Techaisle’s most recent survey data shows that the adoption of artificial intelligence (AI) is likely to increase by 79% within small businesses, 63% in core-midmarket firms, and 53% in upper-midmarket firms. AI has become a priority for 41% of small businesses, 75% of core-midmarket firms, and 79% of upper-midmarket firms. ChatGPT and Large Language Models (LLMs) have recently become the topic of conversations and business usage. When ChatGPT comes up in conversation – especially a discussion focusing on SMBs – the first question will likely be, “How many organizations are using it – and how?” Techaisle extended its artificial intelligence survey to pose the same question to 1872 SMBs. Both small and midmarket businesses forecast a substantial rise in the use of ChatGPT in the next one year. 17% of small businesses, 39% of core midmarket firms, and 79% of upper midmarket firms plan to use systems/tools/other products that embed ChatGPT. Results indicate that ChatGPT penetration within the midmarket, driven primarily by firms with more than 250 employees, will be reasonably robust. However, Techaisle feels that the planned adoption data is likely conservative.

Techaisle Blog

It is the best of places; it is the worst of places. The famous opening line echoed from the Dickens masterpiece “A Tale of Two Cities” describes a period in which opposites – wisdom and foolishness, light and darkness, hope and despair – exist side by side. The events and depths of emotion described in the novel are much more extreme than the scenarios cloud and overall IT adoption presents to businesses. But the notion that there are opposing elements of opportunity and requirement associated with the cloud would ring true to SMB and midmarket executives, who need to balance the new business outcomes that they can achieve via cost-effective cloud/IT solutions with the need to safeguard users, data, and applications from malicious intruders. The upside is competitiveness in a fast-moving economy; the downside is destroying customer relationships and corporate reputations at the core of business success. Where is the safe middle ground – the approach that results in optimal business protection and access to the upside associated with cloud/IT solutions?

The market is buzzing with discussions on zero trust (ZT). A Techaisle survey of 2035 SMBs and Midmarket firms shows that 8% of small businesses, 46% of core-midmarket firms, and 69% of upper midmarket firms know of ZT and that 21% of SMBs and 64% of midmarket firms consider its adoption either very important or important. Critical reasons for adopting zero trust include reducing insider threats, breach prevention, compliance, mitigating endpoint threats, and managing hybrid IT and remote work security issues.

However, most firms need to be made aware that ZT is not a product but a framework that requires a focus on the journey and strategy. Regardless, 14% of “in the know” SMBs and 35% of upper midmarket firms have begun planning their investments in ZT technology, initially focusing on identifying their critical digital assets and security vulnerabilities.

