Xerox, an innovative technology company, was among the early pioneers of PC and ethernet technologies, which are indispensable in today's digital transformation. 3D printing and digital manufacturing are some newer areas of modernization. Among the more critical innovation focus areas is CareAR, which enables live visual interaction and contextual self-guided instructions. From an augmented reality standpoint, it empowers an agent to see what the customer is seeing and walks them through how to resolve customer support issues.

Unbeknownst to many, Xerox IT services is part of the next innovation cycle within the organization. Formed out of three wholly-owned companies, ESI, Lewan, and RK Dixon, Xerox aims to expand its IT services footprint, especially in the SMB segment, which Xerox defines from 25 employees to 2500 employees. Xerox has a growing SMB-focused IT services business, working either as an outsourced provider or in conjunction with existing IT teams to provide hardware and managed IT solutions to SMB clients through Xerox locations in the US, UK, and Canada. Xerox has aspirations to be the leading provider of professional IT solutions to the SMB Market. It is a challenging aspiration, but having deep partnerships with major IT manufacturers, being brand agnostic positions Xerox well in providing solutions that fit SMB customers' needs and budget. Xerox's uniqueness and differentiation lie in its ability to listen to the voice of the customer, offering the best technology solution possible with discipline, uniformity, and consistency.

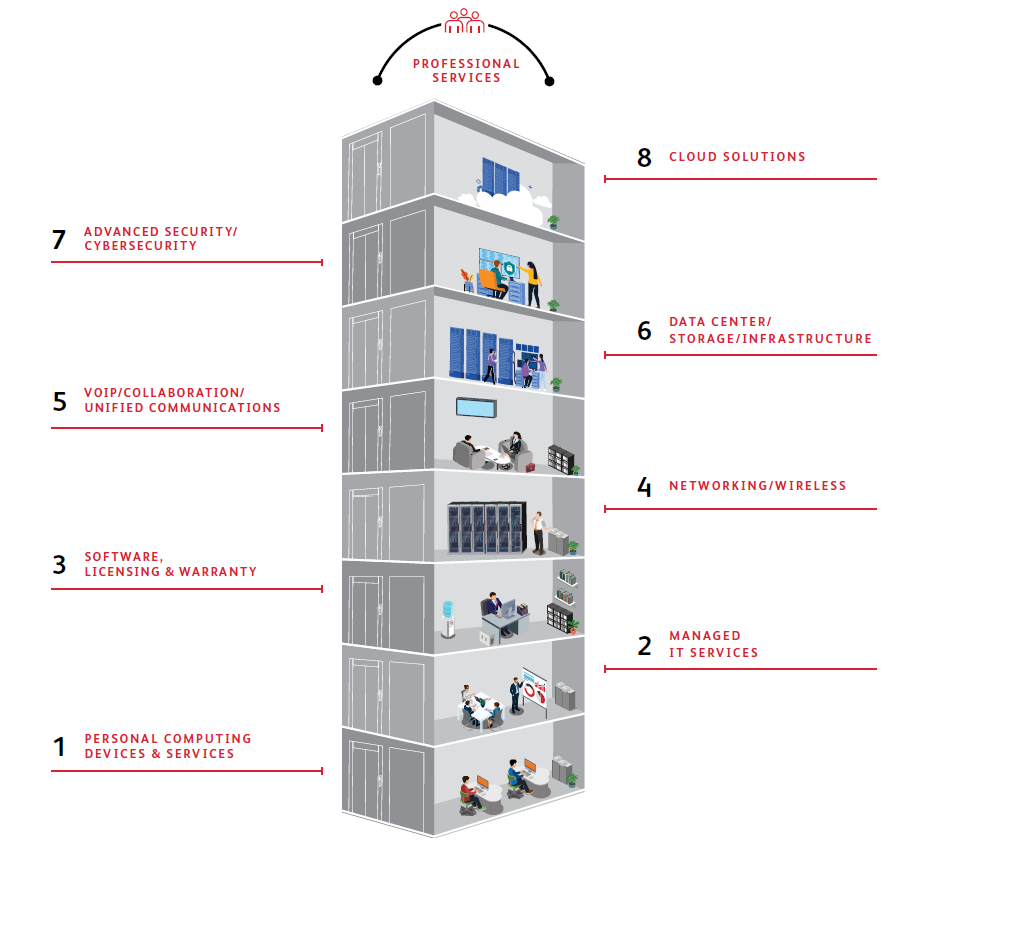

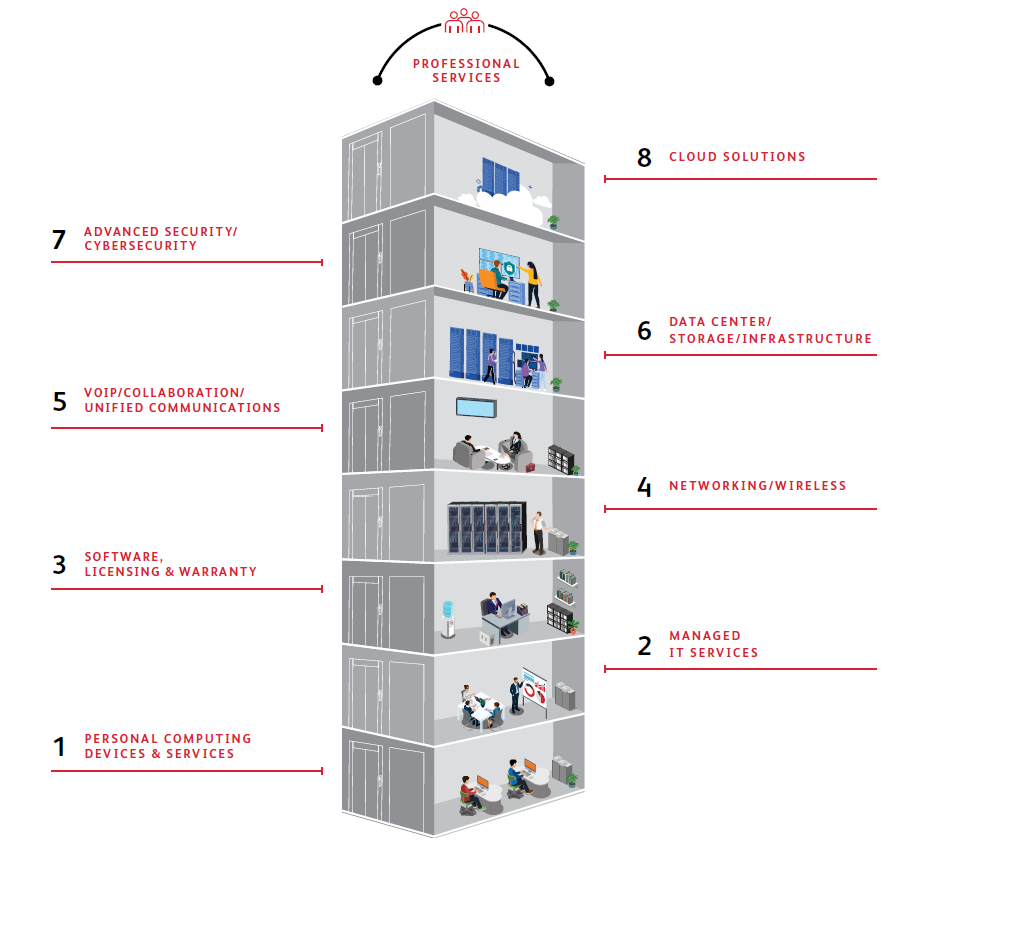

SMB portfolio of services offerings – device procurement to complex consulting

As we had written in our 2021 predictions, SMB executive and corporate interest in digital transformation is a unique business driver for IT services' scale-up. The fear of digital inequality is acute. To accelerate migration to support a mobile workforce, anxious SMBs prioritize automation, application bandwidth, and analytics, each of which requires outlay services. SMBs increasingly need support for hybrid IT environments spanning conventional and cloud infrastructure, which strains the IT staff necessitating professional services skills. There is an urgent need to provide business consulting aligning cloud capabilities with SMB's business requirements, map specific cloud services to these needs, integrate cloud services with existing infrastructure and each other, and provide ongoing support. SMB issues in servicing hardware at home are demanding home office software/hardware packs for service.

