Xerox, an innovative technology company, was among the early pioneers of PC and ethernet technologies, which are indispensable in today's digital transformation. 3D printing and digital manufacturing are some newer areas of modernization. Among the more critical innovation focus areas is CareAR, which enables live visual interaction and contextual self-guided instructions. From an augmented reality standpoint, it empowers an agent to see what the customer is seeing and walks them through how to resolve customer support issues.

Unbeknownst to many, Xerox IT services is part of the next innovation cycle within the organization. Formed out of three wholly-owned companies, ESI, Lewan, and RK Dixon, Xerox aims to expand its IT services footprint, especially in the SMB segment, which Xerox defines from 25 employees to 2500 employees. Xerox has a growing SMB-focused IT services business, working either as an outsourced provider or in conjunction with existing IT teams to provide hardware and managed IT solutions to SMB clients through Xerox locations in the US, UK, and Canada. Xerox has aspirations to be the leading provider of professional IT solutions to the SMB Market. It is a challenging aspiration, but having deep partnerships with major IT manufacturers, being brand agnostic positions Xerox well in providing solutions that fit SMB customers' needs and budget. Xerox's uniqueness and differentiation lie in its ability to listen to the voice of the customer, offering the best technology solution possible with discipline, uniformity, and consistency.

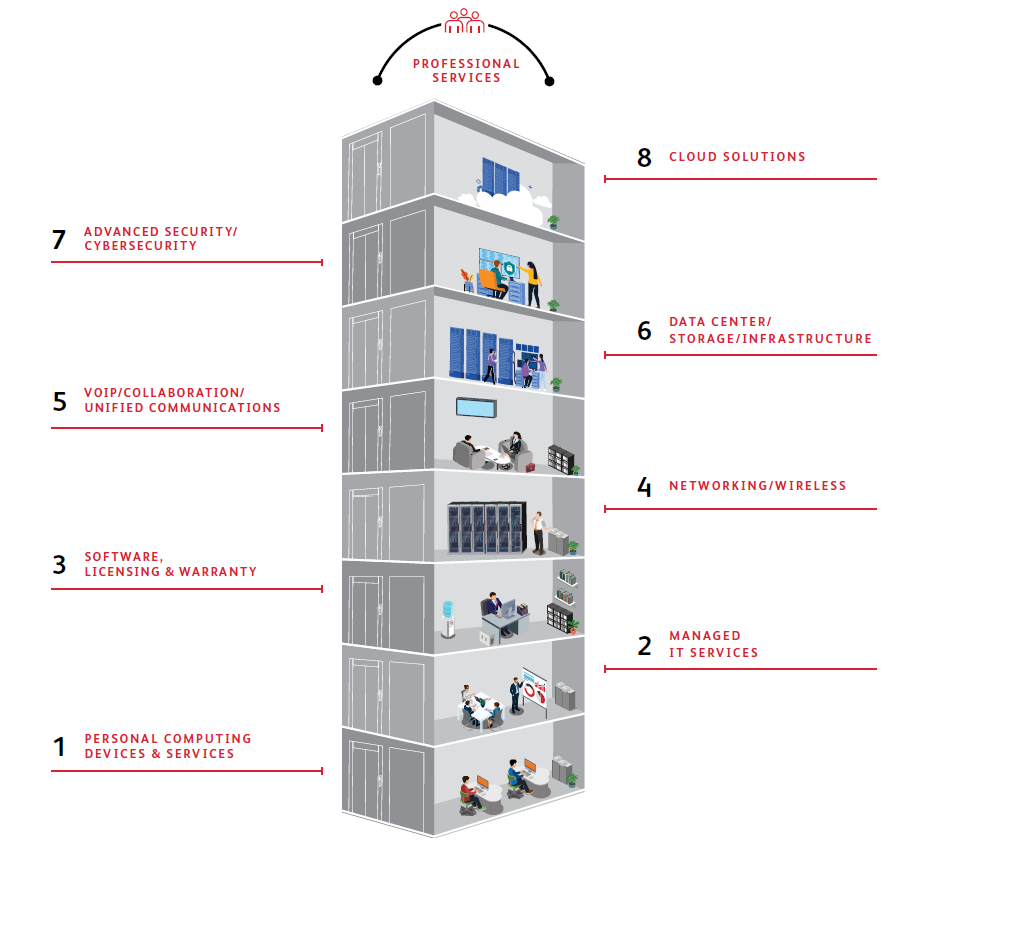

SMB portfolio of services offerings – device procurement to complex consulting

As we had written in our 2021 predictions, SMB executive and corporate interest in digital transformation is a unique business driver for IT services' scale-up. The fear of digital inequality is acute. To accelerate migration to support a mobile workforce, anxious SMBs prioritize automation, application bandwidth, and analytics, each of which requires outlay services. SMBs increasingly need support for hybrid IT environments spanning conventional and cloud infrastructure, which strains the IT staff necessitating professional services skills. There is an urgent need to provide business consulting aligning cloud capabilities with SMB's business requirements, map specific cloud services to these needs, integrate cloud services with existing infrastructure and each other, and provide ongoing support. SMB issues in servicing hardware at home are demanding home office software/hardware packs for service.