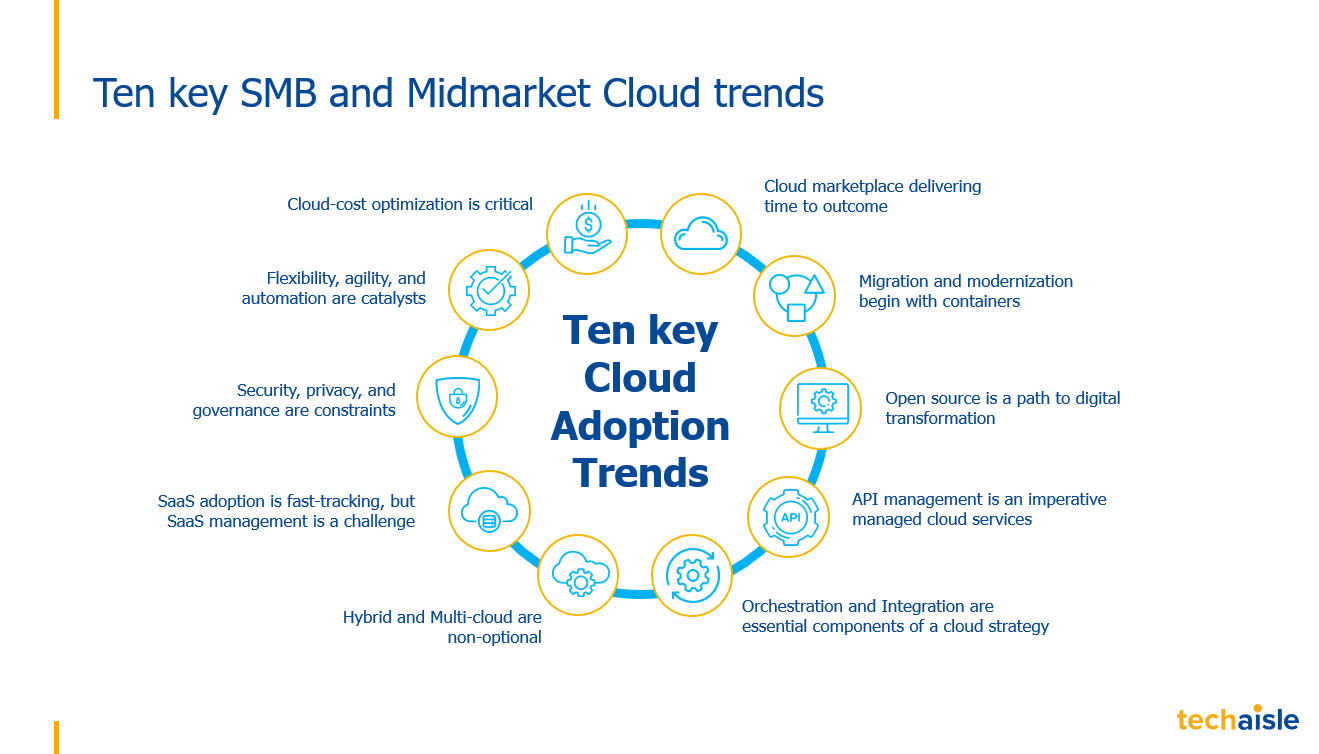

Techaisle’s research of 2150 SMB, core midmarket, and upper midmarket firms reveals ten key cloud trends. The importance of cloud cost optimization, automation, and orchestration cannot be understated. Techaisle’s research of 2150 SMB, core midmarket, and upper midmarket firms reveals ten key cloud trends. The importance of cloud cost optimization, automation, and orchestration cannot be understated. Techaisle survey data shows that cloud cost optimization has moved from 2nd priority to 1st in cloud initiatives for 59% of SMBs and 55% of upper midmarket firms. In addition, it is the top consulting services priority for 100% of firms.

The explosion in cloud use has led to considerable increases in the extent of automation within SMBs and midmarket firms. SMBs are absorbing cloud systems at a very rapid rate: many core infrastructure requirements, systems of record, and systems of engagement either are or soon will be cloud-based, and the cloud is paving the way for new automation in these areas, and in systems of insight (analytics) within SMBs.

The 2023 worldwide SMB, Core Midmarket, and Upper Midmarket IT Security spend will likely be US$84 billion. Additionally, 38% of SMBs and 35% of upper midmarket firms will likely purchase IT security solutions from managed services providers (MSPs). In today’s SMB market, it is critical for vendors to build a detailed understanding of the small, core midmarket, and upper-midmarket segments and to align resources and strategies with requirements as these businesses move from initial experimentation with sophisticated solutions toward mass-market adoption. In the latest research, Techaisle analyzed 2035 survey responses to provide the insight needed to build and execute on security strategies for the small and midmarket customer segments. We find there are six key trends:

Beyond the six key trends, research finds:

- A high proportion of SMBs and upper midmarket firms report that they experienced security breaches last year. However, despite this high exposure rate, most SMBs believe they are either “fully prepared and confident” or “as prepared as they can be” for security issues.

- Small and midmarket firms recognize that the cloud increases the potential for security breaches but are confident – overly so, in Techaisle’s view – in their ability to cope with this expanded risk profile. As a result, most SMBs rely on core security practices and technologies to address cloud-specific threats and are underinvested in cloud security solutions.

- Security solutions currently in use can be divided into four categories: protection of the mobile environment, protection of data entering the corporate environment, traffic inspection and management, and protection of data being used within the corporate environment.

- Security-as-a-Service suppliers have had the most success thus far with data center/server, network, and endpoint security offerings.

- BDMs play an active role in setting security policies, but technical buyers are most likely to acquire security solutions. These technical buyers focus primarily on solution reliability; more junior security professionals focus on support, and senior IT management looks at price/performance.

- Marketing messages aimed at security buyers should be incorporated within preferred source containers (e.g., whitepapers, case studies, blog posts, etc.) and distributed through preferred channels (e.g., vendor websites, search) aligned with different stages of the security decision process. For example, data shows that some source types, including product trials/demo videos and case studies, are essential in identifying and selecting security vendors.