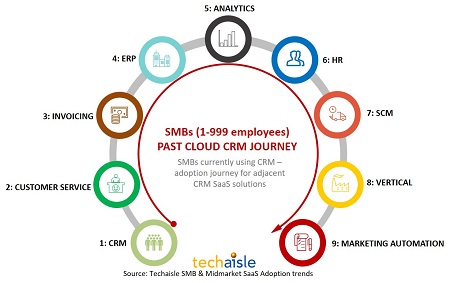

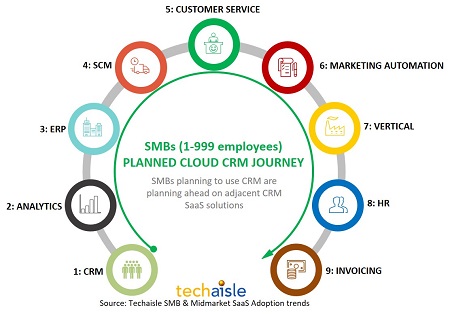

Techaisle’s detailed SaaS adoption survey tracked the current and planned buying journey of cloud CRM, ERP and other SaaS applications within SMBs and Midmarket firms. Cloud orchestration & digital automation have become essential ingredients for business transformation. Techaisle analyzed the extent to which use/intended use of each of these cloud applications is connected with other applications and whether they are part of a conscious effort for digital transformation. The two sets of figures below show past and planned CRM and its adjacent SaaS applications adoption journey.

The research reveals a very stark difference between the past cloud CRM adoption journey and the intended path after adopting cloud CRM for the first time. The past adoption patterns were seemingly random reacting to a specific point of pain, but planned adoption is deliberate keeping in view the business issues & IT challenges and taking giant steps towards a connected digital business.

51% (unweighted) of small businesses using SaaS applications have adopted at least one customer-focused application as compared to 76% of midmarket firms. With “attracting and retaining new customer” being among the top 3 SMB business issues, both the small and midmarket businesses have plans to further add to customer-focused SaaS applications – 67% of small businesses and 87% of midmarket firms.

The data also shows that number of SaaS applications being used is highest within SMBs that have a higher percent of millennial employees than other generations. SMBs with 59% of millennial employees are using between 11-15 SaaS application categories as compared to less than 5 SaaS application categories with 41% of millennials. Although there is no causal relationship between the two but it can be inferred that cloud-based solutions adoption for digital transformation has a high probability when millennials are present in an organization.

Some important differences between past and planned SaaS CRM journeys are:

- Customer service, the next adopted SaaS application within current CRM users is most likely to be replaced by analytics as the preferred SaaS application after CRM within the planned CRM users. Because analytics provides an answer. SMBs are prioritizing a wide range of improved outcomes within their digital businesses: improvement within existing operations and processes, expansion of the customer base, profitability of the business as a whole, creation and accelerated delivery of new offerings, reduced cost, and enhanced ability to manage the unknown. Remarkably, each of the issues can be addressed with analytics solutions.

- Use of marketing automation was almost an afterthought in the past, due in part to cost and complexity, but it has risen four places in the planned adoption journey. Marketing automation is a contributor to an SMB’s sales and marketing initiatives aiming to alleviate the business pain-point of improving sales and reducing cost of customer acquisition. It is also viewed by SMBs as a natural extension of their CRM applications and they believe that marketing automation firmly sits between CRM and business analytics solutions.

- CRM and ERP are getting inextricably intertwined, more so in the future than in the past. In effort to have end-to-end digital linkages between customers, suppliers and employees, the planned CRM SMB users are fast-tracking adoption of ERP and SCM as compared to the current CRM users.

- After the SMB CRM/ERP/SCM base is built (or simultaneously), the order of implementation depends on the SMB’s digital focus, transitioning from manual to fully-automated processes - HR/Payroll, customer service for service companies, industry vertical applications such as retail, communication, finance, manufacturing, etc.

All SMBs are not the same. For example, midmarket firms (100-999 employees) have plans to adopt CRM, ERP and SCM consecutively and some even concurrently at the time of first CRM solution. For small businesses, the order changes with CRM, marketing automation and analytics as the first three CRM adjacent and connected SaaS solutions.

Along the journey, SMBs have made conscious plans to inject Office 365 and file sharing/collaboration solutions. SMBs that are already using any of these productivity suites and collaboration solutions are hoping to integrate them with their CRM solutions.

The data helps illustrate the importance of the types of SaaS suites and digital transformation messaging that leading vendors like SAP, Oracle/NetSuite and Microsoft or their partners need to offer to SMB buyers who are consistently looking for a combination of capabilities as well as integration across these applications in their quest to digitalize their businesses.