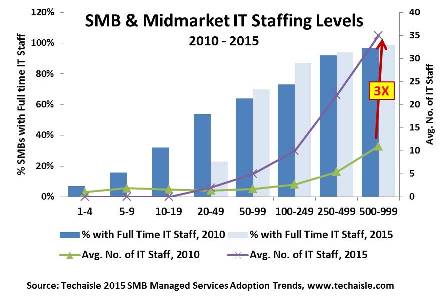

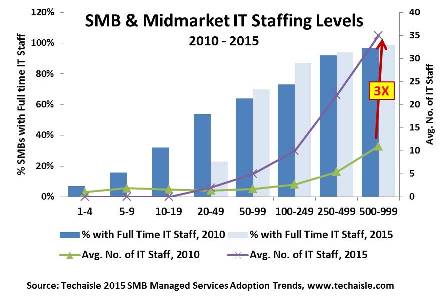

Techaisle’s SMB and Midmarket Managed Services Adoption Trends research shows that contrary to popular belief IT Staffing within SMBs is growing and the percent of businesses with full-time IT staff has increased for 50-999 employee size businesses and even the average no. of IT staff has tripled for midmarket businesses in 2015 from 2010.

Today’s SMBs are heavily invested in an ever-widening portfolio of technology initiatives. For example, on average, US SMBs have current active initiatives in 5.1 technology areas, and midmarket businesses are working in an average of 10.3 different areas – each of which (like cloud or mobility) involve multiple discrete activities.

Techaisle’s SMB survey trend illustrates the IT staffing impact of this expanding IT solution activity. Figure below presents statistics on full-time IT staff from 2010 and 2015. It demonstrates that small and midmarket businesses have sharply different approaches to coping with IT solution sprawl. In businesses with 50 or more employees staffing levels are increasing dramatically. In this segment, not only percent of businesses with full-time internal IT staff has increased in the last five years but the average number IT staff has tripled.

In microbusinesses with 1-19 employees, the trend is exactly the reverse: these firms are unable to keep pace with IT expansion through internal IT staff, and have moved to other approaches to cope with sprawl and complexity. Data indicates that only 4% of microbusinesses have full-time internal IT staff. In the next tier of small businesses (20-99 employees), 28% of firms have outsourced IT, vs. just 23% relying on full-time internal IT staff; the balance report that they depend on part-time internal IT staff (18%), internal non-IT staff (14%), or that “nobody manages IT” (17%). It is easy to say that this last group is courting disaster in an increasingly IT-centric world, and there is certainly truth to that assertion – but the findings are reflective of the cost and complexity associated with delivering a corporate service that is proving to be very cost- and labor-intensive.

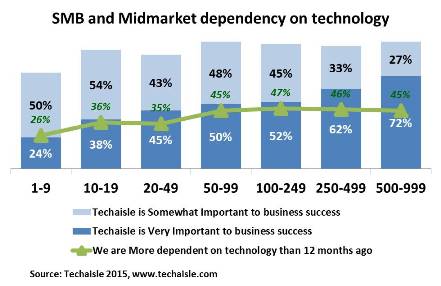

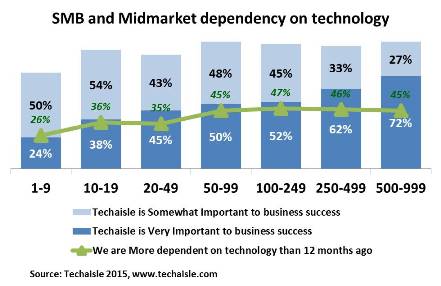

The trend towards increased IT staffing levels also reflects the growing importance of technology within SMB operations. As Figure below illustrates, nearly 75% of businesses with 1-9 employees, and nearly 100% of those with 500-999 employees, consider technology to be “somewhat” or “very important” to their business success, and this importance is rising. 26%-47% of SMB respondents believe that their companies are more dependent on technology today than they were a year ago.

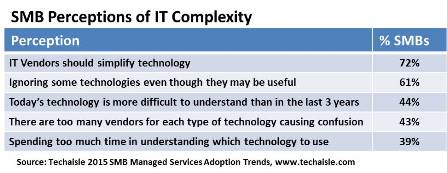

IT is trying to move away from implementations to more strategic roles. But for that SMBs require expertise, skill-sets, time to research and identify appropriate technology. When IT vendors mention simplifying IT for SMBs they couch it as a means of helping SMBs because they lack IT staff (which data demonstrates is far from actual reality). The growing number and penetration of SMB IT staff themselves are asking for simplification of technology due to inherent sprawl and complexity of technology.

The phrase “sprawl and complexity” describes two linked problems for SMBs. Sprawl is apparent in the wide range of technologies included within current solution portfolios. The compounding issue, though, is that SMBs are not just dealing with more technology, but with more complex technology. This in turn is driving SMBs to hire more IT staff.

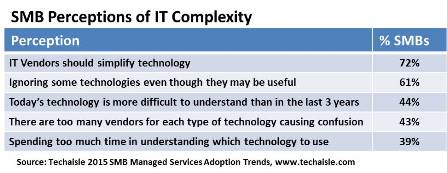

Consider the figure below, which reflects the attitudes of IT-responsible managers (ITDMs) within SMBs. Asked to describe their opinions regarding IT complexity, the most common response is “IT vendors should simplify technology.” Frighteningly (or embarrassingly) for suppliers, the second most common response is “we are ignoring” potentially-useful technologies, followed by observations that technology-related pain points are increasing, and current technology is more difficult to understand than previous-generation solutions.

There is a clear set of messages for suppliers in this data.

- There is no status quo of "lack of IT staff"

- IT staffing within SMBs has undergone a change. “We have simplified technology because SMBs do not have IT staff” is the wrong messaging

- Simplification is required to ensure that SMBs actually embrace new products and their growing IT staff is freed-up to focus on strategic business issues