Xerox has developed an entire portfolio of offerings that address each of the above.

- IT Hardware and Software - trusted advisor to source and support all foundational hardware and software needs

- IT product support services – deployment, installation and configuration, PC imaging and asset tagging, depot repair, warranty services

- IT Professional Engineering Services - Cybersecurity & device security, policy-writing, and threat assessment, Cloud technologies and migration, Data Center and network design, staffing

- Managed IT Services - Help desk support, Virtual CIO, network admin, remote monitoring & management, data Backup & Recovery

Techaisle expects strong growth for services spend. Techaisle market sizing data shows that the US SMB and Midmarket spend on IT services will be US$244B in 2023. Data also shows that 97% of SMBs have become more dependent on technology over the last three years because technology delivers enormous productivity, efficiency, reach, and related advantages. However, these benefits are not always readily accessible to SMBs with limited resources. Moreover, the complexity associated with advanced technology can discourage firms from investing in new technologies – to the extent that 61% of midmarket firms admit to ignoring technologies even though they may be helpful to the business. And the issue is unlikely to disappear in the future: more than half of midmarket firms believe that technology adoption is becoming more complex.

SMBs seeking to keep pace with global enterprises boasting far more extensive IT resources – are increasingly reliant on technology but have a limited pool of skilled IT staff members capable of delivering the services their operations require. Techaisle's research shows that many small and midmarket firms are making extensive use of external assistance – IT services provided by suppliers, rather than internal staff – and that use of service suppliers correlates directly with IT sophistication. Techaisle's research divides midmarket operators into three groups: basic IT or firms that are "focused on delivering core IT capabilities to internal users, but lack ability to expand into more sophisticated applications and technology categories;" advanced IT, businesses that have "progressed beyond core applications and are actively working with more sophisticated solutions;" and organizations with enterprise IT operations, in which "IT is run as a business, providing enterprise-grade support to all aspects of the organization. Roughly 60% of firms in the more sophisticated groups use managed services today, compared with less than half that number for organizations with only "basic IT." And even those that aren't already capitalizing on external services are moving in that direction: more than half of sophisticated IT user organizations who are not currently using managed services plan to do so soon. Xerox is aiming to bridge the gap between fully outsourced and on-staff capabilities to reduce the digital divide.

Xerox trains its sales personnel to sell products that fit the SMBs' needs and are not limited to Xerox's portfolio. As Rich Artese, General Manager, Xerox IT Services, says, "our brand agnostic approach to IT Services enables us to design the right solution for customers while taking into account their brand preferences and budget requirements."

Not a box pusher, not a copier supplier only – but an eight-story building

Xerox is not a box pusher. It is far from it. Besides deploying and managing laptops and desktops, Xerox serves cloud subscriptions. Its in-house solution architects design complex solutions for SMB customers, whether cloud migration or cloud technologies in general or data center solutions and wireless networking.

Xerox illustrates its portfolio of offerings in an eight-story building, representing a typical technology stack, technologies that SMBs require – and require integration across – to support current and emerging business requirements. Partnerships with Acer, Dell, HP, Lenovo for computing devices fit into the bottom floor. Moving up the building takes one to managed services requiring a specific skill set, managing software, and licensing for Microsoft, VMware and Cisco. Middle of the building are infrastructure technology solutions such as data centers, networking, storage, unified communications, security, and at the top are cloud solutions. The Xerox IT Services team holds many industry certifications. In fact, one of their engineers holds the prestigious HPE Aruba Ambassador designation, which is granted to only a limited number of people.

Having a professional services organization conversant with a complete technology stack is essential to SMB buyers. It instills confidence in meeting current and potential needs, helping to align priorities with holes in the IT fabric. Buyers are not attracted to a single supplier approach if that supplier cannot address all, or at least a substantial proportion of, core system needs. SMB buyers say that a single committed supplier can better understand requirements and match technology to business needs. In addition, 37% of SMBs believe that working with a single supplier reduces internal costs (reduced internal overhead resulting in less time spent in vendor management) and external costs (better discounts from volume purchasing). They also believe that working with a single supplier reduces time to benefit due to more streamlined procurement and deployment processes and better end-to-end integration. Xerox checks all the boxes. For example, Xerox's white-glove services, preferred by 34% of SMBs (Techaisle data), minimize workforce productivity interruptions, lowers operating costs due to reduced time spent on support resolution. Not surprisingly, its managed services, specifically remote monitoring and management, have seen an accelerated demand, which is well in line with Techaisle data, which shows that for 53% of SMBs, remote IT support and helpdesk are the biggest challenges for hybrid work enablement.

