Techaisle’s recently completely study 2015 US SMB Cloud Computing Adoption Trends shows that Cloud adoption within US SMB is currently 89 percent and will reach 96 percent in 2015. Cloud is no longer a trend that is discrete from mainstream IT. Cloud is not a future issue – it is an essential (if new) component of SMB IT. Cloud addresses real business needs. The key to accelerating growth within SMBs will be increased Cloud vendor sophistication. Techaisle expects Cloud suppliers will work with SMB buyers to overcome current SMB cloud challenges and will focus on “growing the pie” rather than share-shifting as the market itself becomes firmly entrenched in the early-mass-market stage of the market lifecycle.

Techaisle study clearly shows that for SMBs:

- Cloud is established as essential IT infrastructure

- Cloud is established as essential business infrastructure

- The larger Cloud trend is towards deeper use of SaaS

- Cloud purchase sources, spending are shaped by a combination of legacy relationships and new options

Technology trend watchers have seen a succession of “year of the cloud” pronouncements: HBR dubbed 2010 as “the year the cloud rolled in,” TechRepublic proclaimed 2011 “the year the cloud went mainstream,” ZDNet wondered “will 2012 be the year of the cloud?” Wired claimed that 2013 was “the year cloud just was,” and Computer Weekly stated that “2014 will be the year of the cloud – honest.”

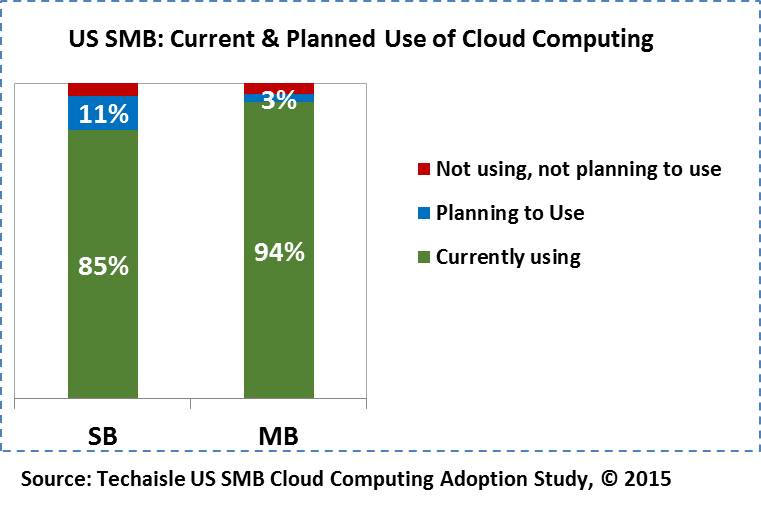

In 2015, one can put an end to this kind of discourse. SMB Cloud is no longer a trend that is discrete from mainstream IT. Data presented in Techaisle’s report shows that Cloud Computing will reach 96% adoption by US SMBs in 2015. Publications looking for future trends will need to turn their gaze to converged infrastructure, or Big Data, or the Internet of Things. Cloud is not a future issue – it is an essential (if new) component of SMB IT.

This shift in Cloud’s positioning brings with it a shift in the kinds of insights needed to help connect suppliers and buyers to address common interests in deployment, integration and expansion strategies. SMBs need help in moving past initial cloud pilots and applications to integrated cloud systems that provide support for mission-critical processes. Cloud sellers need to adjust their messaging to address the needs of early mass market rather than early adopter customers.

Techaisle’s “2015 US SMB Cloud Computing Adoption Trends” report contains the data needed to align content and activities with market needs.

- Cloud is established as essential IT infrastructure. Cloud is a near-universal IT priority within US SMBs – but current usage levels demonstrate that it is also a current IT reality. US SMBs are using cloud today and planning expansion of cloud infrastructure. Techaisle expects cloud momentum to continue through for 2015 and beyond, as cloud addresses some of the key IT issues faced by US SMBs.

- Cloud is established as essential business infrastructure. Techaisle’s survey of US SMBs not only found a strong link between cloud and IT – it also found a strong link between cloud, IT and business success. The research shows that technology is viewed as critical to the success of SMB businesses, and that cloud provides a compelling response to SMB business issues; cloud also addresses constraints within the SMB market, such as the ability to adopt new IT capabilities without adding IT staff.

- The larger cloud trend is towards deeper use of SaaS. There is no longer any sense in asking whether SMBs are investing in IaaS vs. PaaS vs. CaaS vs. SaaS – the answer, increasingly, is “yes.” Cloud plans show clearly that usage is poised for substantial growth within the SMB market, with both current IT-oriented workloads and new SaaS-enabled options finding additional user accounts. However these paths are not of identical length. There is still scope for additional use of cloud infrastructure to replace and/or supplement physical back-office gear, but there is a limit to how much infrastructure is required by an SMB. There is likely some theoretical limit on the number of cloud-based applications that can be usefully deployed within an SMB as well, but it is a much higher threshold – businesses in general, and SMBs in particular, have a large number of poorly-automated or un-automated tasks and processes which could be meaningfully improved by the use of focused, low/variable cost SaaS applications.

- Cloud sources, spending are shaped by a combination of legacy relationships and new options. SMB cloud buyers look first to large, established vendors for cloud solutions, and many (especially in small and micro businesses) allocate a significant proportion of their IT budget to cloud. Buyers across the SMB spectrum rely on a mix of reach and breadth vehicles for insight into cloud options for their businesses.

From an IT perspective, it’s important to understand just how widespread cloud has become within SMBs – and what the next steps in cloud are likely to be. The first part of this is straightforward: cloud is on the minds of nearly all SMBs, and is currently used, to one extent or another, in 89% of US SMBs. 2015 SMB IT priorities data shows cloud’s ubiquity - the extent to which cloud and other important IT infrastructure/solution types factor into 2015 SMB IT plans. Cloud tops the list.

Techaisle survey data finds that small businesses move from point to point, working first on one discrete solution, and then on the next. On the other hand, midmarket businesses have already deployed point solutions, and are now trying to build a longer-term strategy for an integrated, flexible approach to incremental cloud expansion. This dichotomous approach is a real challenge for Cloud suppliers: they need to differentiate discrete solutions for the small business market, and demonstrate that their offerings are essential components of broader strategies for midmarket firms, while attracting attention to their companies and products and building brand preference in both segments.