Techaisle’s SMB Server Virtualization adoption market trends study shows that US SMB server virtualization penetration has reached 54 percent (un-weighted), up from 41 percent two years ago. Within midmarket businesses the penetration has reached 88 percent and another 7 percent are planning in the next one year.

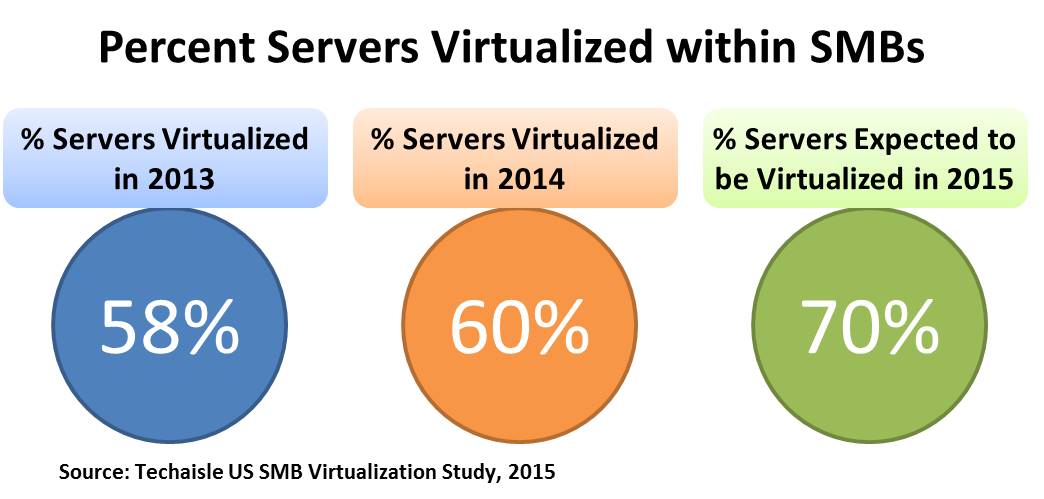

Figure below uses data from multiple surveys to illustrate trends in virtualization penetration within SMB accounts that have adopted server virtualization. In 2013 the proportions of servers virtualized was very similar across all employee size categories, ranging from 61%-62% in microbusinesses (which sometimes only have one server, making virtualization an all-or-nothing proposition) to just over 50% in midmarket enterprises with 500-999 employees, which can be expected to have many servers. The statistics for 2014 show virtualization penetration rising in all employee-size segments: rapidly in microbusinesses and the 500-999 midmarket enterprises, and gradually in other SMB segments. The perspective on future intentions, drawn from the Techaisle SMB 2015 survey, indicates that these trends will continue and accelerate. Microbusinesses and larger SMBs (including both the 250-499 and the 500-999 segments) are expecting rapid further penetration of virtualized servers, and the other midmarket segments are expecting a further 6%-10% of servers to be virtualized.

What does this trend mean to the market?

Clearly, there is increasing opportunity for hypervisor sales, and Techaisle would expect that VMware will find purchase within companies looking to connect virtualized servers to other infrastructure assets (especially, for example, hybrid cloud or software-defined networking or storage), while alternative suppliers, such as Microsoft, gain share in the core market as multi-hypervisor strategies become more common. Techaisle expects that this trend also indicates increased opportunity for converged infrastructure products as these systems can be used to capitalize on advanced virtualization capabilities.

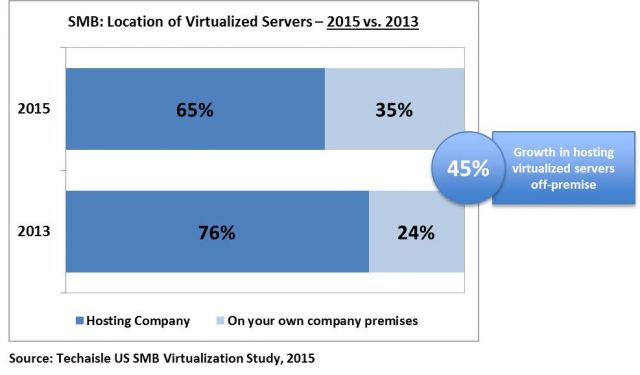

Location of Virtualized servers

A comparison of 2013 and 2015 research results shows that within each employee size segment, SMB end-user organizations are becoming more likely to virtualize servers that are located outside of their business premises. Across the entire SMB community, there has been a 45% increase in off-premise virtualized servers in the past two years: an enormous shift that highlights the broader shift towards remote management of infrastructure resource.

If virtualizing servers is so popular – why isn’t it universal?

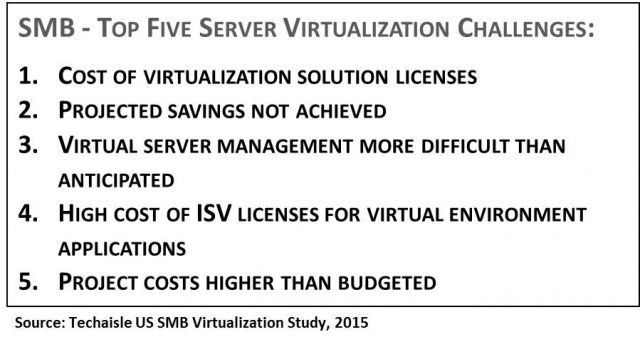

The Techaisle interview of 848 US SMB ITDMs uncovered a number of reasons why SMBs struggle with virtualization adoption. The top five challenges cited in the research illustrate the complexity that can accompany infrastructure changes.

The most prominent challenge, cited by 34% of SMB respondents, was the high cost of virtualization licenses, which may explain why the expansion of virtualization within current user accounts often includes investigation of (and in many cases, migration to) a multi-hypervisor strategy that adds “free” options such as Hyper-V and Xen.

The third most common challenge is that management of virtual servers proved to be more difficult than anticipated, which may reflect initial learning curve struggles and/or incremental complexities associated with environments relying on multiple hypervisors.

The second leading challenge, “projected cost/space/power savings not achieved,” highlights both the cost and complexity issues: it can be difficult to obtain projected densities/utilization rates during the adoption/migration period, and expenses can escalate in several ways: due to costs associated with virtualization solution licenses, and also because of the “high cost of ISV licenses for applications running in a virtualized environment” and generally higher-than-anticipated project costs. It is worth noting as well that in small businesses (1-99 employees), “lack of experience” is also seen as a major server virtualization challenge, cited by 22% of survey respondents.

On the positive side, the relatively high level of server virtualization experience found within the SMB channel partners (Techaisle SMB Channel Trends study) may help mitigate this issue – but it should act as a caution when evaluating market outlooks for VDI and DaaS, where experience levels within both the SMB buyer and SMB channel communities are much lower.