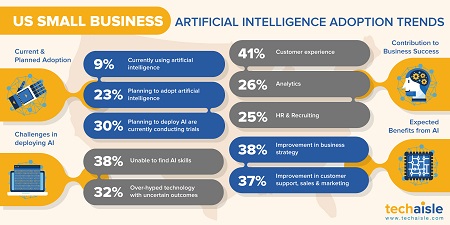

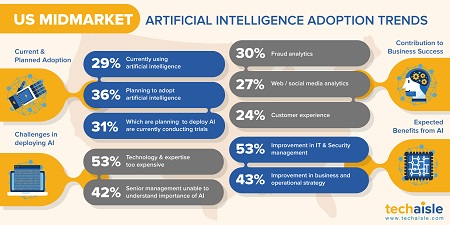

Techaisle’s survey research of 1256 US SMBs shows that 9% of small businesses and 29% of midmarket firms are either currently using artificial intelligence (AI) or are conducting pilots. Comparing data from last year indicates an increase of 80% within small businesses and only 12% increase in midmarket firms. Answer to slower rate of adoption within midmarket firms is present in several follow-up questions. 53% of midmarket firms are finding that AI technology and expertise is too expensive and does not fit within their current budgets. In addition, 42% of midmarket CIOs say that the importance of AI, its benefits and immediate returns are not clear to the executive management thus hindering adoption. As a result, in only 10% of midmarket firms, AI has been designated as a technology priority for internal IT staff. However, of the 36% of midmarket firms that are planning to deploy AI, 31% are conducting trials. This number has nearly doubled from 17% a year ago.

For all of SMBs, data shows that use of AI is among the top 20 on the list of IT priorities for 2020. Cloud, mobility, security, managed services, HCI, unified workspace, SD-WAN, analytics, collaboration and virtualization have higher priorities. This opens up opportunities for channel partners, consultants and AI-technology suppliers to not only evangelize use cases but also build a blueprint for easy understanding, deployment alacrity of AI solutions that can deliver previously unimaginable business outcomes.

The entry point for most SMBs is when AI is embedded in cloud business applications. 25% of small businesses are contemplating using AI for HR and recruiting, a challenge that small business owners constantly face.

Not only is the adoption trend different between small and midmarket businesses, the expected benefits and application usages also differ. 41% of small businesses believe that use of AI in improving customer experience will be integral to their business success whereas 30% of midmarket firms believe that use of AI in fraud analytics and 27% in web/social media analytics will help drive better operational excellence and customer intimacy. For example, a midmarket firm that provides hostel and budget accommodations wanted to deliver analysis and personalized communication to over 500 micro consumer segments. After adopting AI tools from Persado (a marketing language cloud that uses AI-generated language for digital marketing) enabled the company to deliver more precise marketing content resulting in double-digit engagement uplifts and improved customer loyalty.

In fact, survey shows that customer experience improvements and strategic operational excellence are becoming the SMB themes for 2020 and beyond which will likely drive adoption of analytics and AI. 38% of small businesses believe that the use of AI will provide benefits to their customer support, sales/marketing teams as well as assist the entire organization in driving better business strategy. Similarly, 43% of midmarket firms believe that pervasive use of AI could provide benefits to make more informed strategic decisions.

All data and analysis in Techaisle’s upcoming research report SMB and Midmarket Analytics / Artificial Adoption trends.