Xerox has developed an entire portfolio of offerings that address each of the above.

- IT Hardware and Software - trusted advisor to source and support all foundational hardware and software needs

- IT product support services – deployment, installation and configuration, PC imaging and asset tagging, depot repair, warranty services

- IT Professional Engineering Services - Cybersecurity & device security, policy-writing, and threat assessment, Cloud technologies and migration, Data Center and network design, staffing

- Managed IT Services - Help desk support, Virtual CIO, network admin, remote monitoring & management, data Backup & Recovery

Techaisle expects strong growth for services spend. Techaisle market sizing data shows that the US SMB and Midmarket spend on IT services will be US$244B in 2023. Data also shows that 97% of SMBs have become more dependent on technology over the last three years because technology delivers enormous productivity, efficiency, reach, and related advantages. However, these benefits are not always readily accessible to SMBs with limited resources. Moreover, the complexity associated with advanced technology can discourage firms from investing in new technologies – to the extent that 61% of midmarket firms admit to ignoring technologies even though they may be helpful to the business. And the issue is unlikely to disappear in the future: more than half of midmarket firms believe that technology adoption is becoming more complex.

SMBs seeking to keep pace with global enterprises boasting far more extensive IT resources – are increasingly reliant on technology but have a limited pool of skilled IT staff members capable of delivering the services their operations require. Techaisle's research shows that many small and midmarket firms are making extensive use of external assistance – IT services provided by suppliers, rather than internal staff – and that use of service suppliers correlates directly with IT sophistication. Techaisle's research divides midmarket operators into three groups: basic IT or firms that are "focused on delivering core IT capabilities to internal users, but lack ability to expand into more sophisticated applications and technology categories;" advanced IT, businesses that have "progressed beyond core applications and are actively working with more sophisticated solutions;" and organizations with enterprise IT operations, in which "IT is run as a business, providing enterprise-grade support to all aspects of the organization. Roughly 60% of firms in the more sophisticated groups use managed services today, compared with less than half that number for organizations with only "basic IT." And even those that aren't already capitalizing on external services are moving in that direction: more than half of sophisticated IT user organizations who are not currently using managed services plan to do so soon. Xerox is aiming to bridge the gap between fully outsourced and on-staff capabilities to reduce the digital divide.

Xerox trains its sales personnel to sell products that fit the SMBs' needs and are not limited to Xerox's portfolio. As Rich Artese, General Manager, Xerox IT Services, says, "our brand agnostic approach to IT Services enables us to design the right solution for customers while taking into account their brand preferences and budget requirements."

Not a box pusher, not a copier supplier only – but an eight-story building

Xerox is not a box pusher. It is far from it. Besides deploying and managing laptops and desktops, Xerox serves cloud subscriptions. Its in-house solution architects design complex solutions for SMB customers, whether cloud migration or cloud technologies in general or data center solutions and wireless networking.

Xerox illustrates its portfolio of offerings in an eight-story building, representing a typical technology stack, technologies that SMBs require – and require integration across – to support current and emerging business requirements. Partnerships with Acer, Dell, HP, Lenovo for computing devices fit into the bottom floor. Moving up the building takes one to managed services requiring a specific skill set, managing software, and licensing for Microsoft, VMware and Cisco. Middle of the building are infrastructure technology solutions such as data centers, networking, storage, unified communications, security, and at the top are cloud solutions. The Xerox IT Services team holds many industry certifications. In fact, one of their engineers holds the prestigious HPE Aruba Ambassador designation, which is granted to only a limited number of people.