Any vertical - SLED, retail, professional business services, manufacturing, healthcare, other commercial sectors

Xerox has seen great success within the education segment. Serving thousands of students and faculty in any school district is no small feat. Xerox can manage large volumes and receive 20,000 to 40,000 devices into its warehouses, prep them for customers, and deploy them quickly. Xerox even has cardboard compacting machines in its warehouses to efficiently recycle the device packaging. A typical example of proactive white-glove service is what Xerox considers a "milk run." During the school year, its trucks leave their depots every morning, drive around to all of the schools in a district in Virginia, pick up broken machines and drop off the previous day's repaired devices. During COVID, Xerox set up its depots in school parking lots, fixing on-site, real-time, and even swapping out machines for students.

In addition to Education, state and local government, professional business services (accounting, legal), retail, manufacturing, and healthcare are other top verticals for Xerox. As per Techaisle SMB and Midmarket vertical industry research, these verticals have similar challenges and needs. For example, data shows that 49% of SMB manufacturing firms, 32% of healthcare, 46% of retail, and 44% of professional business services would prefer to work with a supplier that provides a total package of solid technology solutions that simplify buying and implementation processes. In addition, each of these verticals is moving to OPEX-based agreements (as-a-service) for technology acquisition and management. As a result, Xerox is positioning itself to be the preferred solutions provider. The biggest challenge for Xerox will be to create awareness of its leadership and capabilities in this space, as the Xerox name has historically been synonymous with photocopying.

True to its innovation roots, Xerox is bringing to market innovative solutions for its customers. For example, Xerox released RPA (Robotic Process Automation) earlier this year as part of its IT Services offerings. This offering enables small and medium businesses to automate repetitive and time-consuming tasks in functions such as Accounts Receivable, Accounts Payable, HR, Legal, etc. One of the areas that Xerox has found acceptance and success with RPA is the legal industry segment. For example, Xerox Robotic Process Automation Service helped Lexitas automate its process for packaging exhibits. In the first month of implementation, RPA freed up approximately 250 hours per month for Lexitas, resulting in valuable capacity creation for engaging employees in revenue-generating activities. The number of hours that have been freed up continues to grow as the automated process matures.

Next step - Homogenizing and expanding

Technology market trends often progress rapidly – but even by those standards, the pace of cloud adoption in the SMB market has been stunning. As recently as five years ago, most SMBs were still evaluating whether and how to apply cloud to their business needs and operations. Today, the cloud is no longer a future issue: 97% of US small businesses and 100% of US midmarket organizations are using the cloud to support some or all of their business processes. The explosion in cloud use has led to considerable increases in the extent of automation within SMBs. SMBs are absorbing cloud systems at a very rapid rate: many core infrastructure requirements (such as storage and productivity applications), systems of record (e.g., accounting), and systems of engagement (e.g., collaboration/conferencing) either are or soon will be cloud-based, and cloud is paving the way for new automation in these areas, and in systems of insight (analytics) within SMBs. Xerox's professional services organization is building its capability to service the market organically. Acquisitions that bring scale, capability, and geographic reach are also a key focus for Xerox. Homogenizing Xerox's offerings across the US, Canada, and the UK is a critical priority for the Xerox IT Services team.

SMB single source for IT services

The question of whether an SMB IT buyer benefits most from a strategy of working with a single or primary supplier, such as Xerox, responsible for integration and management of all resources, or whether it is better to procure individual components, systems, and services from a larger group of 'best of breed' suppliers, is nearly as old as IT. The question is fundamental to SMBs, which generally have limited internal resources and can benefit from third-party integration and streamlined procurement processes. It has historically been the case that many SMBs, especially many small and very small businesses, purchase based on immediate needs and current pricing. As a result, they end up with a mix of technologies and suppliers. Still, even in these segments, Techaisle has observed a more holistic procurement strategy as small businesses encounter increasing requirements for cross-product integration supporting digital business practices and develop a greater appreciation for the value of a trusted technology advisor. On the supply side, the single vs. multi-source question is of great importance to vendors on both sides of the issue. Those looking to establish themselves as single-source suppliers and ecosystem leaders like Xerox are looking for ways to build preference for their IT stack offering. In contrast, if Xerox wants to address the SMBs preferring multi-source procurement, it needs to understand where and how to engage with prospective SMB customers based on their propensity to pursue a best-of-breed rather than single-source strategy. Regardless, besides its copiers and printers, Xerox has best-of-breed products in its eight-story building IT stack.

Final Techaisle Take

With Xerox IT Services, the company is well-placed to expand its long-standing relationships with clients in the traditional print space and open new doors with SMBs in need of IT Service support. Data collected from the Techaisle SMB survey indicates that firms that secure initial contracts are well-positioned to expand their presence within accounts, especially in many accounts. In addition, roughly two-thirds of small businesses, and more than 60% of all SMBs, rely on a single managed services provider – this, even though they are using multiple services. The portfolio breadth of Xerox, constant expansion of their partnerships and alliances with major IT manufacturers, and development of innovative solutions (including automation and cloud IT applications and infrastructure) position the company to meet expanding SMB customer needs while providing diverse services.

The discipline, rigor, uniformity, and consistency of Xerox's professional services offerings are well-matched for SMB needs. In addition, Xerox is determined to listen to the voice of the customer and strongly considers it its responsibility to put the best technology in front of the customer to help drive innovation, resiliency, operational excellence, and business growth.